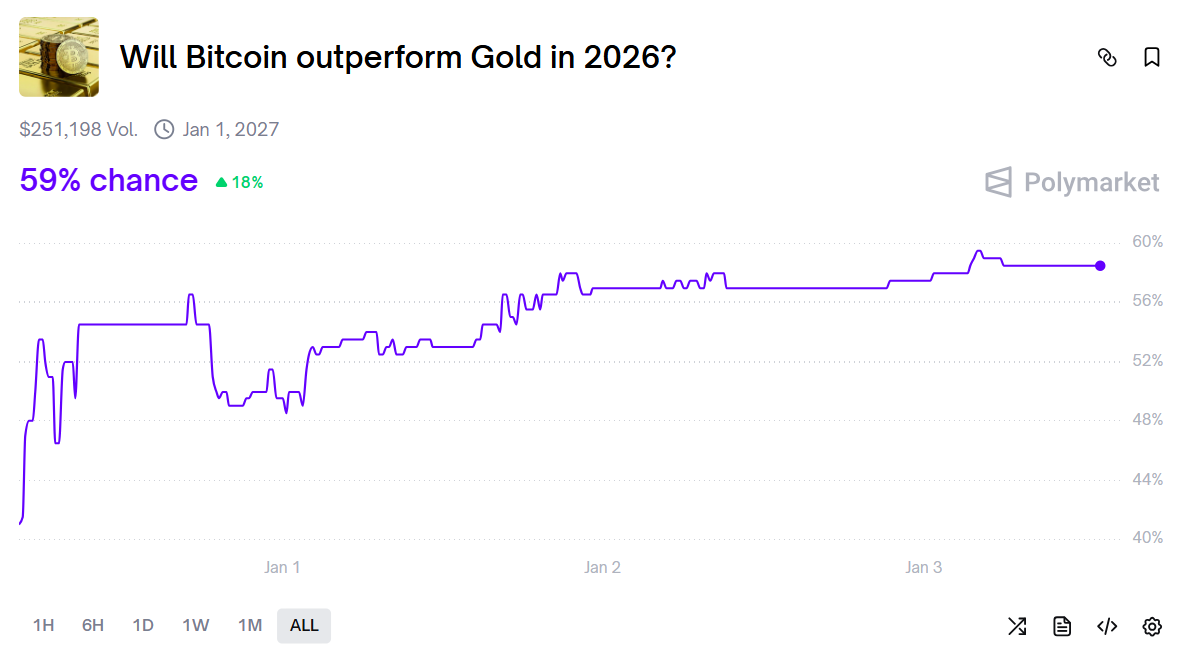

Odds of Bitcoin outperforming gold in 2026 surge to 59% on Polymarket

Key Takeaways

- Bitcoin currently holds a 59% chance of outperforming gold by 2026 on Polymarket, emphasizing growing confidence among traders.

- Polymarket is a blockchain-driven prediction platform, allowing users to bet on the outcomes of various real-world events.

Share this article

The odds that Bitcoin will outperform gold in 2026 have risen to 59%, following the crypto’s move back above $90,000 to start the year.

Bitcoin concluded 2025 down roughly 6%, sharply underperforming gold, which surged over 65% to become the year’s standout asset.

While the digital asset saw a strong start, it faced extreme volatility, peaking at $126,000 in early October before a lack of fresh catalysts and uneven demand triggered a steep year-end retreat.

The rising odds on prediction markets reflect growing trader confidence in Bitcoin’s potential to deliver stronger returns than the traditional precious metal this year.

Near-term expectations are becoming more restrained among some analysts.

Jurrien Timmer of Fidelity Investments believes Bitcoin may have completed its halving-cycle bull phase and could enter a period of consolidation in 2026. The strategist thinks prices could return to the $65,000–$70,000 range, while still seeing upside in the long run.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Lindsay: Overview of Fiscal First Quarter Results

The Typical Down Payment Buyers Are Currently Making—And How Yours Stacks Up

Hyperliquid leads $150m crypto long-liquidation wave as BTC dips

USD Remains in a Holding Pattern: Market Awaits Tomorrow’s Jobs Report and Supreme Court Ruling