Institutional Investors Sold Bitcoin (BTC) and Ethereum (ETH) and Bought These Two Altcoins!

The final week of 2025 began with a slight increase. Bitcoin (BTC) and altcoins started the new week higher, but subsequently experienced price pullbacks.

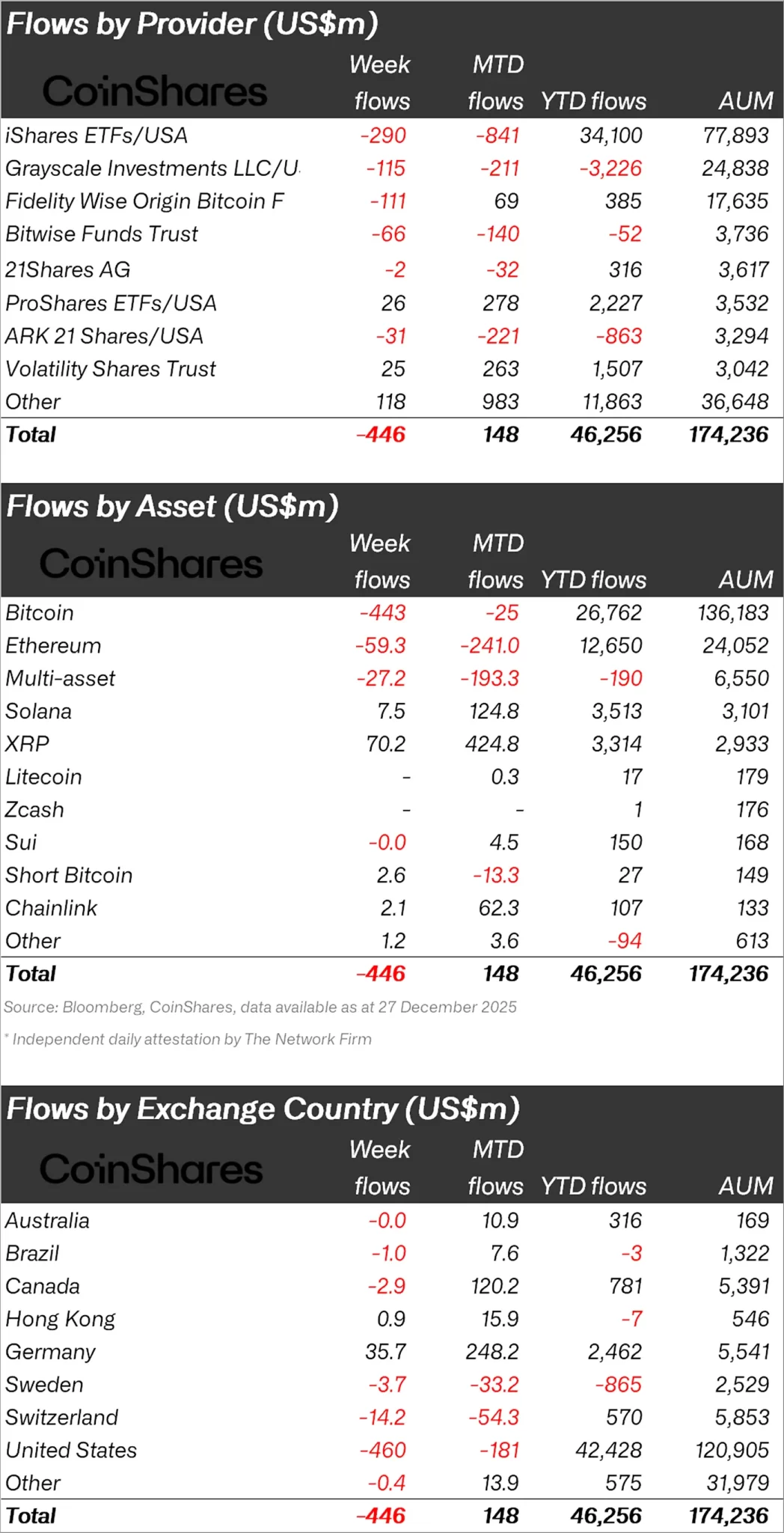

While Bitcoin is expected to finish the year below $100,000, Coinshares has released its weekly cryptocurrency report, stating that there was a $446 million outflow last week.

“Weekly outflows of $446 million were recorded in cryptocurrency investment products, bringing the total outflow since October 10 to $3.2 billion.”

This indicates that market sentiment has not yet fully recovered.”

Exits Concentrated in Bitcoin!

Looking at crypto funds individually, it was observed that the majority of outflows were in Bitcoin.

Bitcoin experienced outflows worth $443 million, while Ethereum (ETH) saw outflows of $59.3 million.

Looking at other altcoins, Solana (SOL) saw $7.5 million in inflows, XRP $70.2 million, and Chainlink (LINK) $2.1 million.

“Last week, XRP and Solana recorded the largest inflows, with $70.2 million and $7.5 million respectively.”

Since their launch in the US in mid-October, they have seen inflows of $1.07 billion and $1.34 billion respectively, despite the negative sentiment seen in other assets.

In contrast, Bitcoin and Ethereum saw outflows of $443 million and $59.5 million respectively last week.

XRP and Solana ETFs have recorded outflows of $2.8 billion and $1.6 billion respectively since their launch.

Looking at regional fund inflows and outflows, the US ranked first with an outflow of $460 million.

After the US, Switzerland experienced an outflow of $14.2 million, followed by Sweden with $3.7 million.

In response to these outflows, Germany experienced an inflow of $35.7 million.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Japan signals a friendlier crypto regime with sweeping tax reform plans

Bitcoin Order Book Imbalance Signals Buy-Side Pressure Near $88,000

MSTR stock price eyes a crash to $100 as dilution accelerates

AI Probability Model Signals Bitcoin Rebound After $88,000 Support Holds