BitMine Begins Staking Its $12 Billion Ethereum Holdings

By:BeInCrypto

BitMine, the largest corporate holder of Ethereum, has begun staking part of its $12 billion ETH treasury. On December 27, on-chain analyst Ember CN reported that the firm deposited approximately 74,880 ETH, valued at about $219 million, into Ethereum staking contracts. Why is BitMine Staking Its Holdings? The move represents only a small slice of BitMines total holdings of roughly 4.07 million ETH, currently valued near $12 billion. Still, it signals a meaningful shift in how the company intends to manage its balance sheet. BitMine Ethereum Staking. Source: Ember CN If the company were to stake its entire treasury at the current estimated annual percentage yield (APY) of 3.12%, it would generate approximately 126,800 ETH annually. At current prices, this equates to $371 million in yearly revenue. Such a structure would effectively recast BitMine as a yield-bearing vehicle tied to Ethereums consensus layer. This means its valuation would no longer hinge primarily on the assets directional price movements. ETH Staking Goals and Risks However, the strategy introduces new financial and operational risks for the company. Unlike Bitcoin held in cold storage, which can be liquidated immediately in stressed market conditions, staked Ether is constrained by protocol-level withdrawal mechanics. Validators exiting the network must pass through an exit queue, which can delay access to capital during periods of heightened volatility. In a liquidity crunch, that delay could leave BitMine exposed to price swings that a non-staking treasury might otherwise avoid. This tradeoff underscores a structural difference between holding Ethereum as a passive asset and deploying it as productive capital within the network. Still, BitMine has a long-term goal of acquiring and staking 5% of Ethereums total supply. To support that vision, the firm is developing a proprietary staking platform, the Made in America Validator Network (MAVAN), scheduled for deployment in early 2026. We continue to make progress on our staking solution known as The Made in America Validator Network (MAVAN). This will be the best-in-class solution offering secure staking infrastructure and will be deployed in early calendar 2026, BitMine chair Thomas Lee said. Meanwhile, critics argue that consolidating such a large share of Ether under a single US-domiciled validator framework introduces centralization risks. They say the structure could undermine a network designed to be neutral and globally distributed. With BitMine currently controlling about 3.36% of the total ETH supply, MAVAN could, in theory, face pressure to comply with the US Office of Foreign Assets Control (OFAC) sanctions. As a result, the firm could refuse to validate blocks containing transactions linked to sanctioned addresses.

0

0

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

PoolX: Earn new token airdrops

Lock your assets and earn 10%+ APR

Lock now!

You may also like

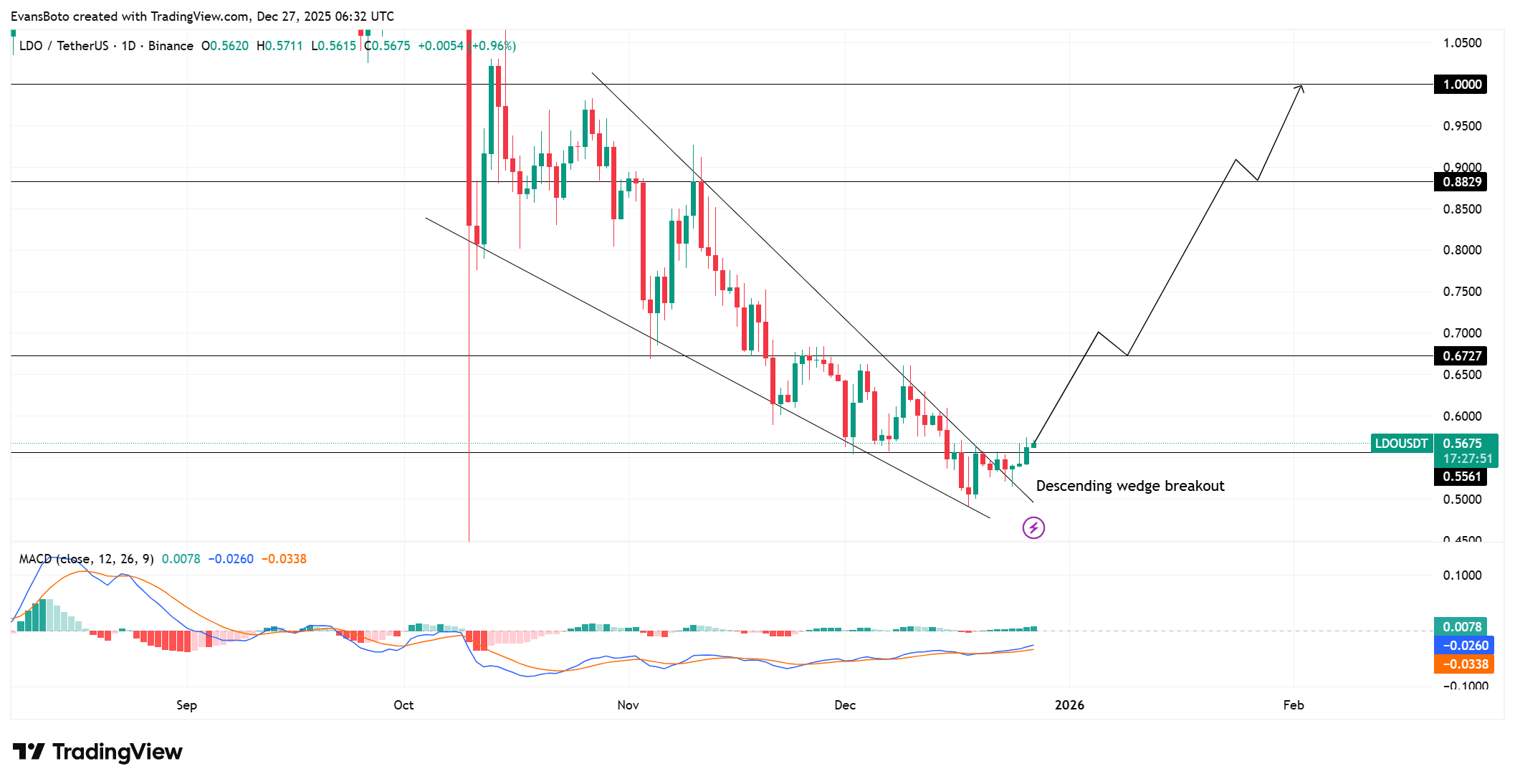

Arthur Hayes goes in on LDO, PENDLE – Is a DeFi rally taking shape?

AMBCrypto•2025/12/27 19:03

XRP ETFs Pause Raises Questions About Market Dynamics

Cointurk•2025/12/27 18:42

Fusionist’s ACE Holds Above Trendline After 6.4% Jump as Price Tests $0.2862 Resistance

Cryptonewsland•2025/12/27 18:39

Bitcoin Short-Term Holders Face Prolonged Pain As Key Metric Stays Red

Newsbtc•2025/12/27 18:33

Trending news

MoreCrypto prices

MoreBitcoin

BTC

$87,453.24

+0.17%

Ethereum

ETH

$2,924.08

+0.04%

Tether USDt

USDT

$0.9993

+0.01%

BNB

BNB

$839.29

+0.73%

XRP

XRP

$1.85

+0.16%

USDC

USDC

$0.9998

-0.00%

Solana

SOL

$123.08

+0.83%

TRON

TRX

$0.2821

+1.57%

Dogecoin

DOGE

$0.1228

+0.59%

Cardano

ADA

$0.3565

+1.96%

How to buy BTC

Bitget lists BTC – Buy or sell BTC quickly on Bitget!

Trade now

Become a trader now?A welcome pack worth 6200 USDT for new users!

Sign up now