Bitcoin is at $89 today, with traders watching the $90 mark.

- Bitcoin is currently trading at US$89.259.

- Forecast of a decline for September-October 2026

- $100 is short-term resistance.

Friday, December 26, 2025 – Bitcoin (BTC) maintained its stability during the Christmas period, trading at US$89.259, up 2% in the last 24 hours. The discreet movement reflected a market with less institutional participation and a cautious mood among investors.

CryptoQuant's analysis indicates that $100.000 has become a critical resistance level in the short term, due to the concentration of recent purchases by large investors and Binance users. The so-called "new whales"—those holding BTC for less than 155 days—have an average acquisition cost of around $100.500, creating a range where both profit-taking and new accumulation are possible.

On the other hand, Binance users in the spot market entered at an average of US$56.000, representing important support should the asset face renewed selling pressure. Meanwhile, long-term holders, with more than 155 days of exposure, maintain positions acquired at around US$40.000. This range is still well below current prices, indicating that these investors continue to have significant profit margins and may be taking advantage of the opportunity to realize some of their gains.

Bitcoin is currently within a strategic range, and the battle between buyers and sellers could define its next moves. The resistance at $100 and the described support levels will serve as key markers in this process.

Bitcoin price analysis: traders are watching the $90 mark.

With Bitcoin currently trading near $89.259, technical analysts highlight the importance of liquidity zones and immediate resistance levels on the daily chart, especially given the expiration of options contracts, which could generate more intense movements in the short term.

Ted (@TedPillows) He draws attention to the consolidation of BTC between US$88.000 and US$90.000, a range in which the asset has been fluctuating without a clear directional force. According to him, "the largest quarterly Bitcoin options expiration is happening today, and we might see some volatility." Ted points out that a daily close above US$90.000 could initiate a possible Christmas rally, with upward momentum at the end of the year.

$ BTC is still stuck in the $88,000-$90,000 range.

The biggest Bitcoin quarterly options expiration is happening today, and maybe we could see some volatility.

If BTC manages a daily close above $90,000 level, we could see a Santa rally.

— Ted (@TedPillows) December 26, 2025

Lennaert Snyder (@LennaertSnyder) Snyder highlights the $90.750 level as a critical liquidity region. According to his analysis, Bitcoin was rejected three times at this point, contributing to the accumulation of pending orders around this range. Snyder believes that "if we capture this liquidity and fail to hold the level, a good selling opportunity may arise." On the other hand, he states that if BTC surpasses and consolidates its position above $94.000, it will open up opportunities for long positions targeting near $100.000.

$ BTC key ~$90,750 liquidity remains untapped.

Bitcoin rejected the level 3 times, creating even more liquidity around $90,750.

If we grab the liquidity and fail to gain, it could be a quality short setup.

When the squeeze is strong and we get a full reclaim of $94K? That's…

— Lennaert Snyder (@LennaertSnyder) December 26, 2025

Both analyses reflect an expectation of movement in the coming days, focusing on the US$90 level as a turning point for the short term. Holding below this range reinforces the consolidation bias, while a consistent breakout could attract buying flow and renew bullish projections.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

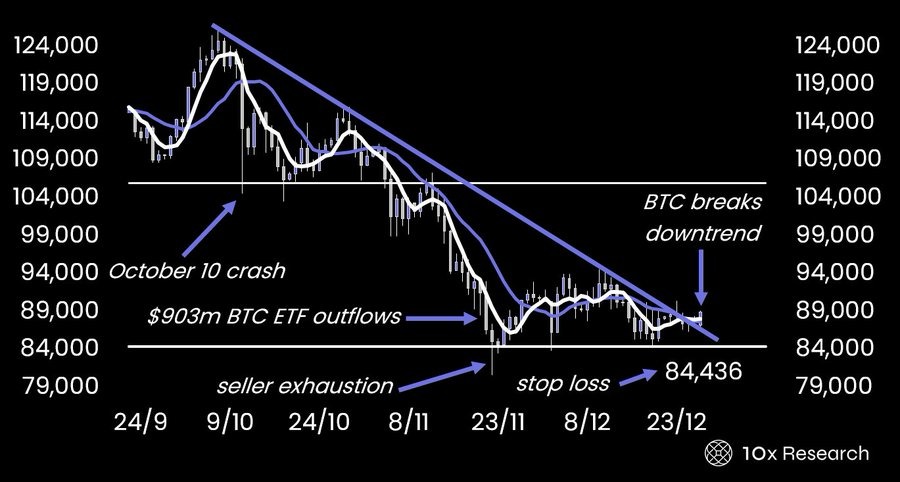

Bitcoin Breakout Alert: 10x Research Sees Multi-Week Rally Pushing BTC To $110K

Lithuania Declares War on Unlicensed Crypto Firms as MiCA Enforcement Begins

Silver Climbs to New ATH of $75.34 as Gold and Platinum Smash Unprecedented Highs, What Does This Mean for Bitcoin?

Best AI Crypto: Trend Research Accumulate ETH While DeepSnitch AI Nears $900k in Presale Revenue As Bonus Offers Attract Investors