Bitcoin (BTC) Whale Longs Halved on Hyperliquid as Shorts Catch Up; Ethereum (ETH) Shorts About Twice ETH Longs

HyperInsight monitoring, as of December 26, indicates a shift in whale exposure on Hyperliquid for key crypto assets. Bitcoin (BTC) Longs have declined while Shorts gain traction, with BTC Longs nearly balanced by Shorts and ETH shorts outpacing longs. Current tallies show roughly 122 BTC Whale Longs and 116 Shorts; for ETH, about 58 Whale Longs and 113 Shorts.

Compared with October 14 data, BTC Whale Longs have contracted from about 234 to around 122, a near‑halving, while short positions hovered near 125, suggesting a shift in bullish leverage without wholesale volatility in the baseline.\n

On-chain dynamics highlight the largest BTC Short Whale on Hyperliquid (address 0x50b) with an average entry around $88,200, a liquidation price near $94,100, and a position size near $76.44 million; the top ETH Short Whale, nicknamed “20 Million Range Hunter”, posts an average entry near $3,129, a liquidation level around $3,796, and a size close to $70.23 million.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

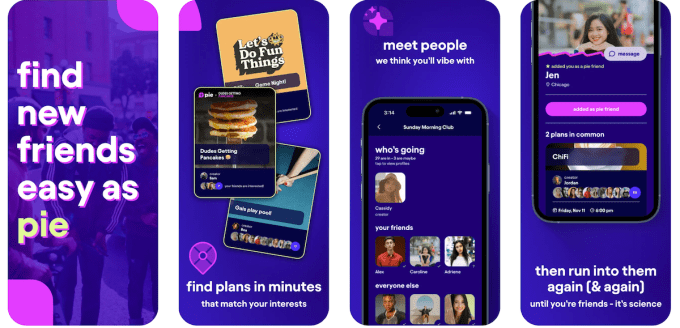

As people look for ways to make new friends, here are the apps promising to help

XRP’s Long-Term Breakout Narrative Builds Even As Short-Term Bears Linger

Next Crypto To Explode: Upexi Shares Slide 7.5% As DeepSnitch AI Attracts Investors With 100% ROI

XRP Holds $1.88 Support as Price Consolidates Below $1.94 Resistance