Bitcoin Just Entered Extreme Oversold Levels And Analysts Predict New ATH Targets

Bitcoin (BTC) has entered an extreme oversold phase, with momentum indicators dropping to levels that historically signal market exhaustion and a trend reversal. Researchers tracking macro conditions and long-term price behavior say that the current drawdown reflects a reset in positioning, not the end of the bull market. Based on past recovery patterns, the analyst believes that Bitcoin could soon forge a path toward a new all-time high.

Bitcoin Enters Extreme Oversold Territory

Thomas Lee, Co-founder and Chief Investment Officer (CIO) of Fundstrat Capital, has flagged Bitcoin’s latest market condition as a key technical development. He pointed to data from Bittel Julien, head of macro research at Global Macro Investor, which highlights how deeply oversold Bitcoin has become within the current cycle and the cryptocurrency’s potential to reach a new ATH.

In his post on X, Lee publicly commended Julien’s analysis, emphasizing that historically extreme oversold conditions in BTC have often been followed by meaningful bounces. Julien, who also shared his report on X this Wednesday, explained that his analysis responds to frequent requests for updates on a long-running market model that tracks Bitcoin’s behavior following major momentum breakdowns.

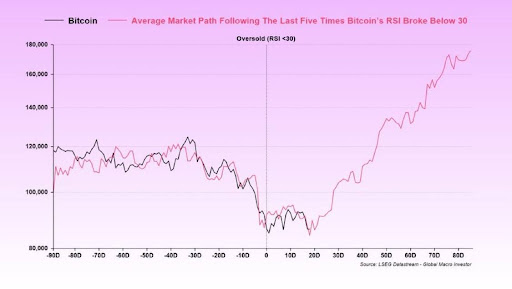

According to him, the model examines BTC’s average price path after the Relative Strength Index (RSI) falls below 30, a level widely considered to indicate extreme oversold conditions. The analyst stated that Bitcoin’s recent price action has closely followed technical historical patterns, provided the broader bull market structure remains intact.

The accompanying chart compares current Bitcoin price behavior with the average historical trajectory observed after the last five instances in which the cryptocurrency entered oversold territory. The point at which RSI declines below 30 is marked as “time zero.” In previous cycles, this moment typically followed a period of stabilization and a strong upward recovery over the following weeks and months.

Source: X

Source: X

Based on historical averages, Julien sees a potential path toward new all-time highs if Bitcoin continues to track past recovery patterns. While the market researcher cautions that the chart is not perfect, he argues that it remains a useful analytical framework, particularly if the four-year cycle thesis continues to play out.

BTC Cycle Could Extend Into 2026 As 4-Year Pattern Breaks

Julien’s analysis also suggests that the current Bitcoin cycle could extend well into 2026 and challenge the relevance of the traditional four-year cycle thesis. According to the market researcher, the BTC cycle has never been driven by halving events, contrary to what the broader crypto community believes. Instead, he stated that the cycle is fueled by public debt refinancing, which was delayed by a year after COVID.

He highlighted that Bitcoin’s four-year cycle is now officially broken due to an increase in the weighted average maturity of the debt term structure. He also noted that liquidity conditions and ongoing interest expense monetization, which far exceed GDP growth, support a prolonged cycle.

Furthermore, Julien emphasized that Bitcoin’s price bases usually take time to form and often include periods of volatility before a significant upward move occurs. The market researcher explained that his analysis was not a signal of an immediate market decline but rather a framework that assumes the bull market is still firmly in place.

BTC price fails to recover | Source:

BTC price fails to recover | Source:

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Trump fusion merger with TAE Technologies marks bold energy sector pivot and $6 billion bet

How to Buy Crypto on DEX

Heima Unveils Advanced On-Chain Lending Project with Programmed Hedging on HyperliquidX

PUMP Price Crashes to 5-Month Low After 33% Decline This Week