Uniswap (UNI) Surges 10% to $5.28 as Whale Accumulation and Short-Position Reversals Reshape the Market

According to HyperInsight, UNI posted a near-term gain of about 10%, trading near $5.28. Market observers link the move to evolving sentiment around Binance‘s dual‑coin investment initiative, with liquidity flows contributing to the burst. A prominent Hyperliquid whale wallet ending in 0x413c shows unrealized gains surpassing 50%, supported by a position of roughly $1.18 million opened at an average price of $4.99. The address established a 10x leveraged long on UNI at midnight yesterday and has continued accumulating as of four hours ago.

On the sentiment side, the largest UNI short exposure held by the Shanzhai Short Army Vanguard fell by more than 30% around 13:00(UTC+8) yesterday, leaving the position near $3.38 million with unrealized gains of about $1.39 million (roughly 410%). The juxtaposition of aggressive long-building with shrinking shorts signals an evolving risk profile for UNI liquidity and may influence short‑term volatility.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Fading ETF Interest Puts Pressure on Dogecoin as Price Approaches Critical Cost-Basis Zone

Why British politicians are flocking to American tech giants

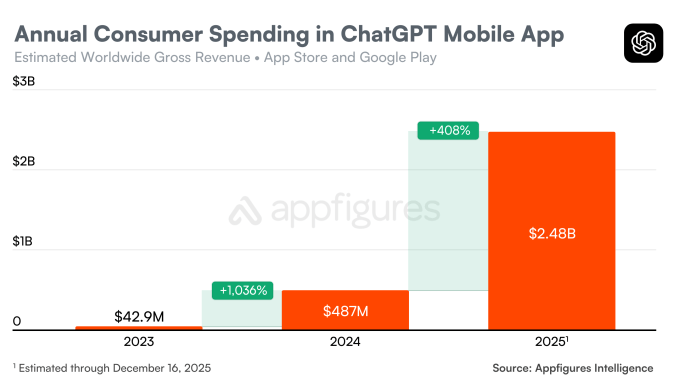

ChatGPT’s mobile app hits new milestone of $3B in consumer spending

Pepe Coin price eyes 30% dip as whales start capitulating