Major Moves from the Most Important US Institutions, the FED and SEC! SEC Releases New Guidance Rules Regarding Cryptocurrencies!

Positive news regarding cryptocurrencies continues to come from the US. In this context, news has been coming in quick succession from the SEC and the FED, two of the most important institutions in the US.

While the US Federal Reserve (FED) withdrew guidelines restricting some banks from participating in cryptocurrency transactions, the US Securities and Exchange Commission (SEC) published custody guidelines for digital assets.

The SEC’s Division of Trade and Markets has issued new guidelines for brokerage firms regarding the custody of digital asset securities.

The rules, known as the 15c3-3 Rule, outline how digital asset securities can be held and managed within the existing securities regulatory framework.

This directive stipulates that, if a brokerage firm meets certain conditions, digital asset securities held on behalf of clients will be considered the physical property of the brokerage firm for compliance purposes.

The SEC stated that this step aims to address uncertainty regarding the application of federal securities laws to digital assets.

The SEC also added that it continues to examine issues related to the custody of digital assets by intermediaries and that it is providing this guidance as a temporary measure in response to requests from market participants.

As the SEC released new guidelines on digital assets, SEC Commissioner Hester Peirce took action to solicit market opinions on cryptocurrency trading on national exchanges.

Accordingly, Hester Peirce stated that the suitability of Regulation ATS and Regulation NMS for the current cryptocurrency market structure needs to be re-examined.

Peirce added that the SEC is exploring ways to create a more flexible regulatory pathway for trading crypto asset securities, while also protecting investor protection and market order.

Peirce concluded by stating that the SEC is prepared to support platforms that list legitimate trading pairs, emphasizing the need for regulations that protect investors and maintain fair markets without hindering innovation.

“Public participation is crucial in designing policies related to cryptocurrencies and blockchain. The practical experiences and suggestions of market participants will play a critical role in determining future regulatory directions.”

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Ethereum Foundation Proposed Three Solutions for One of ETH’s Biggest Problems

Fading ETF Interest Puts Pressure on Dogecoin as Price Approaches Critical Cost-Basis Zone

Why British politicians are flocking to American tech giants

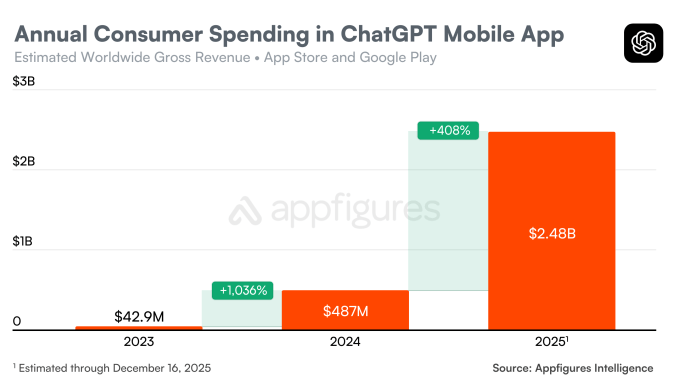

ChatGPT’s mobile app hits new milestone of $3B in consumer spending