EquiLend Invests in Digital Prime’s Tokenet to Advance RWA Tokenization and Stablecoin-Collateralized Crypto Lending

COINOTAG News reports that EquiLend, a leading securities lending infrastructure firm managing a roughly $40 trillion lendable pool, has struck a strategic minority stake in Digital Prime Technologies, a regulated crypto-lending provider. The deal size was not disclosed. The investment signals a strategic push to capture value in real-world asset (RWA) tokenization and the wider digital asset market, anchored by demand for a compliant, transparent, and governable workflow that bridges traditional finance and crypto assets.

Under the agreement, the teams will leverage Digital Prime’s Tokenet institutional lending network to extend multi-custodian and multi-collateral lifecycle coverage, alongside risk exposure monitoring and institutional-grade reporting. Future phases target the integration of compliance stablecoins as collateral and the rollout of additional tokenized financial instruments, enhancing cross-asset liquidity and reporting fidelity.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

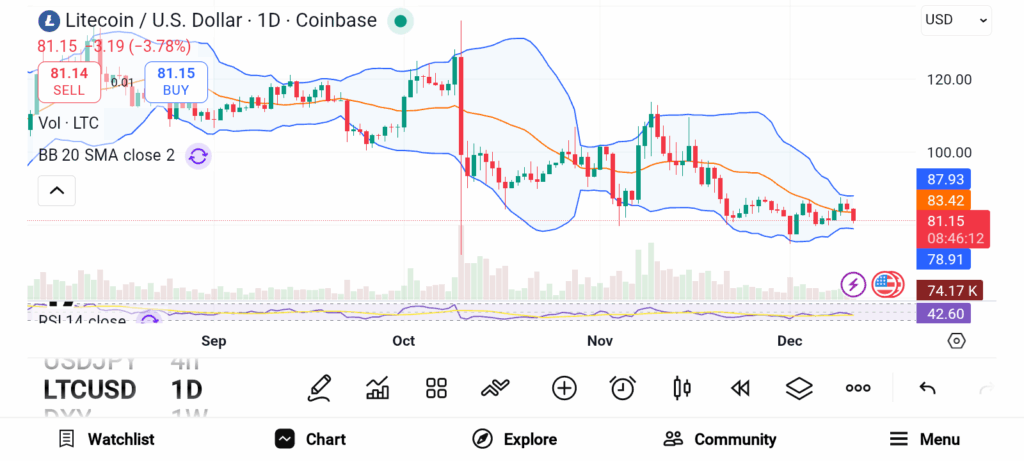

Festive Market Surge: 3 Bullish Cryptos to Watch Before Christmas

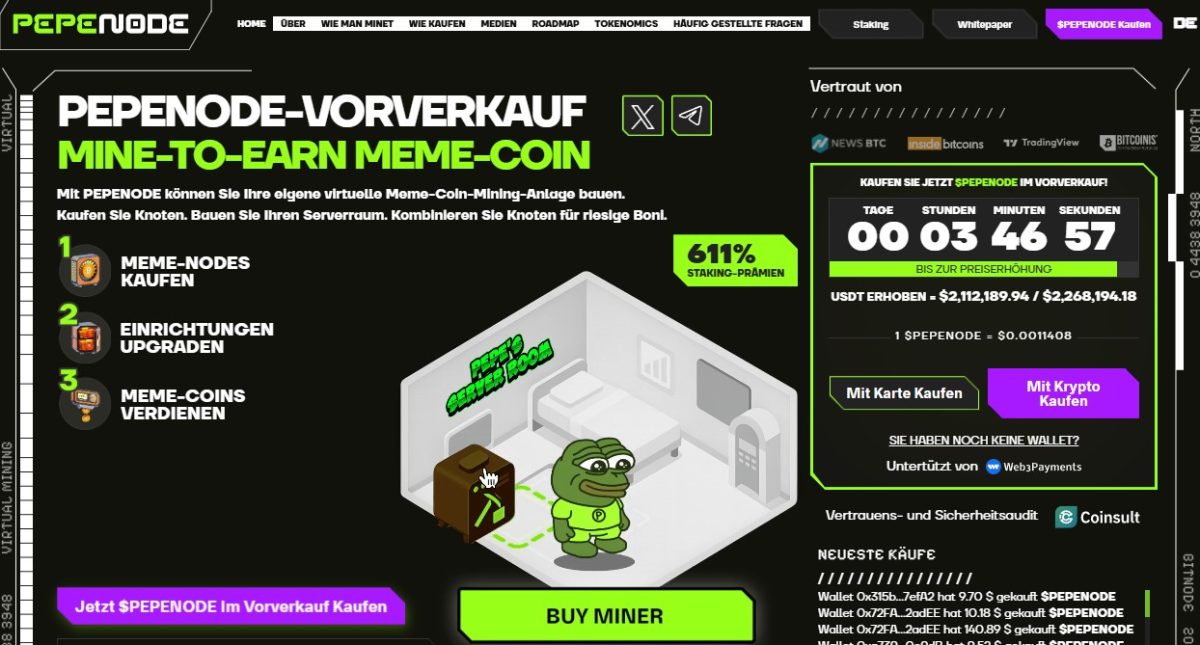

Ethereum Prognose: PepeNode als Ausweich-Play

Cardano price forms bullish divergence as NIGHT token demand jumps