Coinsdrom Review: Why the Future of Digital Assets is “Minimalist”

If you walk into a modern cryptocurrency exchange, you are often greeted by a cockpit of confusion: flashing red and green candles, scrolling order books, leverage sliders, and hundreds of unfamiliar ticker symbols. For the average individual who wants to participate in the digital economy, this complexity is not a feature—it is a barrier.

In this review, we analyze Coinsdrom, a Lithuania-based platform that challenges the industry status quo by asking a radical question: What if an exchange did less, so the user could own more?

We explore how Coinsdrom’s “minimalist” architecture is redesigning the user experience for the next wave of digital adoption.

The “Cockpit” vs. The “Gateway”

Most platforms function as trading terminals. They are built for day-traders who need to stare at screens for hours. Coinsdrom functions as an exchange gateway.

The distinction is vital. A gateway has one purpose: to move you from Point A (Fiat Currency) to Point B (Crypto Asset Ownership) as efficiently as possible.

When you log into Coinsdrom, there are no charts to analyze and no “market depths” to decipher. The interface is stripped down to the essentials:

- What do you want to exchange? (Bitcoin or Ethereum)

- How much?

- Where should we send it?

This design philosophy removes the “decision fatigue” that paralyzes many new users. By eliminating the noise of speculative trading tools, the platform focuses entirely on the utility of acquisition.

The Direct-to-Wallet Model

The most significant operational difference in this review is the nature of the platform. Coinsdrom does not hold your assets.

In a standard exchange, buying Bitcoin is like buying a video game on a digital platform—you have the license to use it, but the platform holds the files. If the platform shuts down, you lose access.

Coinsdrom operates more like a vending machine for digital assets.

- The Process: You initiate a transaction.

- The Execution: Coinsdrom processes the exchange from Fiat to Crypto.

- The Delivery: The assets are sent immediately to your personal external wallet (e.g., Ledger, Metamask, or Trezor).

This model enforces a healthy digital habit: Self-Control. By requiring users to provide their own wallet address, Coinsdrom ensures that the user creates a true ownership structure from Day 1. You don’t leave your assets on the platform; you take them with you.

Quality Over Quantity: The BTC & ETH Standard

In an era where there are over 20,000 different cryptocurrencies, Coinsdrom’s decision to support only Bitcoin and Ethereum is a deliberate stance on quality.

- Bitcoin serves as the digital standard for a store of value (often compared to gold).

- Ethereum serves as the global standard for decentralized applications (the “internet” of value).

By restricting the platform to these two infrastructure-grade assets, Coinsdrom protects users from the “analysis paralysis” of choosing between thousands of unproven experimental tokens. It positions the exchange not as a casino for gambling on new tokens, but as a utility for acquiring the backbone assets of the digital web.

The Regulatory Backbone

While the user interface is minimalist, the backend is robust. As a regulated Virtual Asset Service Provider (VASP) based in Lithuania, Coinsdrom adheres to strict European standards.

This geographical choice is significant. Lithuania has emerged as a primary hub for Fintech in the EU, offering a regulatory framework that balances innovation with strict oversight. For the user, this provides a layer of institutional trust that anonymous, offshore platforms cannot offer. The requirement for identity verification is the trade-off for this security, ensuring that the platform remains a clean, compliant bridge to the banking world.

The Verdict: Who is Coinsdrom For?

In our analysis, Coinsdrom is not built for everyone.

- It is NOT for: High-frequency financial experts, chart analysts, or “degens” looking for the newest meme coins.

- It IS for: The “Buy and Use” individual.

It is designed for the person who treats digital assets as long-term property rather than a short-term flip. If your goal is to convert part of your monthly income into Bitcoin or Ethereum and store it safely in your own cold storage, Coinsdrom offers one of the most direct, clutter-free, and compliant pathways to achieve that.

In a noisy digital world, Coinsdrom proves that sometimes, the most advanced feature a platform can offer is simplicity.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Global gold market rally reshapes exploration, drill results and strategic M&A in 2025

Alliance for OpenUSD specification 1.0 sets universal language for scalable 3D world building

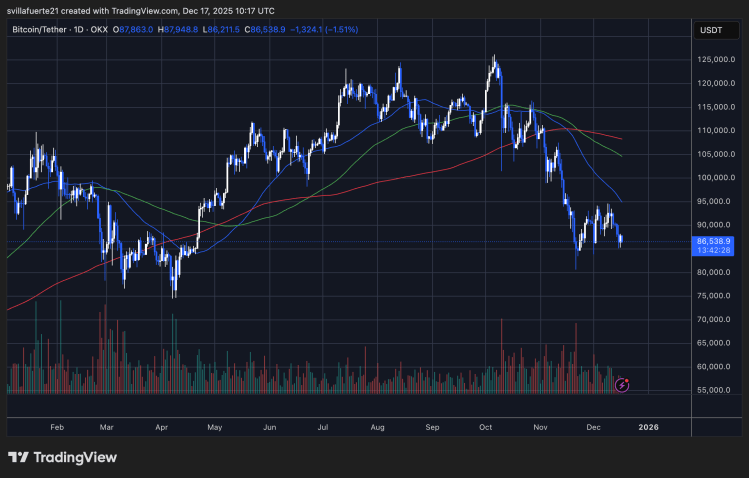

Bitcoin Structure Turns Bearish As Structural Indicators Flip Negative

Amazon appoints longtime AWS exec Peter DeSantis to lead new AI org