The UK’s financial watchdog has opened a major public consultation on how crypto assets should be regulated. This follows the government’s recent confirmation that crypto firms will fall under formal regulation from October 2027.

The Financial Conduct Authority (FCA) said the consultation is wide in scope and covers almost every part of the crypto market. The regulator is asking firms, investors, and the public to share views before the rules are finalized.

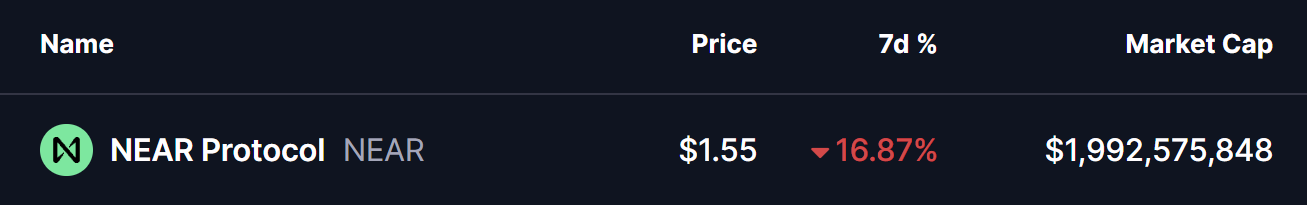

Along with the consultation, the FCA released new research showing a sharp drop in crypto ownership among UK adults. The proportion of people holding crypto fell from 12% to 8% over the past year, a roughly one-third decline.

The regulator said this data indicates investors are in need of clearer rules and better protections. While crypto interest is massive among the citizens, fewer people are currently exposed to digital assets compared to last year.

Britain wants to follow Donald Trump’s approach in the United States, where the GENIUS ACT was signed not long ago, rather than the European Union, which implemented MiCA earlier this year.

What the Proposed Rules Cover

The FCA’s proposals apply many of the same ideas used in traditional finance to crypto markets. Firms would need to give clear and accurate information so investors understand what they are buying and the risks involved.

The rules would cover how crypto assets are listed, standards for trading platforms, and requirements for brokers and other intermediaries. The watchdog also wants stronger measures to prevent insider trading and market manipulation.

Other areas under review include crypto staking, where users lock up tokens in return for rewards, and crypto lending and borrowing services.

The FCA is also seeking views on DeFi, where trading and lending happen without a central middleman. The agency is asking whether existing financial rules should apply to these services as well.

According to earlier reports, however, the British government is considering a ban on crypto donations to politicians for their campaigns.

Margin Trading and Crypto Borrowing Rules

Under the new plans, individuals would be allowed to trade crypto assets they have borrowed rather than own outright, according to The Telegraph.

This type of trading can increase gains but can also rapidly accelerate losses as well. The FCA had earlier planned to block retail access to these services, but that doesn’t look to be the case anymore.

Also, crypto platforms would not be required to run credit checks or provide special support to users close to default. However, customers would need to provide more collateral than the value of the borrowed crypto, and losses would be limited to the amount of collateral posted.

Moreover, the FCA said the consultation will remain open until 12 February 2026. Feedback will be used to refine the final rules, which the regulator aims to complete by the end of next year.