Crypto ETF Weekly Report | Last week, US Bitcoin spot ETFs saw a net inflow of $286 million; US Ethereum spot ETFs saw a net inflow of $209 million

Bitwise's top ten crypto index fund has officially been listed and is now trading as an ETF on NYSE Arca.

Compiled by: Jerry, ChainCatcher

Performance of Crypto Spot ETFs Last Week

US Bitcoin Spot ETFs Net Inflow of $286 Million

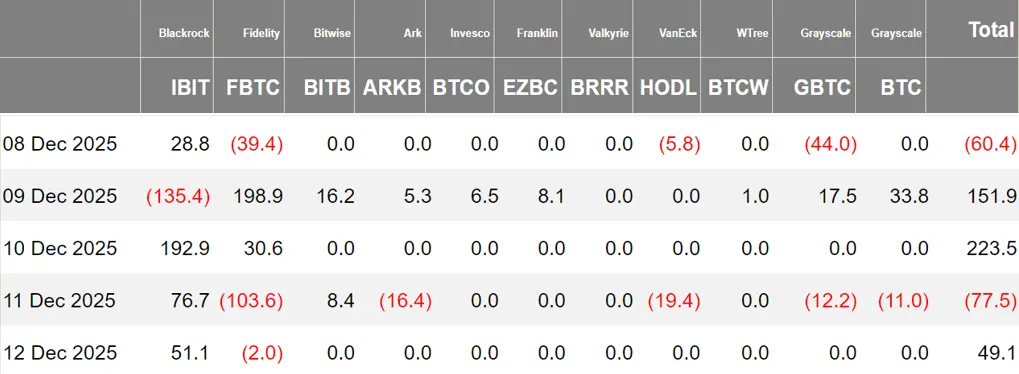

Last week, US Bitcoin spot ETFs saw net inflows for three days, with a total net inflow of $286 million, and the total net asset value reached $118.27 billion.

Last week, six ETFs were in a net outflow state, with inflows mainly coming from IBIT, FBTC, and BITB, with inflows of $214 million, $84.5 million, and $24.6 million respectively.

Data source: Farside Investors

US Ethereum Spot ETFs Net Inflow of $209 Million

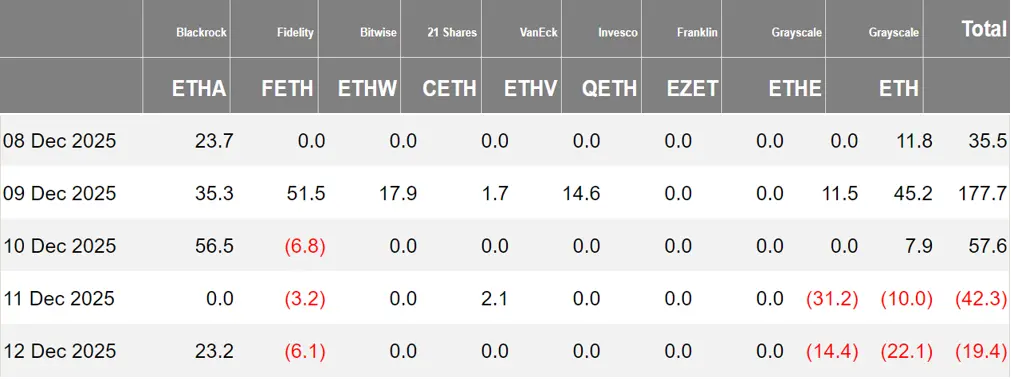

Last week, US Ethereum spot ETFs saw net inflows for three days, with a total net inflow of $209 million, and the total net asset value reached $19.42 billion.

The inflows last week mainly came from BlackRock's ETHA, with a net inflow of $138 million. Six Ethereum spot ETFs were in a net inflow state.

Data source: Farside Investors

Hong Kong Bitcoin Spot ETFs Net Inflow of 46.59 Bitcoins

Last week, Hong Kong Bitcoin spot ETFs saw a net inflow of 46.59 Bitcoins, with a net asset value of $354 million. Among them, the holdings of the issuer Harvest Bitcoin dropped to 291.37 Bitcoins, while ChinaAMC increased to 2,390 Bitcoins.

There was no capital inflow for Hong Kong Ethereum spot ETFs, with a net asset value of $105 million.

Data source: SoSoValue

Performance of Crypto Spot ETF Options

As of December 12, the notional total trading volume of US Bitcoin spot ETF options was $2.02 billion, with a notional total long-short ratio of 1.62.

As of December 11, the notional total open interest of US Bitcoin spot ETF options reached $33.89 billion, with a notional total long-short ratio of 1.83.

In the short term, trading activity for Bitcoin spot ETF options has increased, with overall sentiment leaning bullish.

In addition, the implied volatility is 45.98%.

Data source: SoSoValue

Overview of Crypto ETF Developments Last Week

Data: Public companies, governments, ETFs, and exchanges collectively hold 5.94 million Bitcoins, accounting for 29.8% of the circulating supply

glassnode published an analysis stating that the holdings of major Bitcoin holder types are as follows: public companies: about 1.07 million Bitcoins, government agencies: about 620,000 Bitcoins, US spot ETFs: about 1.31 million Bitcoins, exchanges: about 2.94 million Bitcoins. These institutions collectively hold about 5.94 million Bitcoins, accounting for about 29.8% of the circulating supply, highlighting the trend of liquidity increasingly concentrating among institutions and custodians.

VanEck to Launch Degen Economy ETF, Focusing on Digital Gaming, Prediction Markets, and More

According to Bloomberg analyst Eric Balchunas, VanEck will launch the Degen Economy ETF, focusing on digital gaming, prediction markets, and related fields. This ETF evolved from a previous gaming ETF, which was forced to adjust due to poor performance. Eric Balchunas noted that this represents the growing presence of the "gambler" group in the economic sector.

CBOE Approves Listing and Registration of 21Shares XRP ETF

According to Cointelegraph, the Chicago Board Options Exchange (CBOE) has approved the listing and registration of the 21Shares XRP ETF.

Invesco Has Submitted Form 8-A for Its Solana ETF to the US SEC

Global asset management giant Invesco has submitted Form 8-A for its Invesco Galaxy Solana ETF to the US Securities and Exchange Commission (SEC), a step usually taken before the official launch of the product.

After submitting such documents, trading usually begins the next day.

US Company Nicholas Financial Plans to Launch Bitcoin ETF, Holding BTC Only During US Market Off-Hours

According to CoinDesk, boutique wealth management firm Nicholas Financial Corporation has filed an application with the US Securities and Exchange Commission (SEC) to launch a Bitcoin ETF that holds Bitcoin assets only at night, completely avoiding US trading hours. The fund, named Nicholas Bitcoin and Treasuries AfterDark ETF (ticker NGTH), will buy Bitcoin at 4:00 pm US Eastern Time (when the US market closes) and sell it at 9:30 am US Eastern Time the next day (before the market reopens).

During the daytime, the fund will invest in short-term US Treasuries for preservation and yield. The company has also filed for a second product, the Nicholas Bitcoin Tail ETF (ticker BHGD). If approved, this ETF will add a new dimension to the growing ecosystem of Bitcoin investment products by making the time of day a key factor in its strategy.

Bitwise 10 Crypto Index Fund Officially Listed as an ETF on NYSE Arca

According to market news, Bitwise's "10 Crypto Index Fund" has officially been listed as an ETF on the NYSE Arca exchange, after previously being delayed due to SEC review.

This ETF covers the ten major crypto assets: Bitcoin (BTC), Ethereum (ETH), XRP, Solana (SOL), Cardano (ADA), Chainlink (LINK), Litecoin (LTC), Sui (SUI), Avalanche (AVA), and Polkadot (DOT).

BlackRock Submits Application for iShares Staked Ethereum Trust ETF

Bloomberg analyst Eric Balchunas posted on social media that BlackRock has submitted a formal prospectus (Form S-1) for the iShares Staked Ethereum Trust ETF to the US SEC, which will become its fourth crypto-related ETF product.

Previously, BlackRock had applied for spot Bitcoin, spot Ethereum, and "Bitcoin yield" ETFs.

Opinions and Analysis on Crypto ETFs

Glassnode: Ethereum Spot ETFs Show Signs of Recovery, Moderate Inflows Suggest Redemption Pressure Has Eased

Glassnode posted an analysis on X, stating that after several weeks of continuous outflows, Ethereum spot ETFs are beginning to show signs of recovery.

Moderate inflows have started to appear, suggesting that redemption pressure has eased. If net inflows continue, it would indicate improved demand before the end of the year.

Ripple CEO: Total AUM of XRP Spot ETFs on the Market Has Surpassed $1 Billion

Ripple CEO Brad Garlinghouse posted on X that the total assets under management of listed XRP spot ETFs surpassed the $1 billion mark in less than four weeks, making XRP the fastest crypto to reach this milestone since the launch of ETH spot ETFs. In 2025, the US launched over 40 crypto ETFs, indicating huge demand for regulated crypto products. With Vanguard opening crypto trading channels for traditional retirement/trading accounts, millions of ordinary users who are not tech-savvy can now access crypto. For new "off-chain" crypto holders, stability and community are underestimated but crucial themes.

Grayscale CEO: Two Ethereum ETFs Have Generated About $11.8 Million in ETH Staking Rewards

Grayscale CEO Peter Mintzberg posted on X that since Grayscale Ethereum Trust (ETHE) and Ethereum Mini Trust (ETH) began supporting staking rewards, they have generated about $11.8 million in ETH staking rewards for investors in less than sixty days, making them two of the best-performing ETF products in the US ETF market so far.

Bloomberg Analyst: 124 Crypto Asset ETFs Registered in the US Market

Bloomberg ETF senior analyst Eric Balchunas posted a chart on X showing that by the end of 2025, there are 124 crypto-related ETP (exchange-traded product) registration applications in the US market, including: Bitcoin-related products with the highest share, totaling 21 (18 of which are based on the 1940 Act derivative structure). Next are basket products (15), as well as XRP (10), Solana (9), and Ethereum (7) among mainstream tokens. Currently, 42 are spot applications under the 1933 Act, with the rest being derivatives or structured funds.

Solana Foundation Chair: SOL Spot ETFs Saw Nearly $1 Billion Net Inflow Against the Market, DAT Companies to Bridge Solana and Public Markets

Solana Foundation Chair Lily Liu stated at Solana Breakpoint 2025: "Solana is the first blockchain platform to establish a policy research institute.

Today, it is imperative for every institution to formulate a digital asset strategy. As these institutions enter the blockchain space, they are choosing Solana. Western Union, which processes over $60 billion in remittances annually, chose Solana. Pfizer, which processes $2 trillion in merchant payments annually, also chose Solana. Other institutions are following suit.

Of course, ETFs are a major theme this year. We finally have physically-backed Solana staking ETFs—they landed in the Solana ecosystem about six weeks ago, and in just six weeks, their assets under management have approached $1 billion. During a period of overall market underperformance, we saw three consecutive weeks of net inflows. In the US market alone, six physically-backed Solana staking ETFs have been listed.

Another important theme this year, though somewhat controversial, is DAT (crypto treasury companies). Many see DAT as a short-term liquidity tool, but we take the opposite view. Solana is one of the few platforms that allows enterprises to build at both the infrastructure and asset layers. We believe DAT will be long-term ecosystem companies, serving as bridges to connect Solana with public markets, building infrastructure, asset management systems, and integrating all these functions."

Japan FSA: Before Approving Crypto ETFs, Overseas ETF-Linked CFDs Unlikely to Be Opened Domestically

According to Yahoo News, the Japan Financial Services Agency (FSA) clarified in a revised Q&A that derivatives such as CFDs (contracts for difference) linked to overseas crypto asset ETFs are not ideal for domestic provision, as Japan has not yet approved crypto ETFs and the investor protection environment is insufficient.

The FSA pointed out that such products are essentially linked to spot crypto asset prices and fall under the category of crypto derivatives, with insufficient risk disclosure and regulatory framework. As a result, IG Securities has announced the suspension of CFD trading based on US spot Bitcoin ETFs (such as IBIT). Regulatory direction indicates that in the short term, it will be difficult to open up crypto derivatives linked to overseas ETFs in Japan.

Korean Media: Due to Regulatory Delays, South Korea's Plan to Allow Spot Crypto ETF Trading This Year Has Basically Fallen Through

According to Korean media naver, due to delays in amending South Korea's Capital Markets Act, the country's plan to allow spot crypto ETF trading within the year has basically fallen through.

Currently, there are four pending amendments related to the approval of spot crypto ETFs, but some analysts point out that due to the restructuring of the Financial Services Commission and Financial Supervisory Service, as well as government stock market activation measures consuming significant policy resources, the institutionalization process for crypto assets may have been relegated to a secondary position.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

The market is not driven by individuals, but dominated by emotions: how trading psychology determines price trends

Crypto Coins Surge: Major Unlocks Impact Short-Term Market Dynamics

In Brief Crypto market anticipates large-scale unlocks, exceeding $309 million in total market value. Significant cliff-type unlocks involve ZK and ZRO, impacting market dynamics. RAIN, SOL, TRUMP, and WLD highlight notable linear unlocks within the same period.

Bitcoin Stable But Fragile Ahead Of BoJ Decision

BONK Remains Under Pressure as Bearish Structure Limits Recovery Attempts