Brazil’s Largest Private Bank Advises 3% Bitcoin Allocation For Clients

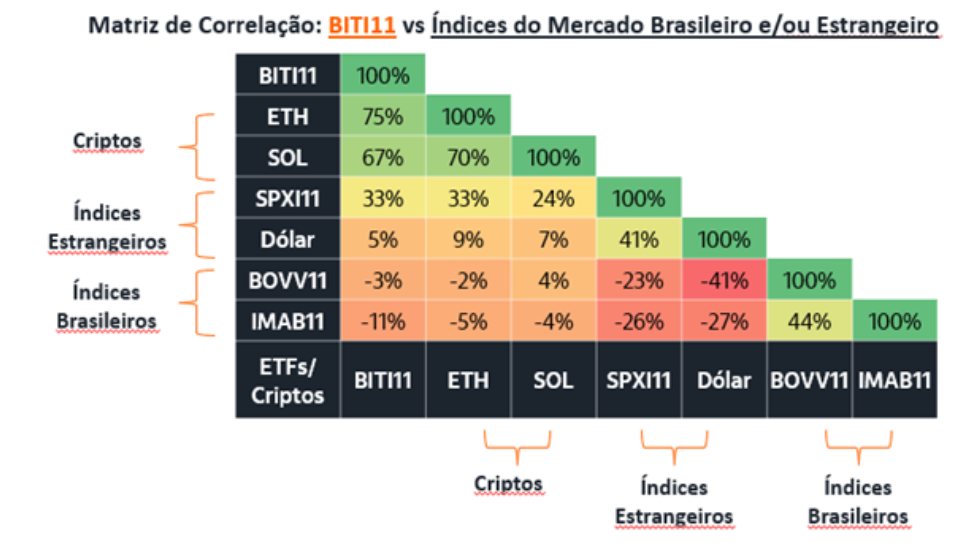

Itau argues that Bitcoin’s low correlation with traditional assets and its global nature can improve diversification without materially increasing portfolio risk.

Itaú Unibanco Holding SA, Latin America’s largest private bank, has advised clients to allocate up to 3% of their portfolios to Bitcoin for 2026.

The bank framed the cryptocurrency not as a speculative asset, but as a hedge against the erosion of the Brazilian real.

Why Itau Wants Clients’ Funds in Bitcoin

In a strategy note, analysts at the Sao Paulo-based lender said investors face a dual challenge from global price uncertainty and domestic currency fluctuations. They argued that these conditions necessitate a new approach to portfolio construction.

The bank recommends a Bitcoin weight of 1% to 3% to capture returns uncorrelated with domestic cycles.

“Bitcoin [is] an asset distinct from fixed income, traditional stocks, or domestic markets, with its own dynamics, return potential, and — due to its global and decentralized nature — a currency hedging function,” the bank wrote.

Itau emphasized that Bitcoin should not become a core holding. Instead, the bank framed the asset as a complementary allocation calibrated to an investor’s risk profile.

The objective is to capture returns that are not closely tied to domestic economic cycles and to provide partial protection against currency depreciation. It also aims to preserve exposure to long-term appreciation.

The bank pointed to the relatively low correlation between Bitcoin and traditional asset classes. It argued that an allocation of 1% to 3% can enhance diversification without overwhelming overall portfolio risk.

Bitcoin Performance vs Traditional Assets. Source:

Itau

Bitcoin Performance vs Traditional Assets. Source:

Itau

The approach, the note said, requires moderation, discipline, and a long-term horizon, rather than reactions to short-term price swings.

“Attempting ‘perfect timing’ in assets like Bitcoin or other international markets is risky — and often counterproductive,” the bank warned.

Itaú’s 3% ceiling places it squarely in line with the most forward-looking global guidance, narrowing the gap with US counterparts.

Notably, major US banks such as Morgan Stanley and Bank of America have recommended that their clients allocate up to 4% of their assets to the flagship digital asset.

For Brazilian investors, however, the stakes are different.

Itaú said that in a world of shortening economic cycles and more frequent external shocks, Bitcoin’s “hybrid character” sets it apart from traditional assets.

The bank described the flagship cryptocurrency as part high-risk asset and part global store of value. It argued that this combination offers a form of resilience that fixed income can no longer guarantee.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Hyperliquid (HYPE) Price Rally: Key Factors Behind Institutional Embrace in 2025

- Hyperliquid's HIP-3 upgrade enabled permissionless perpetual markets, driving $400B+ trading volume and 32% blockchain revenue share in 2025. - Institutional adoption accelerated via 90% fee reductions, TVL of $2.15B, and partnerships with Anchorage Digital and Circle's CCTP V2. - HYPE's deflationary model (97% fees fund buybacks) and $1.3B buyback fund fueled price surges, mirroring MicroStrategy's Bitcoin strategy. - Regulatory alignment with GENIUS Act/MiCAR and USDH stablecoin compliance strengthened

HYPE Token's Unpredictable Rise: Analyzing Altcoin Hype After the 2025 Market Overhaul

- HYPE token's 2025 volatility surged with Hyperliquid's $47B weekly trading volume, driven by whale accumulation and $340M buybacks. - Institutional support via HIP-3 protocol upgrades boosted open interest to $15B, but technical indicators signaled short-term fragility. - Regulatory shifts in UAE and Fed policy amplified risks, while social media FOMO triggered extreme price swings between $41.28 and $27.43. - Market share erosion to <20% and $11M liquidations exposed structural weaknesses despite instit

The Value of Including CFTC-Approved Clean Energy Marketplaces in Contemporary Investment Portfolios

- CFTC-approved clean energy platforms like CleanTrade enable institutional investors to hedge risks, diversify portfolios, and align with ESG goals through renewable energy derivatives. - CleanTrade's $16B in two-month notional value highlights urgent demand for scalable, transparent infrastructure to access low-carbon assets with real-time analytics and risk tools. - These platforms reduce market fragmentation by standardizing VPPAs, PPAs, and RECs, offering verifiable decarbonization pathways and dynami

The Influence of Educational Institutions on the Development of AI-Powered Industries

- Farmingdale State College (FSC) invests $75M in AI infrastructure , doubling tech enrollment and launching an AI Management degree blending technical and business skills. - Industry partnerships with Tesla and cybersecurity firms, plus 80% graduate employment rates, highlight FSC's success in aligning education with AI-driven workforce demands. - FSC's RAM mentorship program and NSF-funded AI ethics research foster interdisciplinary innovation, addressing supply chain and healthcare challenges through ap