Zcash Buyers Pull $17 Million Off Exchanges as Price Pauses — What Comes Next?

The Zcash price has seen a sharp run this cycle, up over 700% in three months, followed by a healthy pause. After rallying strongly through the last week, the price is now pulling back, raising questions about whether momentum is fading or simply resetting. While short-term price action looks undecided, on-chain and volume data suggest

The Zcash price has seen a sharp run this cycle, up over 700% in three months, followed by a healthy pause. After rallying strongly through the last week, the price is now pulling back, raising questions about whether momentum is fading or simply resetting.

While short-term price action looks undecided, on-chain and volume data suggest buyers may still be quietly in control. The next move depends on whether Zcash can turn consolidation into continuation.

Buyers Still Control Structure Despite Cooling Volume

Zcash price is currently trading inside a tightening triangle pattern, which reflects short-term buyer and seller indecision rather than outright weakness. Importantly, the price continues to respect the rising trend line that has guided the uptrend this cycle. As long as that structure holds, the broader setup remains constructive.

Volume behavior adds key context. Using Wyckoff-style volume color analysis, blue bars indicate buyer-led activity, while yellow and red bars reflect increasing seller control.

Although buyer volume has cooled recently, blue bars are still dominant. A similar slowdown occurred after October 17, when buying pressure briefly weakened, before Zcash went on to rally by more than 300%.

Cooling volume alone did not end that trend. As long as the blue bars dominate, the rally is likely to remain strong, despite any pullbacks.

Zcash Buyers In Control:

Zcash Buyers In Control:

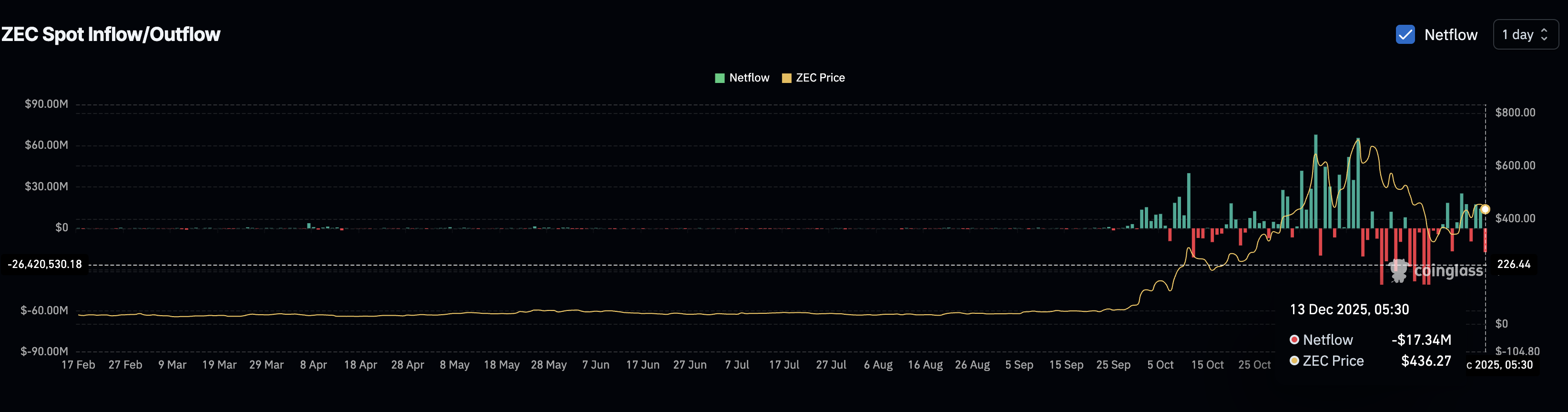

Spot flow data reinforces this picture. Spot flows track whether coins are moving onto or off exchanges.

Inflows suggest potential selling, while outflows signal accumulation. On December 12, Zcash recorded roughly $14.26 million in spot inflows, meaning coins moved onto exchanges.

By December 13, that flipped sharply to around $17.34 million in net outflows, showing coins being pulled off exchanges instead.

Sudden Surge In Sopt Buyers:

Sudden Surge In Sopt Buyers:

That shift matters. Exchange outflows reduce immediate sell pressure and often reflect spot buyers stepping in during pullbacks rather than distributing into strength.

Despite a mild pullback of about 2.5% over the past 24 hours, Zcash remains up roughly 20% over the past week and more than 700% over the past three months. The trend has not broken. It is consolidating.

Zcash Price Levels That Define the Next Move

For the bullish structure to continue, the Zcash price needs to break out of the triangle. The key level to watch is $511, a 24% move from current levels. A clean daily close above this level would confirm a bullish resolution and signal renewed buyer control.

If that breakout occurs, the first upside target sits near $549, followed by $733, which capped rallies earlier in the cycle. Higher resistance zones exist near $850 and $1,190, though reaching those would require sustained momentum and supportive broader market conditions.

Zcash Price Analysis:

Zcash Price Analysis:

Downside risk remains clearly defined. If the Zcash price loses $430, the triangle structure weakens. Strong support sits near $391, and a deeper breakdown could open the door to $301 if risk-off pressure spreads across the market.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

The Rise of a Fluid Clean Energy Marketplace: How CleanTrade is Transforming Institutional Investment in Renewable Resources

- CleanTrade's CFTC-approved SEF platform transforms VPPAs, PPAs, and RECs into institutional-grade renewable energy commodities. - The platform addresses historic market issues like illiquidity and opacity, enabling $16B in notional trading volume within two months. - Industry giants Cargill and Mercuria validate clean energy as a serious asset class through strategic participation in the regulated market. - By aligning financial and ESG goals, CleanTrade creates scalable alpha opportunities as global cle

Clean Energy Market Dynamics and Investment Prospects: The Role of CFTC-Approved Platforms in Facilitating Institutional Participation

- CFTC-approved platforms like CleanTrade are transforming clean energy markets by standardizing derivatives and centralizing trading infrastructure, boosting institutional liquidity and transparency. - CleanTrade’s SEF designation in September 2025 enabled $16B in notional trades within two months, converting illiquid assets like RECs into tradable commodities with ESG-aligned risk management tools. - Institutional demand surged as 70% of large asset owners integrated climate goals, with IRA-driven clean

The Growing Significance of Financial Well-Being in Planning for Lasting Wealth

- Financial wellness is redefining long-term wealth planning by integrating personal well-being with financial outcomes. - Intentional habits and AI-driven tools boost resilience, reducing behavioral underperformance by 2.5% annually. - Debt management via sustainable finance mitigates risks, especially in developing economies with robust policies. - Early financial education and four-quadrant frameworks balance objective metrics with subjective well-being. - Technology and financial therapy bridge gaps, e

The Rise of Liquid Clean Energy Markets and Their Impact on Investment Opportunities

- Global energy transition accelerates liquid clean energy markets, reshaping institutional investment strategies with ESG-aligned assets. - U.S. DOE and private firms advance infrastructure, including fusion and hydrogen projects, addressing scalability and reliability. - RESurety’s CFTC-approved CleanTrade platform boosts transparency and liquidity in clean energy derivatives, enabling $16B in trading. - Institutional investors diversify portfolios with clean energy derivatives, leveraging ESG compliance