Whales Are Going All-In on Ethereum — But Record Leverage Puts Their Longs at Risk

After the FED announced interest rate cuts, major whale wallets began pouring capital into long positions on Ethereum (ETH). These moves signal strong confidence in ETH’s upside. They also increase overall risk. Several factors suggest that their long positions may face liquidation soon without effective risk management. How Confident Are Whales in Their Ethereum Long

After the FED announced interest rate cuts, major whale wallets began pouring capital into long positions on Ethereum (ETH). These moves signal strong confidence in ETH’s upside. They also increase overall risk.

Several factors suggest that their long positions may face liquidation soon without effective risk management.

How Confident Are Whales in Their Ethereum Long Positions?

Whale behavior offers a clear view of current sentiment.

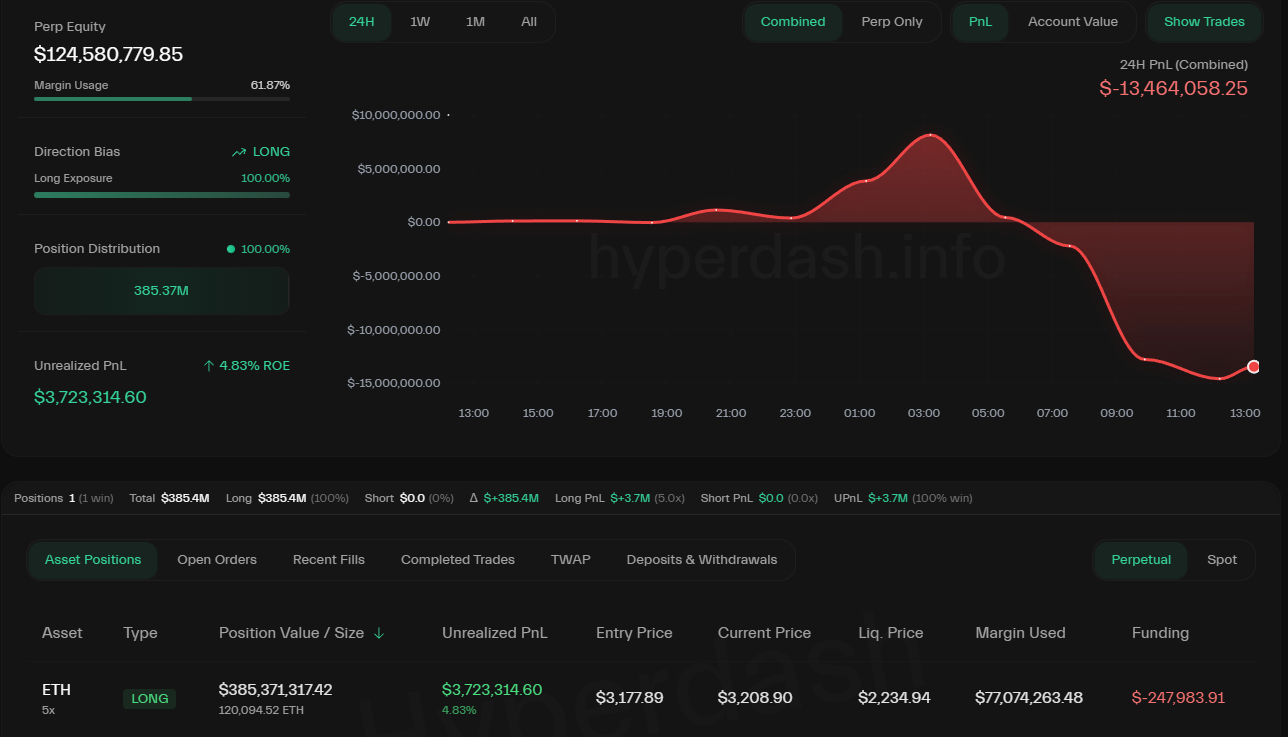

On-chain tracking account Lookonchain reported that a well-known whale, considered a Bitcoin OG, recently expanded a long position on Hyperliquid to 120,094 ETH. The liquidation price sits at only $2,234.

This position is currently showing a 24-hour PnL loss of more than $13.5 million.

A Whale’s Long ETH Position on Hyperliquid. Source:

HyperDash

A Whale’s Long ETH Position on Hyperliquid. Source:

HyperDash

Similarly, another well-known trader, Machi Big Brother, is maintaining a long position worth 6,000 ETH with a liquidation price of $3,152.

Additionally, on-chain data platform Arkham reported that the Chinese whale trader who called the 10/10 market crash is now holding a $300 million ETH long position on Hyperliquid.

Whale activity in ETH long positions reflects their expectation of a near-term price increase. However, behind this optimism lies a significant risk stemming from Ethereum’s leverage levels.

ETH Leverage Is Reaching Dangerous Highs

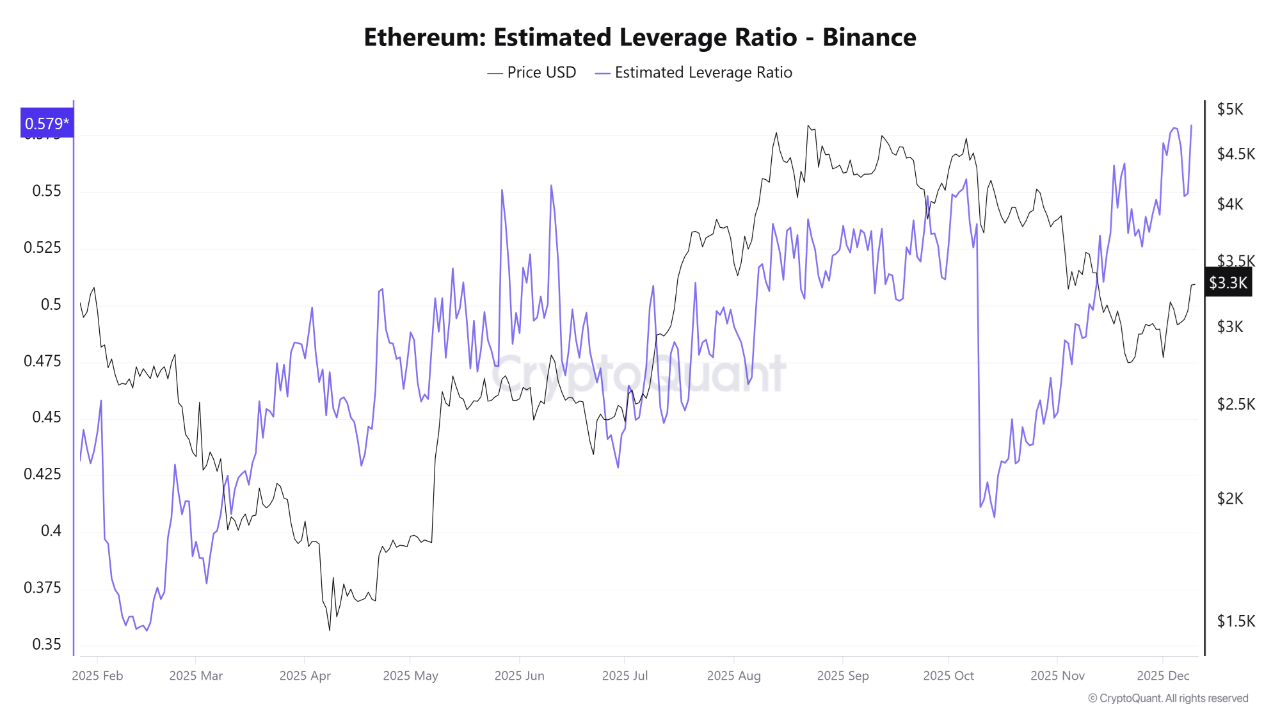

CryptoQuant data shows that ETH’s estimated leverage ratio on Binance has reached 0.579 — the highest in history. This level indicates extremely aggressive leverage usage. Even a small price swing could trigger a domino effect.

Ethereum Estimated Leverage Ratio – Binance. Source:

CryptoQuant

Ethereum Estimated Leverage Ratio – Binance. Source:

CryptoQuant

“Such a high leverage ratio means that the volume of open contracts financed by leverage is rising faster than the volume of actual assets on the platform. When this occurs, the market becomes more vulnerable to sudden price movements, as traders are more susceptible to liquidation—whether in an upward or downward trend,” analyst Arab Chain said.

Historical data indicate that similar peaks typically coincide with periods of intense price pressure and often signal local market tops.

Spot Market Weakness Adds More Risk

The spot market is also showing clear signs of weakening. Crypto market watcher Wu Blockchain reported that spot trading volume on major exchanges dropped 28% in November 2025 compared to October.

November Exchange Data Report: Spot trading volume of major exchanges in November 2025 fell 28% compared with October. The top three exchanges by change rate were Bitfinex +17%, Coinbase -8%, and KuCoin -17%. The bottom three were Bitget -62%, Gate -44%, and MEXC -34%.…

— Wu Blockchain (@WuBlockchain) December 10, 2025

Another report from BeInCrypto highlighted that stablecoin inflows into exchanges have declined by 50%, falling from $158 billion in August to $ 78 billion as of today.

Combined, low spot buying power, high leverage, and shrinking stablecoin reserves reduce ETH’s ability to recover. These conditions could put whale long positions at significant risk of liquidation.

Read the article at BeInCryptoDisclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Runway unveils its inaugural world model and introduces built-in audio support to its newest video model

Rivian plans to introduce its AI assistant to its electric vehicles at the beginning of 2026

OpenAI responds to Google's 'code red' alert by launching GPT-5.2