350 Million XRP Changes Hands as Bigger Whales Take Over Amid Price Downtrend

XRP continues to struggle under a persistent downtrend as bearish cues from the broader crypto market limit recovery attempts. Despite this weakness, the altcoin still benefits from the support of major wallets, even as some whale cohorts reduce their exposure. XRP Supply Changes Hands Whale activity shows a notable redistribution of XRP supply between major

XRP continues to struggle under a persistent downtrend as bearish cues from the broader crypto market limit recovery attempts.

Despite this weakness, the altcoin still benefits from the support of major wallets, even as some whale cohorts reduce their exposure.

XRP Supply Changes Hands

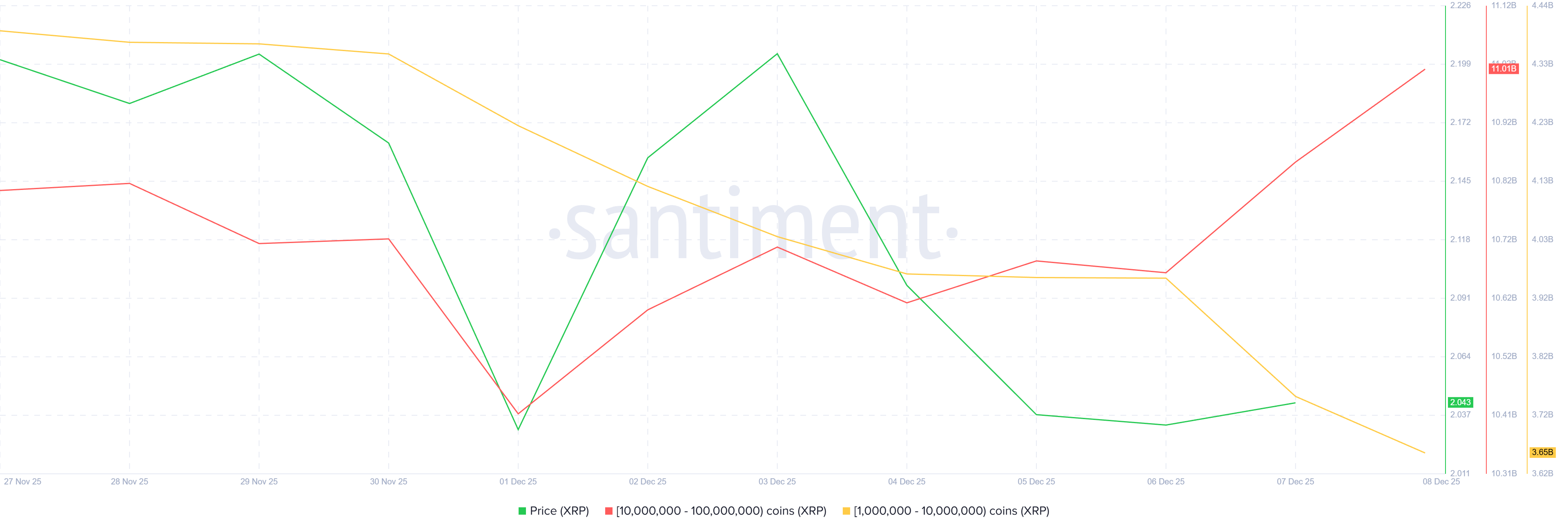

Whale activity shows a notable redistribution of XRP supply between major cohorts. Addresses holding 1 million to 10 million XRP offloaded more than 330 million XRP in the past four days, reflecting skepticism among mid-sized whales. Their selling pressure, however, did not send supply to exchanges or retail holders.

Instead, larger wallets holding 10 million to 100 million XRP absorbed this supply. Their combined holdings climbed by 350 million XRP during the same period, worth more than $729 million. This accumulation signals confidence from deeper-pocketed investors who often act as stabilizing forces when market sentiment weakens.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter.

XRP Whale Holding. Source:

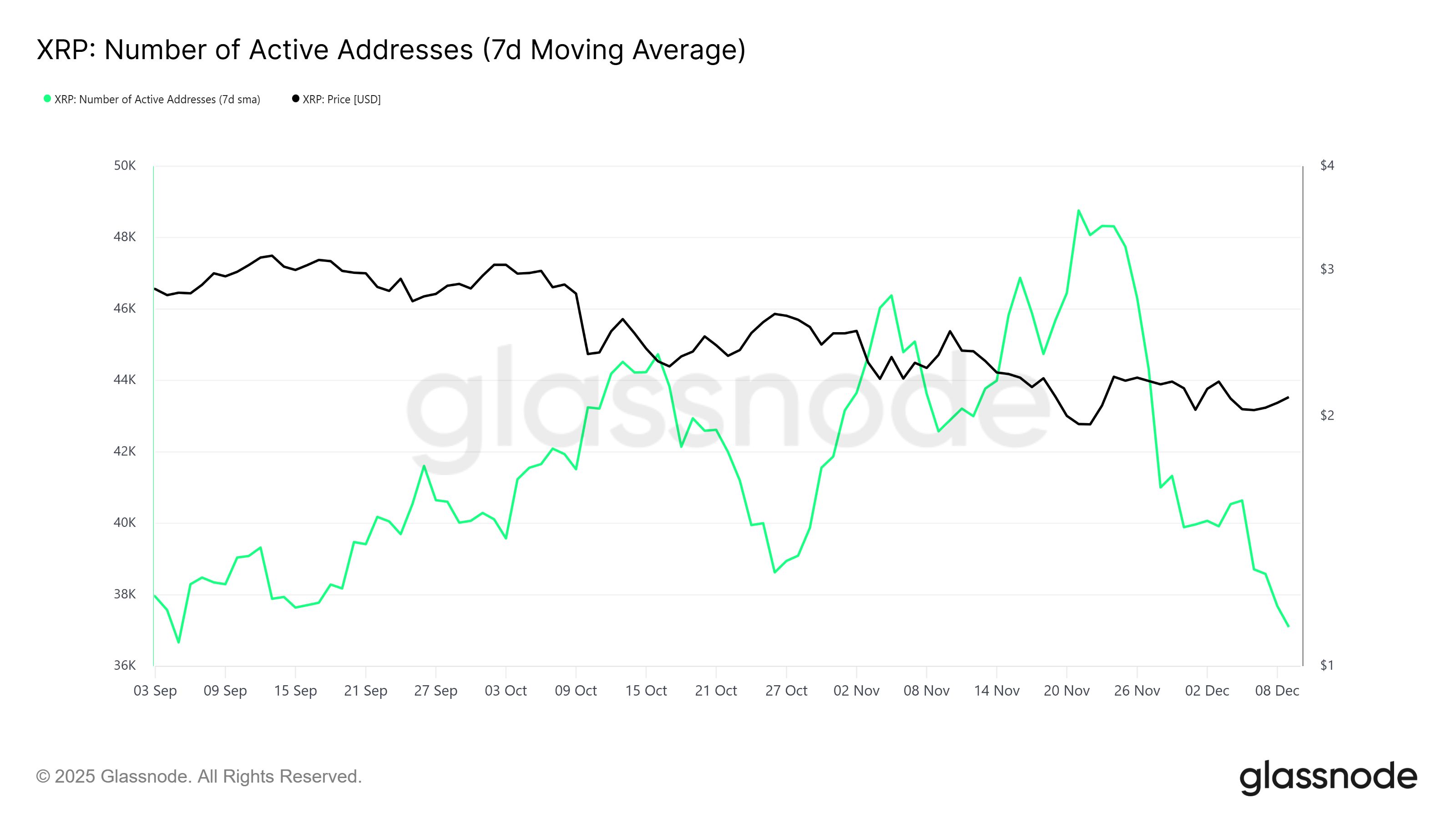

XRP’s macro picture remains challenged by declining network activity. Active addresses have fallen to a three-month low of 37,088, showing that many investors are not transacting or engaging with the network. Such a drop typically signals fading interest or uncertainty about near-term price direction.

XRP Whale Holding. Source:

XRP’s macro picture remains challenged by declining network activity. Active addresses have fallen to a three-month low of 37,088, showing that many investors are not transacting or engaging with the network. Such a drop typically signals fading interest or uncertainty about near-term price direction.

Reduced participation also impacts liquidity, making it harder for XRP to stage a strong recovery even when large holders are accumulating. With fewer users initiating transactions, demand remains muted, slowing down the pace at which XRP can escape its downtrend.

XRP Active Addresses. Source:

XRP Active Addresses. Source:

XRP Price Could Remain Rangebound

XRP is trading at $2.08 at the time of writing, extending a nearly month-long downtrend. For several days, the altcoin has oscillated within the narrow range between $2.20 and $2.02. This highlights the ongoing struggle to generate momentum.

The mixed signals from whales and weak network activity suggest that XRP may continue consolidating within this band. If broader market conditions improve, a break above $2.20 could allow XRP to target $2.36. This would mark its first meaningful recovery attempt in weeks.

XRP Price Analysis. Source:

XRP Price Analysis. Source:

If bullish sentiment fails to develop, XRP faces the risk of another downturn. Losing the $2.02 support level would send the price below $2.00. This would invalidate the bullish thesis, exposing the altcoin to deeper losses.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Federal Reserve Strategies and the Rising Worth of Solana: How Changes in Monetary Policy Propel Institutions Toward High-Performance Blockchain Adoption

- Fed's 2025 rate cuts and QT halt injected $72.35B liquidity, coinciding with a 3.01% Solana price surge. - Institutional capital shifted toward Solana due to infrastructure upgrades and accommodative monetary policy. - Regulatory frameworks like MiCA and GENIUS Act boosted Solana's institutional appeal despite macroeconomic volatility. - Fed's policy normalization accelerated blockchain adoption, positioning Solana as a long-term investment amid uncertainty.

ICP Caffeine AI's Rapid Growth and What It Means for Cryptocurrency Markets Powered by AI

- DFINITY's ICP Caffeine AI (launched July 2025) merges AI app development with low-code/no-code accessibility via chain-of-chains architecture. - Platform's $237B TVL by Q3 2025 signals institutional confidence in financial sector applications despite 22.4% dApp activity decline. - Token price volatility (11% drop by 2025) and reverse-gas mechanism raise concerns about adoption sustainability and valuation stability. - Analysts project $4.4-$20.2 price range for ICP in 2025, emphasizing need for $6.50+ pr

SOL Price Forecast for Early 2025: Network Enhancements and Growing Institutional Interest Transform Solana’s Core Dynamics

- Solana's 2025 advancements in scalability (65k TPS) and sub-150ms finality position it as a leading blockchain for institutional finance. - Institutional adoption by Franklin Templeton, Securitize, and Société Générale accelerates asset tokenization and cross-border payment solutions. - Marinade Select's $436M TVL and Bitwise/Grayscale ETFs drive institutional capital inflows, supporting bullish SOL price forecasts ($150–$300 in 2025). - Regulatory clarity and partnerships with Visa/Coinbase reinforce So

Reddit is currently experimenting with verification badges