Key Market Information Discrepancy on December 10th - A Must-Read! | Alpha Morning Report

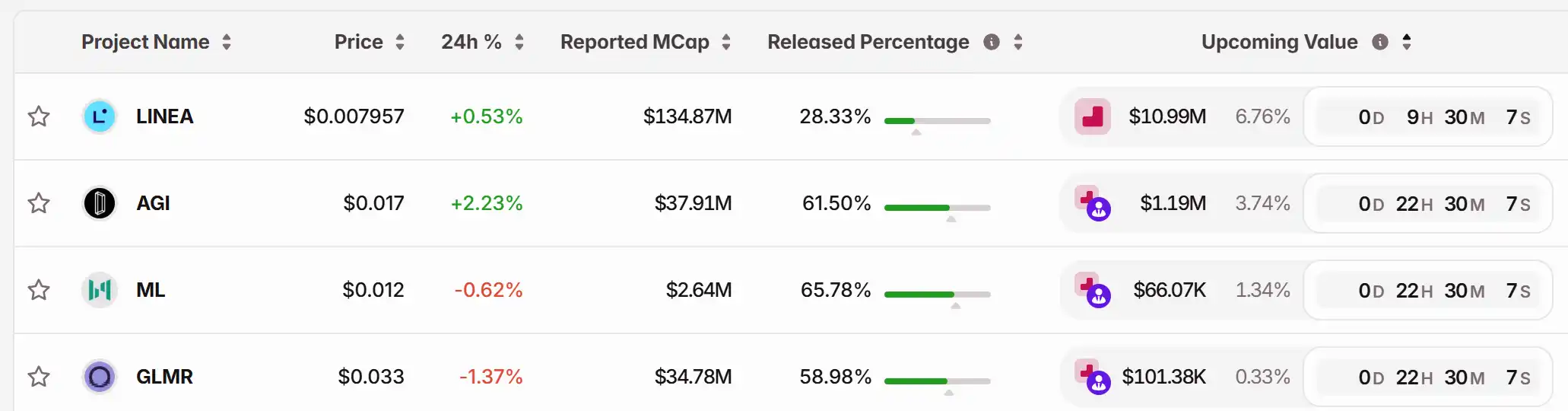

1. Top News: The "CLARITY Act" draft is expected to be released this week, with a hearing and vote scheduled for next week. 2. Token Unlock: $LINEA, $AGI, $ML, $GLMR

Featured News

1."CLARITY Act" Draft Expected to Be Released This Week, Hearing and Vote Scheduled for Next Week

3.SpaceX Plans IPO at $1.5 Trillion Valuation, Poised for Largest-Ever Public Offering

Articles & Threads

1. "Crypto VIPs Spending Eight Figures a Year on Security, Fear Blue Kirby-Style Heists"

A travel blogger with over 20 million followers on TikTok, Blue Kirby, was robbed. In recent years, from France to the UAE, from the US to South America, kidnappings of cryptocurrency holders have been on the rise. As assets do not rely on banks and can be transferred on the go, coupled with the often "digitally astounding" wealth of crypto elites, they have become top targets for certain criminal groups, rather than "random victims." This also explains why the security budgets of crypto VIPs are so high that even traditional businesses are stunned.

2. "Exclusive Interview with Solstice Founder: How to Redefine Yield on Solana from First Principles"

By the end of November 2025, Solstice Staking, in collaboration with the Liechtenstein Trust Integrity Network (LTIN), Swiss crypto finance giant Bitcoin Suisse, and the decentralized staking protocol Obol, jointly launched an institutional-grade Ethereum Distributed Validator Technology (DVT) cluster. This seemingly technical collaboration hides a grander ambition. On the very same day, the DeFi platform Kamino in the Solana ecosystem announced the launch of the PT-USX token on Solstice Market, offering a fixed yield of 16.5%. At this time, Solstice's Total Value Locked (TVL) had surpassed $3.2 billion, with over 26,000 holders and 131,000 monthly active users.

Market Data

Daily Market Overall Capital Heatmap (Reflected by Funding Rate) and Token Unlocks

Data Source: Coinglass, TokenUnlocks

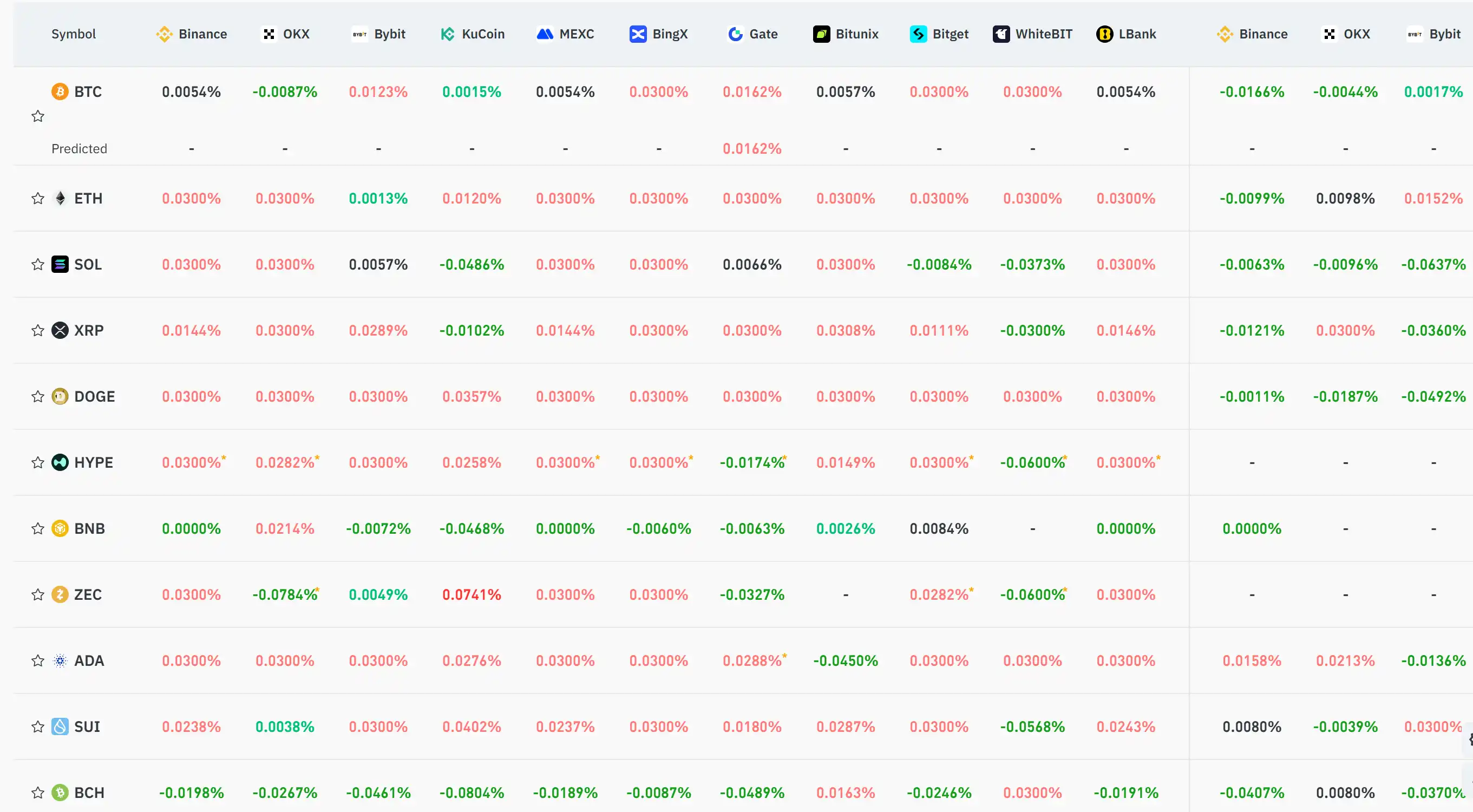

Funding Rate

Token Unlocks

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin’s Abrupt Price Swings in Late 2025: Macroeconomic Triggers and the Actions of Institutional Investors

- Bitcoin's 2025 crash from $126,000 to $80,553 stemmed from macroeconomic shocks, institutional leverage risks, and regulatory shifts. - Trump's 100% China tariffs and Fed rate uncertainty triggered $19B in crypto liquidations, linking Bitcoin to equity market volatility. - Leveraged offshore trading platforms and de-pegged stablecoins exposed crypto's structural vulnerabilities during cascading margin calls. - U.S. Bitcoin ETF approval and EU MiCA regulation boosted institutional adoption, but post-crash

Bitcoin Leverage Liquidation Spike: An Urgent Reminder for Enhanced Risk Controls in Cryptocurrency Trading

- Bitcoin's late 2025 price drop below $86,000 triggered $2B in leveraged liquidations, exposing systemic risks in over-leveraged retail trading. - Major exchanges reported $160M+ forced unwinds, with 90% losses from long positions and a $36.78M single liquidation highlighting concentrated risk. - Regulatory scrutiny intensified as U.S. SEC capped ETF leverage and CFTC examined stablecoin reserves, signaling growing focus on crypto market stability. - Retail traders showed emerging maturity through risk ca

Bitcoin’s Latest Downturn: Key Factors for Investors to Monitor in the Weeks Ahead

- Bitcoin fell below $100,000 in 2025 amid geopolitical tensions, U.S. trade tariffs, and regulatory shifts, raising concerns over market stability. - The Trump administration's pro-crypto policies, including the GENIUS Act and CFTC reforms, aim to boost adoption but face criticism over fraud risks. - Global regulatory divergence, from EU's MiCAR to UAE's innovation-friendly rules, highlights fragmented oversight and cross-border coordination challenges. - Central bank actions, including Fed rate hikes and