Key Market Intelligence for December 9th, how much did you miss?

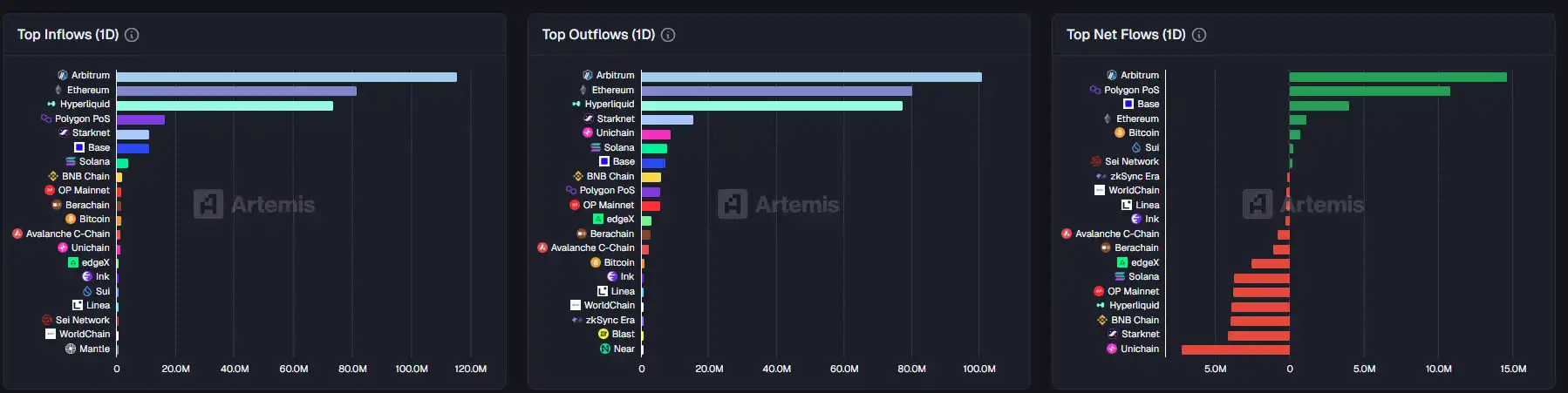

1. On-chain Funds: $14.6M flowed into Arbitrum last week; $7.2M flowed out of Unichain 2. Largest Price Swings: $LUNA, $NIGHT 3. Top News: NFT Market Sees Another "Meme Dog" Surge, Multiple Regular Animals Trades Eclipse $35,000

Top News

1. NFT Market Sees Another "Golden Dog," Regular Animals See Multiple Trades Surpassing $35,000

2. U.S. Short-Term Zero-Interest Bond Issuance Reaches Near Historic High, Signaling Escalating U.S. Debt Crisis

3. Zcash Privacy Narrative Shaken, Arkham De-Anonymizes Over Half of Its Transactions

4. SOL On-Chain Meme Coin Franklin24 Surges 160% in 24 Hours

5. EU Plans to Include Cryptocurrency Firms in ESMA Regulation, Aims to Launch Capital Market Union Reform in 2027

Featured Articles

1. "Crypto Tycoons Spending Eight-Figure Sums on Security Each Year, Fearing Blue War Non-Encounter"

Travel blogger Blue War Non, with over 20 million fans on TikTok, was robbed. In recent years, from France to the UAE, from the U.S. to South America, kidnapping cases involving cryptocurrency holders have been on the rise. Assets not dependent on banks, easily transferable on the go, combined with the "digitally staggering" wealth of crypto tycoons, have made them the top targets for certain criminal groups, rather than just "random victims." This also explains why the security budgets of crypto tycoons are shocking even to traditional enterprises.

2. "Exclusive Interview with Solstice Founder: Reshaping Yield on Solana from First Principles"

At the end of November 2025, Solstice Staking partnered with the Liechtenstein Trust Integrity Network (LTIN), Swiss crypto finance giant Bitcoin Suisse, and decentralized staking protocol Obol to launch an institutional-grade Ethereum Distributed Validator Technology (DVT) cluster. This seemingly technical collaboration hides a grander ambition behind it. On the same day, Kamino, a DeFi platform in the Solana ecosystem, announced the launch of the PT-USX token on Solstice Market, offering a 16.5% fixed yield. At this time, Solstice's Total Value Locked (TVL) had surpassed $3.2 billion, with over 26,000 holders and 131,000 monthly active users.

On-chain Data

Weekly On-chain Fund Flows for December 9th

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin Experiences Steep Drop: What Causes the Sudden Sell-Off?

- Bitcoin plummeted 30% in November 2025, erasing $1 trillion in market cap amid macroeconomic pressures and institutional profit-taking. - Central bank uncertainty (Fed, ECB) and leveraged liquidations amplified the selloff, with ETF outflows exceeding $3.79 billion. - Bitcoin's 0.90 correlation with the S&P 500 highlighted its shift from "digital gold" to risk-on asset, contrasting gold's 55% surge. - On-chain metrics revealed structural weaknesses: hash rate declines, miner revenue drops, and divergent

PENGU USDT Sell Alert and Stablecoin Price Fluctuations: Evaluating Algorithmic Dangers Amid Changing Cryptocurrency Markets

- PENGU USDT's 2025 volatility reignited debates on algorithmic stablecoin fragility amid regulatory uncertainty and post-UST market skepticism. - Technical analysis showed conflicting signals: overbought MFI vs bearish RSI divergence, with critical support/resistance levels at $0.010-$0.013. - $66.6M team wallet outflows and 32% open interest growth highlighted liquidity risks, while UST's collapse legacy exposed algorithmic design flaws. - Investors increasingly favor fiat-backed alternatives like USDC ,

HYPE Token Experiences Rapid Growth in December 2025: Evaluating Authenticity and Investment Opportunities Amidst an Unstable Post-ETF Cryptocurrency Landscape

- HYPE token surged in Dec 2025 amid post-Bitcoin ETF crypto optimism , raising questions about its investment legitimacy. - Hyperliquid's 72.7% decentralized trading volume share and $106M monthly revenue highlight its DeFi infrastructure strength. - Institutional backing from Paradigm and a $1B DAT fund signals confidence, though major exchange listings remain pending. - Price volatility, token unlocks, and mixed expert opinions underscore risks, with potential $53–$71 targets contingent on market condit

LUNA Falls by 5.77% Over 24 Hours Despite Fluctuating Medium-Term Performance

- LUNA fell 5.77% in 24 hours to $0.1512, but rose 47.52% in 7 days and 105.96% in 30 days. - However, it still faces a 64.14% annual loss, highlighting crypto market volatility and long-term risks for investors. - The price swing reflects sensitivity to macroeconomic shifts and sentiment, with analysts noting ongoing uncertainty in forecasts. - Investors are weighing recent resilience against regulatory challenges and institutional behavior shifts, monitoring if the drop signals a bearish trend or tempora