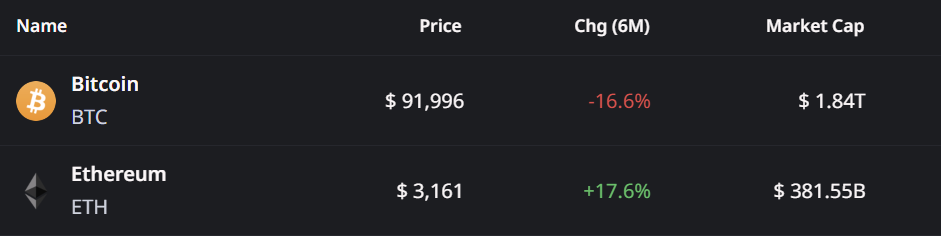

As 2025 approaches its final stretch with Bitcoin consolidating around $90,000 and Ethereum stabilizing near $3,100, the overall crypto market looks volatile with recent large liquidation events. The total market capitalization is moving close to $3.2 trillion, yet investor sentiment remains cautiously optimistic.

While Bitcoin is down over 16% in the second half of 2025, Ethereum has quietly outperformed with a 17% rise, leaving altcoins lagging behind in fragmented momentum.

Source: Cryptorank

Source: Cryptorank

But underneath that uneven structure, both BTC and ETH have printed eerily similar fractals to their previous breakout phases, hinting at what could be a powerful bullish setup heading into the first half of 2026.

Bitcoin (BTC) and the Repeating Wedge Setup

The Bitcoin daily chart shows a textbook falling wedge, nearly identical to what formed in the February–April 2025 corrective phase. Back then, BTC broke its wedge resistance, reclaimed the 100-day moving average, and unleashed a powerful rally of nearly 50%, pushing the price to a new all-time high above $126,000.

Bitcoin (BTC) Daily Chart/Coinsprobe (Source: Tradingview)

Bitcoin (BTC) Daily Chart/Coinsprobe (Source: Tradingview)

Now, once again, BTC is grinding through a similar compression phase. The current falling wedge has price squeezed tightly between descending resistance and structural demand, with BTC repeatedly testing the upper boundary. The difference this time is psychological fatigue — investors are waiting for a clear reclaim of the 100-day moving average, currently sitting around $106,534.

A breakout above wedge resistance and a confirmed 100 MA support retest would not just be bullish — it would complete the fractal symmetry and confirm what could be the first major upside wave of the 2026 cycle.

Ethereum (ETH) Mirroring Its Own Breakout History

ETH has printed an almost identical recovery footprint to what it demonstrated in May 2025. That period began with a falling wedge breakdown, a reclaim of the 50-day moving average, and then an explosive 250% rally to $4,954. The exact same corrective architecture has now unfolded again — a defined falling wedge, compression under the 50-day moving average, and price slowly leaning upward into diagonal resistance.

Ethereum (ETH) Daily Chart/Coinsprobe (Source: Tradingview)

Ethereum (ETH) Daily Chart/Coinsprobe (Source: Tradingview)

The 50-day MA stands at $3,362, and this level now acts as the pivot for momentum confirmation. A reclaim would not only finalize the wedge breakout but reawaken liquidity inflows that have been sidelined since early Q4.

If ETH breaks above the wedge and clears the 50-day average with volume, it could open room toward $4,500 initially, and then challenge the psychological $6,000 region in H1 2026.

What for H1 2026 Crypto Market Prediction?

If both fractals mature into full breakouts, H1 2026 could represent the continuation of the post-halving cycle extension, rather than a late-stage cooldown. This scenario places Bitcoin into a potential $140,000 to $150,000 upside window, and Ethereum toward $6,000 and beyond. Such moves would naturally spill liquidity into sidelined altcoins, paving the way for a delayed but forceful catch-up rally.

However, fractals are not guarantees — they are echoes. Market sentiment, macro liquidity, ETF flows, and regulatory stances will all determine whether pattern symmetry translates into real directional conviction. The key remains the moving averages: BTC above its 100-day and ETH above its 50-day. Until those confirmations arrive, any upside is a developing thesis, not a completed breakout.