4 Key US Economic Data to Shape Bitcoin Sentiment This Week

Bitcoin traders are preparing for a pivotal week, as four major US economic releases, including the Federal Reserve’s interest rate decision and essential labor market data, stand to influence market sentiment and determine the crypto’s next move. This convergence of monetary policy updates and employment figures finds Bitcoin trading near technical levels that may result

Bitcoin traders are preparing for a pivotal week, as four major US economic releases, including the Federal Reserve’s interest rate decision and essential labor market data, stand to influence market sentiment and determine the crypto’s next move.

This convergence of monetary policy updates and employment figures finds Bitcoin trading near technical levels that may result in notable volatility, upward or downward.

FOMC Interest Rate Decision

The FOMC (Federal Open Market Committee’s) interest rate decision, scheduled for Wednesday at 2:00 p.m. ET, is widely viewed as the most significant event for Bitcoin and risk assets this week.

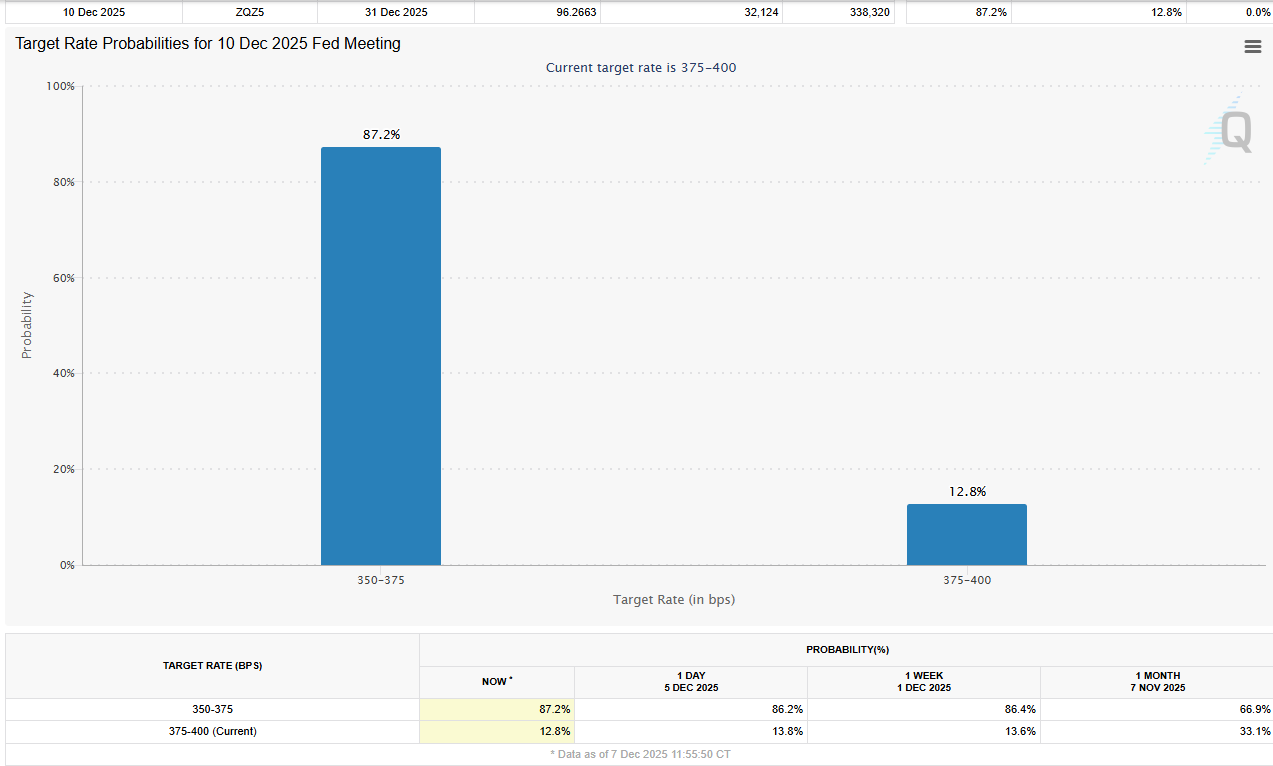

Market pricing implies an 87% probability of a rate cut, based on CME Group data, reflecting broad expectations for accommodative monetary policy that often benefits cryptocurrencies.

Interest Rate Cut Probabilities. Source:

Interest Rate Cut Probabilities. Source:

Speculation is growing on social media about the scope of any rate change, with some saying that the market is already pricing a rate cut.

Market already pricing it in.

— Rodney (@cryptojourneyrs) December 8, 2025

This assumption comes as the Bitcoin price is already showing strength, holding well above the $90,000 psychological level after the weekend’s whipsaw event.

Bitcoin (BTC) Price Performance. Source:

Bitcoin (BTC) Price Performance. Source:

Beyond the interest rate decision, the actual impact on Bitcoin may depend less on the decision and more on the Fed’s guidance for future policy.

Fed Chair Powell Press Conference

After the announcement, Federal Reserve Chair Jerome Powell will hold a press conference at 2:30 p.m. ET. Powell’s commentary on future policy, inflation, and the economy is likely to provide important cues for crypto investors.

Historically, his statements have shaped positioning across markets, with Bitcoin being especially sensitive to changes in monetary policy direction.

🚨 BREAKING11 OUT OF 12 FOMC MEMBERS SUPPORT A 50BPS RATE CUT ON DECEMBER 10.BULLISH FOR BITCOIN AND CRYPTO! pic.twitter.com/dR7ekJhJbT

— 0xNobler (@CryptoNobler) December 7, 2025

Market analysts caution that unexpected hawkish comments could put pressure on Bitcoin, even if the rate decision itself appears positive for crypto.

Job Openings (JOLTS) and Initial Jobless Claims

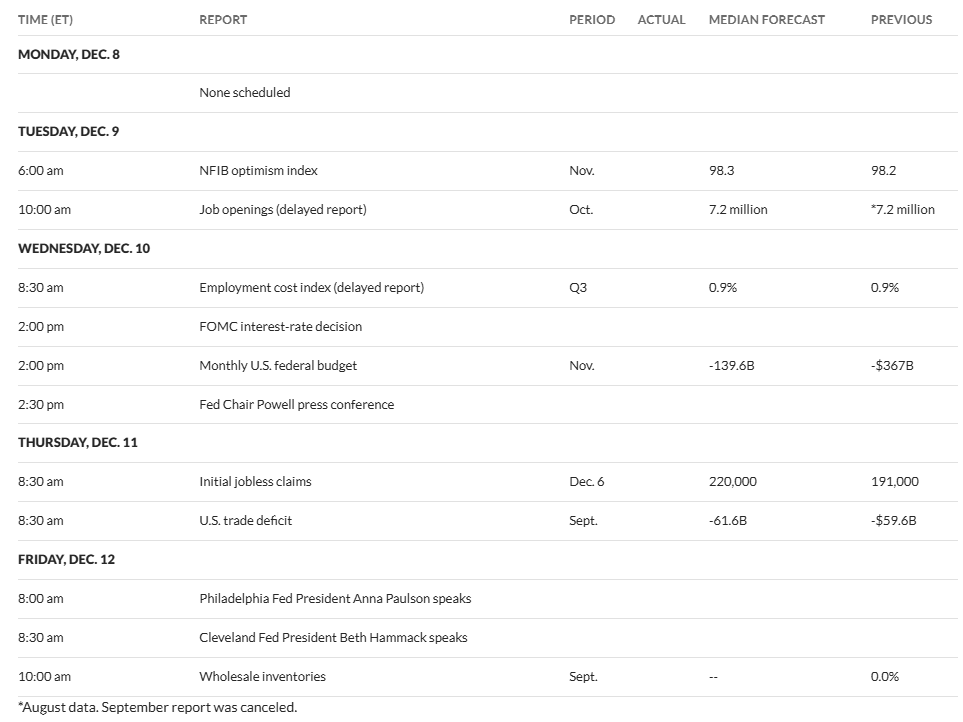

Job openings data for October will be released on Tuesday at 10:00 a.m. ET, with economists anticipating 7.2 million openings, unchanged from last month.

This data measures labor market tightness and influences Federal Reserve policy. Strong job openings could discourage aggressive rate cuts, possibly limiting Bitcoin’s short-term gains.

Initial jobless claims for the week ending December 6 will be published Thursday at 8:30 a.m. ET. Analysts expect 220,000 claims, up from the prior week’s 191,000, which was a near two-year low.

At 191,000 initial jobless claims just hit their lowest level in nearly two years. pic.twitter.com/hmGh9HaJgc

— Josh Schafer (@_JoshSchafer) December 4, 2025

Large departures from this forecast could spark swift market moves as traders reassess economic strength and policy outlooks.

The jobs market’s status can cut both ways for Bitcoin. Strong figures can suggest economic health, which typically supports risk appetite, yet may lessen the push for monetary easing. Conversely, weaker data could prompt more rate cuts but signal risk-off sentiment in speculative markets.

Technical analysts are focusing on Bitcoin’s key levels in advance of these releases. The $86,000 mark is a crucial support; consistent moves below it may open a path toward $80,000. Conversely, reclaiming $92,000 could fuel momentum toward the headline $100,000 level.

I’m okay with a little fear before FOMC, even a sweep down toward the $BTC 87k area. If that happens and price snaps back quickly, that’s strength, not weakness.For me it’s clear levels only: Lose 86k and this idea fails, with risk of a deeper move toward 80k. Reclaim and hold… pic.twitter.com/vins0z3wn8

— Ak47♛ (@HolaItsAk47) December 7, 2025

Additional Federal Reserve officials, such as Philadelphia Fed President Anna Paulson and Cleveland Fed President Beth Hammack, are due to speak on Friday after the FOMC meeting. Their remarks could further clarify policy and influence how markets interpret recent decisions, extending the Bitcoin impact beyond Wednesday.

This Week’s Major US Economic Reports & Fed Speakers. Source:

This Week’s Major US Economic Reports & Fed Speakers. Source:

This compressed timeline of major economic updates sets the stage for amplified reactions. Bitcoin’s response will likely determine its path in December, impacting year-end investor positioning and testing the resilience of recent institutional interest.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

The ZK Atlas Upgrade: Revolutionizing the Infrastructure of Decentralized Finance

- ZKsync's 2025 Atlas Upgrade achieves 43,000 TPS with $0.0001 fees, outperforming Ethereum and most Layer-2 solutions. - Deutsche Bank , Sony , and Citi adopt ZKsync for cross-chain settlements and tokenized assets, boosting TVL to $3.5B by 2025. - ZK token surged 150% post-upgrade, with analysts projecting 60.7% CAGR growth to $90B by 2031 for ZK-based solutions. - Upcoming Fusaka upgrade aims to double throughput, but faces regulatory risks and competition from StarkNet and Scroll.

Financial Wellness Emerging as a Key Trend for Consumers and Investors: How Financial Knowledge and Learning Drive Change

- The financial wellness industry is transforming through tech innovation, shifting consumer priorities, and rising demand for financial literacy education. - Market research projects the global financial literacy sector will surpass $8.6B by 2033, driven by Gen Z/Millennial demand for gamified/digital-native learning tools. - Investment opportunities span edtech platforms, micro-investing apps, and corporate partnerships integrating financial education into mainstream services. - Challenges include regula

Pudgy Penguins (PENGU) To Rise Further? This Potential Bullish Pattern Formation Suggests So!

Is Sei (SEI) Poised For a Breakout? This Key Bullish Pattern Suggests So!