Short-Term Bitcoin Holders Are Dominating Profits, But Will It Lead To Recovery?

Bitcoin is making another attempt to break the downtrend that has kept the crypto king capped since late October. Price is hovering near $91,000 as investors watch a rare shift in market structure unfold.

For the first time in more than two and a half years, short-term holders have surpassed long-term holders in realized profits, creating both opportunities and risks for BTC.

Bitcoin Sees Some Shift

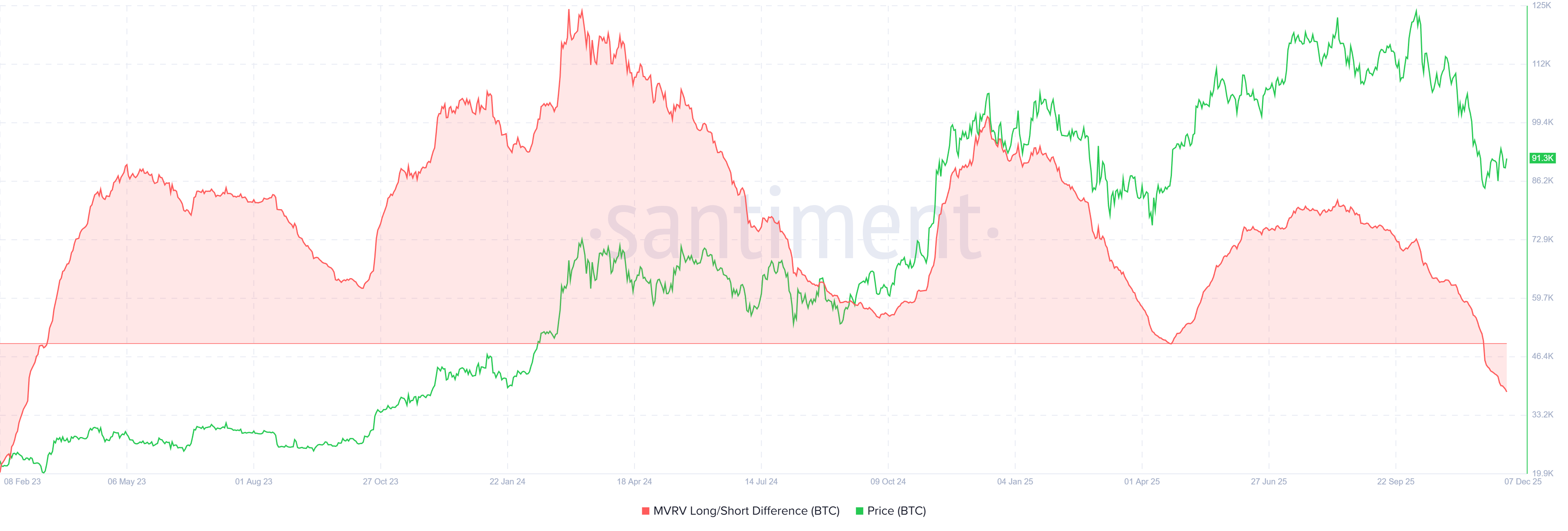

The MVRV Long/Short Difference highlights a notable change in Bitcoin’s profit distribution. A positive reading usually signals long-term holders hold more unrealized gains, while a negative value indicates short-term holders are ahead.

In Bitcoin’s case, the difference has dipped into negative territory for the first time since March 2023. This marks 30 months since short-term holders last led in profits.

Such dominance raises concerns because short-term holders tend to sell aggressively when volatility increases. Their profit-taking behavior could add pressure on BTC’s price if the broader market weakens, especially during attempts to break the downtrend.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

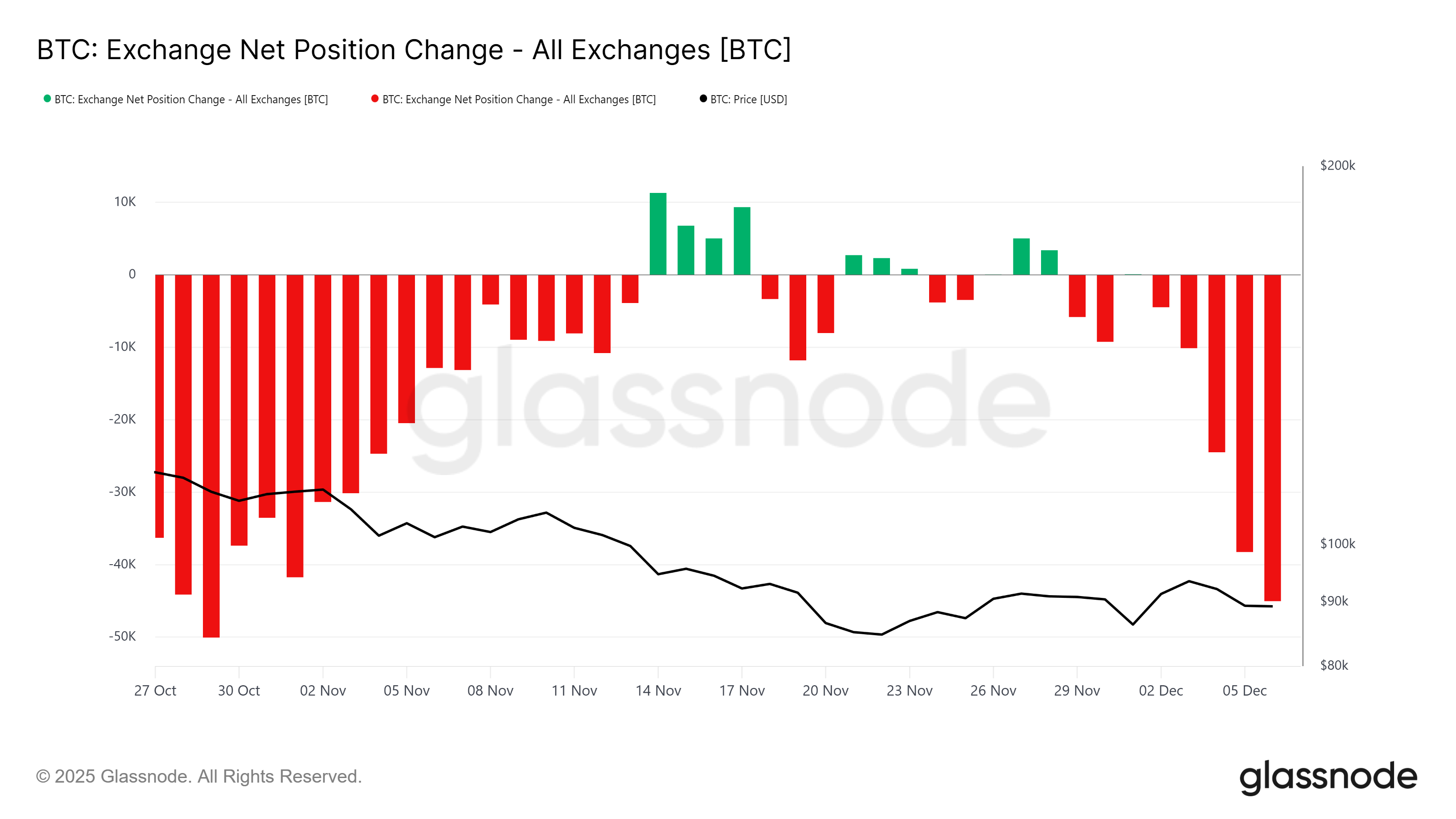

Despite this shift, Bitcoin’s broader momentum shows encouraging signs. Exchange net position change data confirms rising outflows across major platforms, signaling a shift in investor accumulation. BTC leaving exchanges is often treated as a bullish indicator, reflecting confidence in long-term appreciation.

This trend suggests that many traders view the $90,000 range as a reasonable bottom zone and are preparing for a potential recovery. Sustained outflows support price stability and strengthen the probability of BTC breaking above immediate resistance levels.

BTC Price Is Trying Its Best

Bitcoin is trading at $91,330 at the time of writing, positioned just below the $91,521 resistance. Reclaiming this level and flipping it into support is essential for BTC to challenge the month-and-a-half-long downtrend. Without this breakout, upside momentum remains limited.

If short-term holders refrain from selling and accumulation continues, Bitcoin could climb toward $95,000. A successful break above that level may send BTC toward $98,000, signaling renewed bullish strength.

However, if short-term holders start taking profits, the pressure could push BTC back toward $86,822. A drop to this level would prevent any meaningful breakout and invalidate the bullish setup, keeping Bitcoin confined within its multiweek downtrend.

The post Short-Term Bitcoin Holders Are Dominating Profits, But Will It Lead To Recovery? appeared first on BeInCrypto.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

PENGU Price Forecast in the Context of Changing Market Trends

- Pudgy Penguins (PENGU) gains traction via institutional adoption, real-world utility partnerships, and retail expansion across 10,000+ stores. - 76% of global investors increase crypto exposure, with PENGU benefiting from buybacks and institutional confidence in its low-correlation profile. - Macroeconomic risks (65% institutional crypto exposure) and technical weakness (3.62% spot holding reduction) threaten PENGU's stability amid Bitcoin-linked volatility. - Analysts project $0.02782–$0.068 price range

The Growing Importance of Financial Wellbeing in Retirement Strategies

- U.S. financial wellness market grows to $1.21B by 2029, driven by holistic retirement platforms integrating health and wealth. - Employers address 61% employee financial stress through AI tools, budgeting, and mental health resources beyond 401(k) plans. - Innovators like Finaciti and ETFs (HRTS, HHL) target wellness-driven retirement solutions amid 33% retirement confidence gap. - Sector faces 2025 healthcare sector underperformance but gains traction via GLP-1 therapies and AI diagnostics in niche ETFs

HYPE Token's Soaring Rise in November 2025: Real Worth or Just Hype-Driven Frenzy?

- Hyperliquid's HYPE token surged to $41.28 in Nov 2025, then fell to $27.43, sparking debates over genuine value vs speculative mania. - Structural upgrades (HIP-3 fee cuts) and partnerships (USDH stablecoin, Kinetiq) boosted utility, while UAE regulatory clarity attracted institutional interest. - Token unlocks ($308M-$351M) and retail-driven FOMO amplified volatility, with 23.4% of unlocked tokens sold over-the-counter. - Analysts highlight mixed signals: VanEck notes institutional accumulation and 36%

USE.com Opens Its Presale Phase as Global Demand for Next-Generation Exchanges Surges