HBAR Price Fell 11% After Failed Breakout, But Investors Have Not Given Up

HBAR price slipped 11 percent this week as Hedera failed to break out of a consolidation range that has persisted for more than three weeks. Despite the downturn, investor confidence remains intact, with early signs suggesting that accumulation may be quietly strengthening beneath the surface. Hedera Investors Show Optimism The Chaikin Money Flow is registering

HBAR price slipped 11 percent this week as Hedera failed to break out of a consolidation range that has persisted for more than three weeks.

Despite the downturn, investor confidence remains intact, with early signs suggesting that accumulation may be quietly strengthening beneath the surface.

Hedera Investors Show Optimism

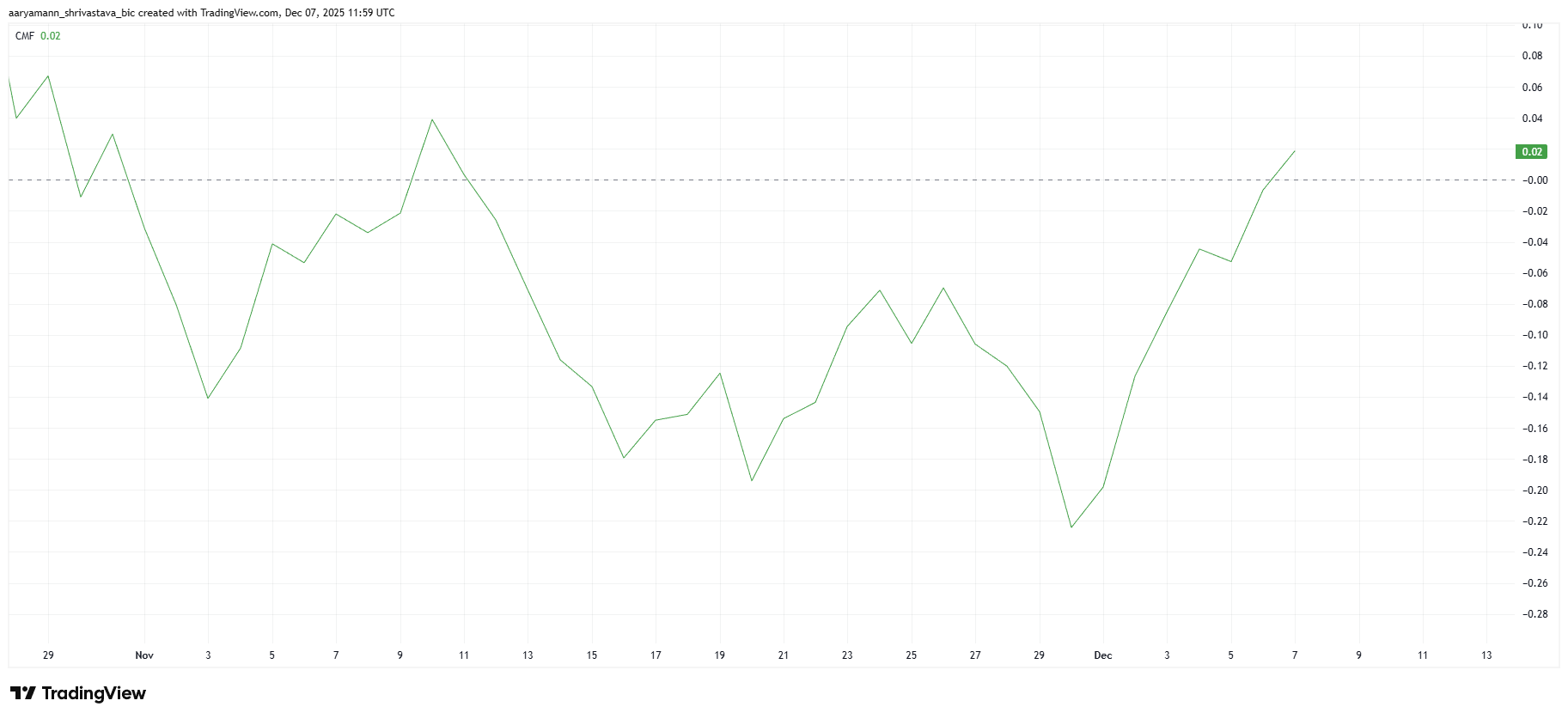

The Chaikin Money Flow is registering a sharp uptick, signaling renewed inflows into HBAR. After spending nearly a month in negative territory, the indicator has pushed back above the zero line.

This shift suggests that investors are beginning to allocate fresh capital to Hedera, even as its price continues moving sideways. Such behavior often reflects confidence in long-term prospects despite short-term stagnation.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter

HBAR CMF. Source:

HBAR CMF. Source:

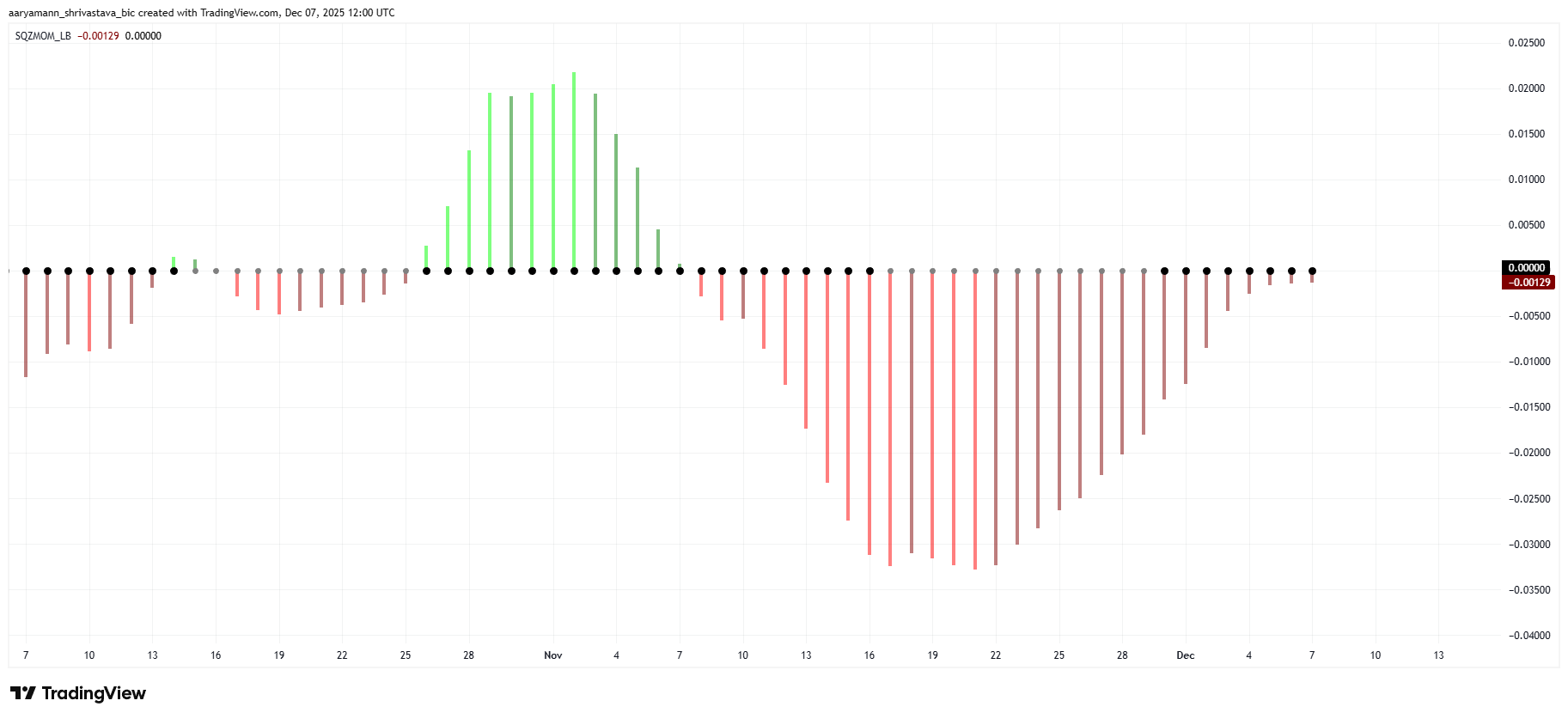

The Squeeze Momentum indicator highlights a squeeze forming, with bearish pressure steadily weakening. The histogram shows momentum nearing a bullish crossover, an early sign that sellers may be losing control.

If the squeeze releases while momentum has shifted to the positive side, HBAR could experience a volatility-driven breakout. This setup is often associated with trend reversals, especially when accompanied by improving inflows.

HBAR Squeeze Momentum Indicator. Source:

HBAR Squeeze Momentum Indicator. Source:

HBAR Price To Continue Consolidation

HBAR is down 11 percent over the past week and remains locked in a narrow band between $0.150 and $0.130. Three weeks of consolidation have stalled any attempt at sustained upward movement.

If the improving CMF and building bullish momentum take hold, HBAR could rebound from the $0.130 support and attempt a breakout above $0.150. Clearing this ceiling would open the path toward $0.162, offering the first meaningful sign of recovery.

HBAR Price Analysis. Source:

HBAR Price Analysis. Source:

However, if bullish momentum fails to materialize, consolidation may continue. A shift in investor sentiment toward selling could send HBAR below $0.130. This would expose the token to a drop to $0.125 and invalidate the bullish thesis.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

The ZK Atlas Upgrade: Revolutionizing the Infrastructure of Decentralized Finance

- ZKsync's 2025 Atlas Upgrade achieves 43,000 TPS with $0.0001 fees, outperforming Ethereum and most Layer-2 solutions. - Deutsche Bank , Sony , and Citi adopt ZKsync for cross-chain settlements and tokenized assets, boosting TVL to $3.5B by 2025. - ZK token surged 150% post-upgrade, with analysts projecting 60.7% CAGR growth to $90B by 2031 for ZK-based solutions. - Upcoming Fusaka upgrade aims to double throughput, but faces regulatory risks and competition from StarkNet and Scroll.

Financial Wellness Emerging as a Key Trend for Consumers and Investors: How Financial Knowledge and Learning Drive Change

- The financial wellness industry is transforming through tech innovation, shifting consumer priorities, and rising demand for financial literacy education. - Market research projects the global financial literacy sector will surpass $8.6B by 2033, driven by Gen Z/Millennial demand for gamified/digital-native learning tools. - Investment opportunities span edtech platforms, micro-investing apps, and corporate partnerships integrating financial education into mainstream services. - Challenges include regula

Pudgy Penguins (PENGU) To Rise Further? This Potential Bullish Pattern Formation Suggests So!

Is Sei (SEI) Poised For a Breakout? This Key Bullish Pattern Suggests So!