Hyperliquid Token Hits 7-Month Low as Market Share Collapses

With the token down almost 30% in a month, traders have turned sharply bearish, with some warning that HYPE could fall toward $10.

Hyperliquid’s HYPE token slid to a seven-month low as the market reacted to a steep decline in the protocol’s dominance and renewed concern over recent token movements.

According to BeInCrypto data, the token dropped more than 4% in the past 24 hours to $29.24, its weakest level since May.

Why is HYPE Price Falling?

CoinGlass data showed that the drop triggered more than $11 million in liquidations, adding to pressure on a market already turning cautious.

The shift marks a stark reversal for a protocol that once controlled the on-chain perpetuals market. Earlier in the year, Hyperliquid dominated the decentralized perpetuals market with near-total authority. However, that edge has faded.

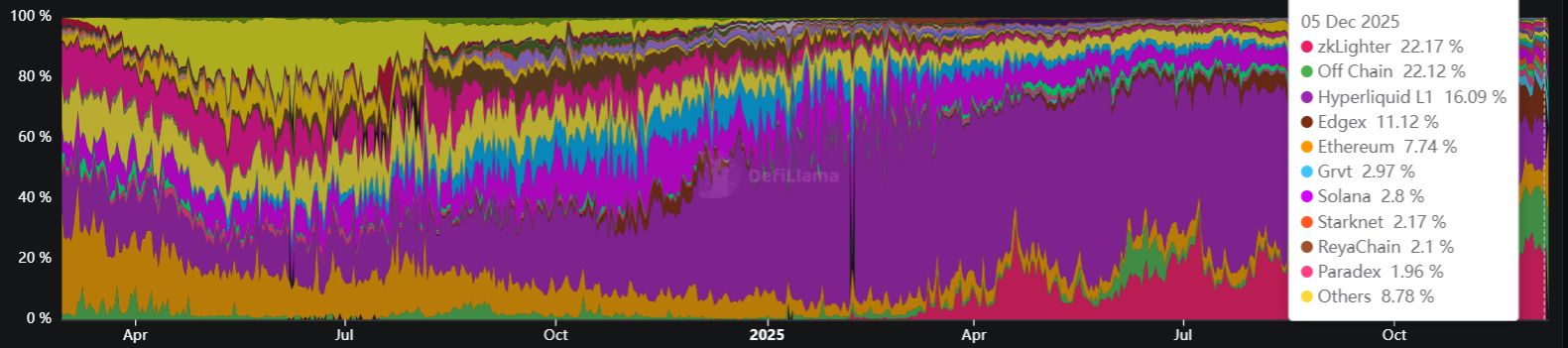

Data from DeFiLlama reveals a staggering erosion of its dominance, with the protocol’s share of the perpetuals market cratering from a peak of nearly 70% to less than 20% at press time.

Hyperliquid’s Falling Market Dominance. Source:

DeFiLlama

Hyperliquid’s Falling Market Dominance. Source:

DeFiLlama

This can be linked to the emergence of more aggressive rivals, such as Aster and Lighter, which have successfully siphoned volume through superior incentive programs.

As a result, investors are rapidly repricing HYPE and are no longer viewing it as the sector’s inevitable winner but as a legacy incumbent bleeding users.

Simultaneously, internal token movements have rattled confidence.

Blockchain analytics firm Lookonchain reported last month that team-controlled wallets unstaked 2.6 million HYPE, valued at roughly $89 million.

The HyperLiquid team recently unstaked 2.6M $HYPE($89.2M).Of that amount:1,088,822 $HYPE($37.4M) was restaked;900,869 $HYPE($30.9M) remains in the wallet;609,108 $HYPE($20.9M) was sent to #Flowdesk;1,200 $HYPE was sold for 41,193.45 $USDC.

— Lookonchain (@lookonchain) November 30, 2025

While the team restaked roughly 1.08 million tokens, the market fixated on the outflows.

A total of 900,869 HYPE remained liquid in the wallet, and another 609,108 HYPE, worth about $20.9 million, moved to Flowdesk, a prominent market maker. The project also sold an additional 1,200 tokens for about $41,193 in USDC.

These events have had a psychological toll on the community.

As a result, HYPE has shed nearly 30% of its value over the last 30 days, ranking as the worst-performing asset among the top 20 digital currencies by market capitalization.

Considering this, crypto traders have become significantly bearish on the token. Crypto trader Duo Nine has suggested that the token’s value could drop to as low as $10.

“Prepare mentally for such a scenario if you want to survive what’s coming,” the analyst stated.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Momentum (MMT) Gaining Traction Through Key Alliances and Growing Attention from Institutions

- Momentum (MMT) gains traction in 2025 via strategic partnerships with Sui , Coinbase , and OKX, boosting institutional adoption. - A $10M HashKey Capital funding round and regulatory clarity underpin MMT's cross-chain DEX launch and RWA tokenization efforts. - Ve(3,3) governance and buybacks drive deflationary dynamics, with TVL exceeding $600M and $1.1B daily trading volumes. - Technical indicators signal potential bullish reversal at $0.52–$0.54, despite 70% post-TGE price correction and volatile forec

ALGO Falls by 3.33% Amidst Market Developments and Announced Restructuring Plans

- ALGO drops 3.33% in 24 hours, part of a broader 61.02% annual decline amid volatile market conditions. - Upcoming Swiss rate decisions, U.S. jobless claims, and bond auctions may intensify market uncertainty affecting crypto assets. - Argo Blockchain's approved restructuring plan, including new mining equipment, could indirectly impact ALGO supply/demand dynamics. - Market participants monitor macroeconomic indicators and blockchain sector developments to gauge ALGO's future trajectory.

LUNA Value Increases by 10.29% Over 24 Hours as Network Upgrade and Growing Inflows Drive Momentum

- LUNA surged 10.29% in 24 hours, driven by a network upgrade and rising on-chain inflows. - The terrad v3.6.1 upgrade aims to resolve legacy contract issues and enhance blockchain security ahead of December 18 implementation. - Derivatives open interest in LUNC futures rose to $25.55M, signaling renewed investor confidence linked to the upgrade. - Technical indicators show LUNA trading above 50-week EMA with RSI at 56, suggesting sustained upward momentum. - Analysts project continued gains if the upgrade

KITE Stock Performance After Listing: Understanding Investor Reactions and Institutional Ambiguity in Initial Tech IPO Phases

- KITE's stock plummeted 63% post-IPO despite strong retail occupancy and NOI growth, highlighting market uncertainty in early-stage tech. - Analyst ratings diverged (Buy at $30 vs. Neutral at $24), reflecting skepticism about KITE's ability to compete with AI-driven disruptors. - Institutional positions split sharply, with COHEN & STEERS boosting stakes while JPMorgan/Vanguard cut holdings, revealing sector risk fragmentation. - KITE trades at a 35.17 P/E (vs. 27.1x retail REIT average) but lags high-grow