Will Solana’s Price Trajectory Be Defined By Losses?

Solana is in a critical phase as its recent decline continues to validate a channel pattern that has shaped its price action over the past week. The downward movement highlights growing uncertainty, with investors now playing a key role in determining whether SOL continues slipping or finds support for a reversal. Solana Investors Remain Bearish

Solana is in a critical phase as its recent decline continues to validate a channel pattern that has shaped its price action over the past week.

The downward movement highlights growing uncertainty, with investors now playing a key role in determining whether SOL continues slipping or finds support for a reversal.

Solana Investors Remain Bearish

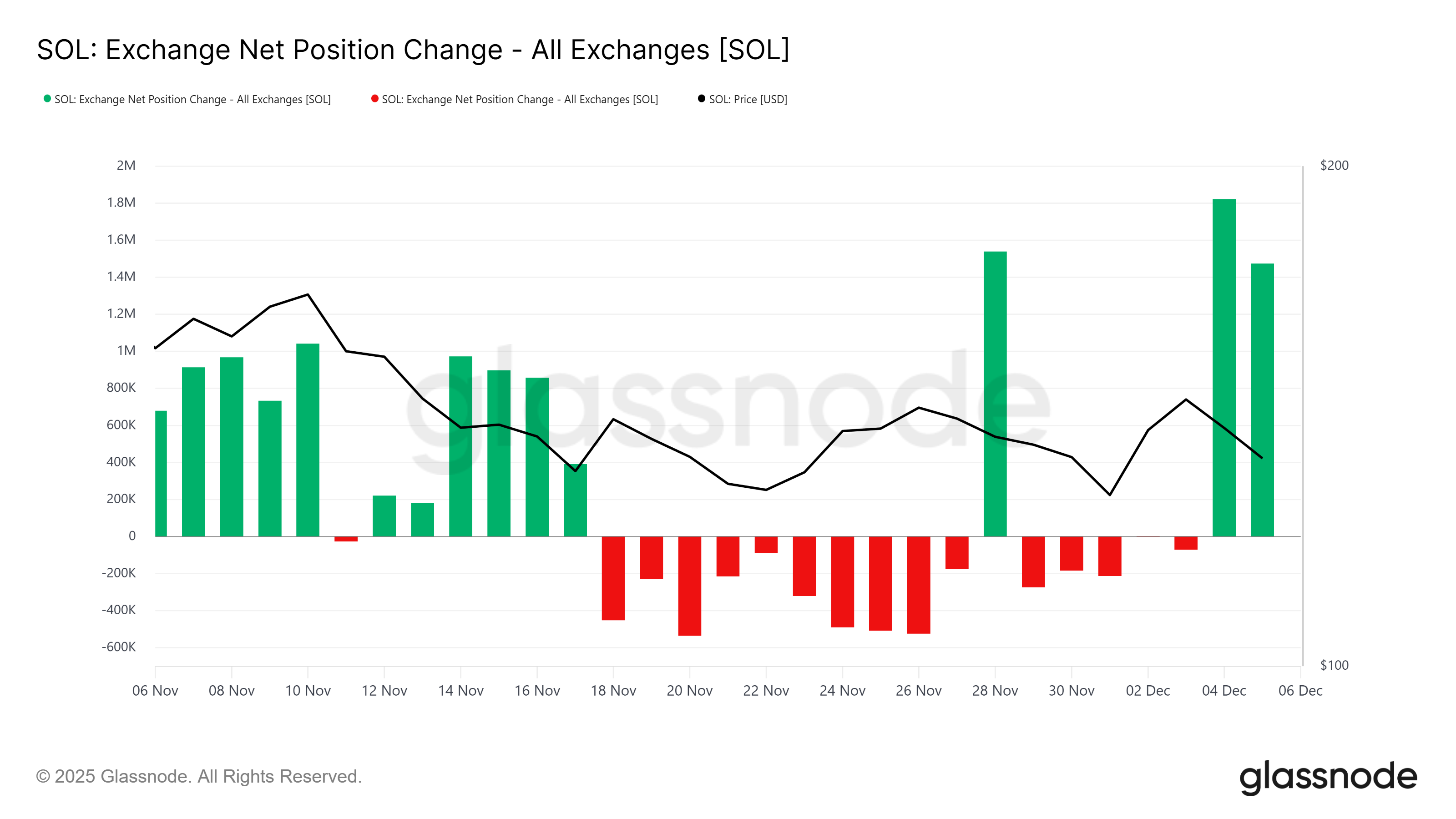

The exchange net position change reflects conflicting signals from Solana holders. Throughout the past week, SOL wallets have oscillated between accumulation and distribution, creating an unstable backdrop.

Notably, the last 48 hours recorded a dominance of green bars, indicating heavier outflows from exchanges.

Such inconsistent behavior points to uncertainty among holders rather than strong conviction. The repeated switches between buying and selling reflect a market struggling to find direction.

With selling currently outweighing accumulation, Solana’s short-term outlook remains vulnerable.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter

Solana Exchange Net Position. Source:

Glassnode

Solana Exchange Net Position. Source:

Glassnode

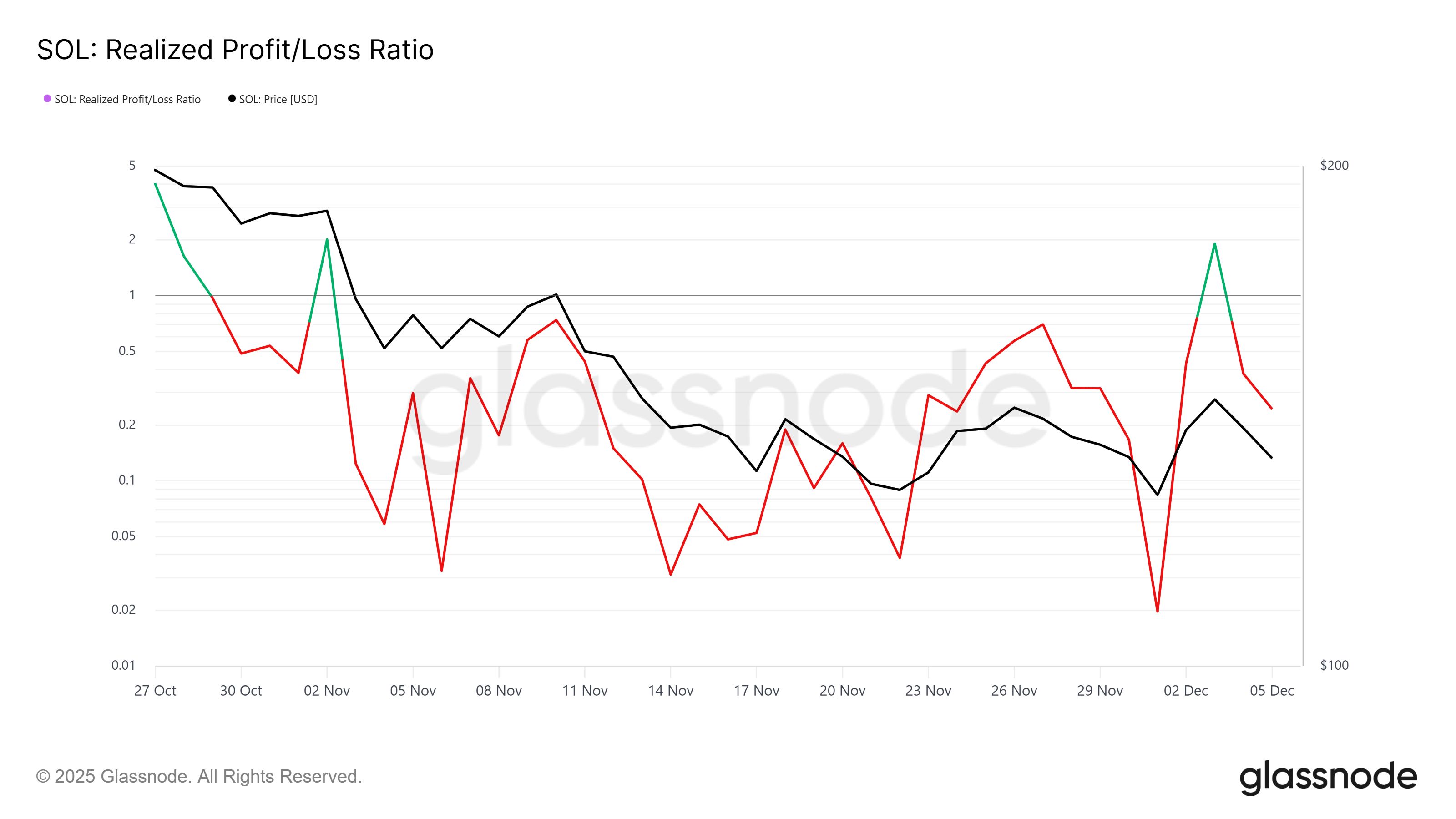

The Realized Profit/Loss Ratio further reinforces this bearish sentiment. The indicator shows that losses are dominating Solana as holders increasingly sell at lower prices to avoid deeper drawdowns. Panic-driven exits, even on a smaller scale, point to fading confidence.

When losses dominate, price tends to face additional downward pressure unless broader sentiment shifts. At present, the macro environment suggests investors are bracing for potential declines rather than preparing for accumulation.

Solana Realized Profit/Loss. Source:

Glassnode

Solana Realized Profit/Loss. Source:

Glassnode

SOL Price Needs To Find Direction

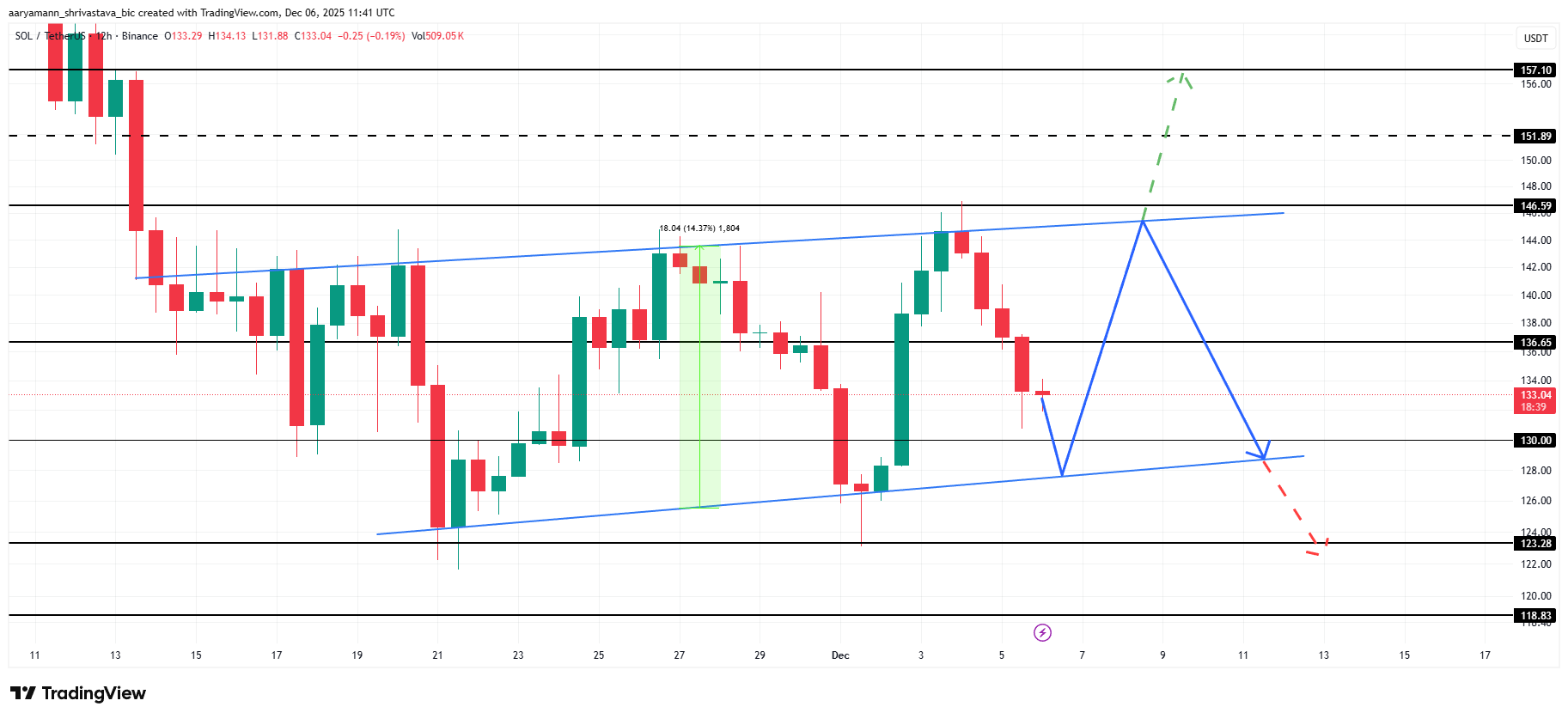

Solana’s price continues to trend within a descending channel after failing to break past the $146 resistance earlier this week. This structure leaves two potential paths depending on upcoming market cues and investor behavior.

If the channel remains intact and bearish sentiment persists, SOL risks falling below the lower trend line. Such a breakdown could drag the price toward $123 or even $118 if selling pressure continues to build.

Solana Price Analysis. Source:

TradingView

Solana Price Analysis. Source:

TradingView

Alternatively, a successful bounce off the channel support could spark a recovery attempt. If SOL regains strength and challenges the $146 resistance once more, a breakout could push the price toward $151 and eventually $157.

However, this outcome requires a renewed shift to bullish market conditions to invalidate the current bearish thesis.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

PENGU Price Forecast: Managing Immediate Market Fluctuations and Exploring Future AI Opportunities

- PENGU token's price fell to $0.01114 in Nov 2025, far below its 2024 peak of $0.068, amid regulatory and macroeconomic risks. - Short-term volatility is amplified by SEC ETF delays, $7.68M short positions, and susceptibility to broader crypto market downturns. - Long-term potential emerges through AI-driven features like dynamic staking and cross-chain interoperability, plus Schleich's physical collectible partnerships. - Pudgy Penguins' hybrid digital-physical model, including Walmart retail presence, d

The Rise of Dynamic Clean Energy Markets

- CleanTrade, CFTC-approved as a Swap Execution Facility (SEF), transformed clean energy markets into institutional-grade assets by standardizing VPPAs, PPAs, and RECs. - The platform addressed fragmented pricing and opaque risks, enabling $16B in transactions within two months and bridging renewable assets with institutional capital. - Institutional investors now use CleanTrade’s tools to hedge fossil fuel volatility and lock in renewable energy prices, mirroring traditional energy strategies. - Global cl

COAI Token Fraud: Insights for Cryptocurrency Investors During Times of Regulatory Ambiguity

- COAI token's 88% collapse in late 2025 exposed systemic risks in AI-driven DeFi ecosystems, with $116.8M investor losses. - Governance flaws included 87.9% token concentration in ten wallets, untested AI stablecoins, and lack of open-source audits. - Panic selling accelerated by AI-generated misinformation and CEO resignation, amid conflicting global crypto regulations. - Lessons emphasize scrutinizing token distribution, demanding transparent audits, and avoiding jurisdictions with regulatory ambiguity.

Renewable Energy Training as a Key Investment to Meet Future Workforce Needs

- Farmingdale State College's Wind Turbine Technology program aligns with surging demand for skilled labor in decarbonizing economies, driven by U.S. renewable energy targets. - Industry partnerships with Orsted, GE Renewable Energy, and $500K in offshore wind funding validate the program's role in addressing workforce shortages in expanding wind sectors. - Hands-on training with GWO certifications and VR simulations prepares graduates for high-demand, high-salary roles ($56K-$67K annually), reducing corpo