Zcash Price Struggle Below $400 Is Down To Bitcoin, Here’s How

Zcash price has faced renewed selling pressure after a sharp 16% decline in the last 24 hours, pulling the altcoin down from its attempted move above $400. The rejection has delayed ZEC’s attempt to reclaim higher levels, and the extended wait could introduce further challenges for traders if market sentiment weakens again. Zcash Pulls Away

Zcash price has faced renewed selling pressure after a sharp 16% decline in the last 24 hours, pulling the altcoin down from its attempted move above $400.

The rejection has delayed ZEC’s attempt to reclaim higher levels, and the extended wait could introduce further challenges for traders if market sentiment weakens again.

Zcash Pulls Away From Bitcoin

The correlation between Zcash and Bitcoin has been slipping in recent days, dipping back below the zero line. A negative correlation means ZEC is no longer moving in tandem with BTC’s price direction.

While this may initially seem neutral, it introduces an unusual risk dynamic. If Bitcoin rallies, Zcash may fail to benefit from broader market optimism.

Conversely, if Bitcoin falls sharply, ZEC could unexpectedly move higher, but with no guarantee of sustained strength.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

ZEC Correlation To Bitcoin. Source:

ZEC Correlation To Bitcoin. Source:

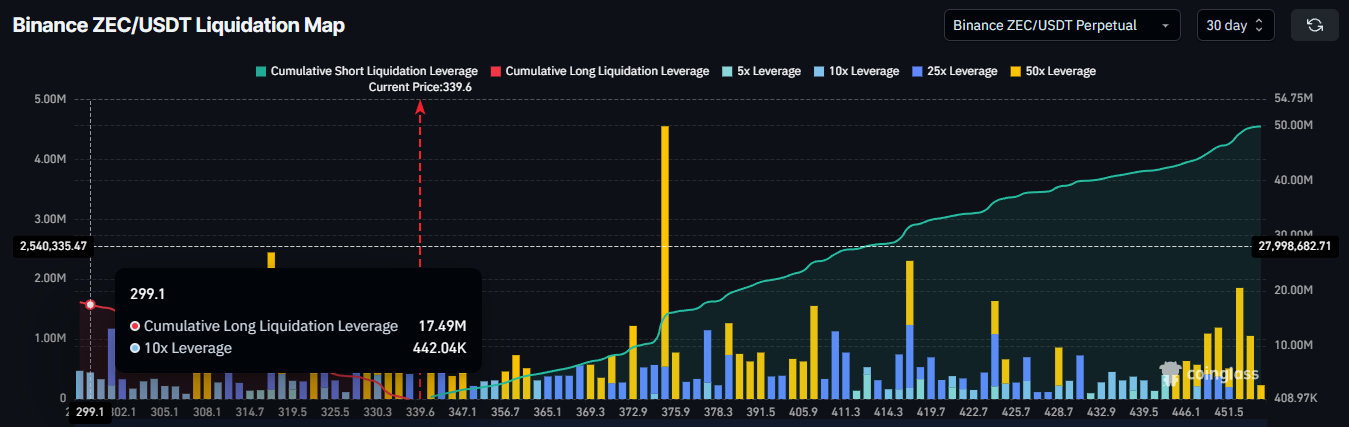

The liquidation map adds another layer of caution for ZEC holders at the moment. Long traders are facing elevated liquidation risk, with nearly $17.49 million in long contracts exposed if ZEC drops to $300 or below.

These potential liquidations represent a major pressure point for bullish sentiment.

If prices approach this threshold, cascading liquidations could accelerate downward movement. Such events often prompt traders to exit long positions and discourage new long exposure, contributing to a feedback loop that reinforces bearish momentum.

Zcash Liquidation Map. Source:

Zcash Liquidation Map. Source:

ZEC Price Faces Resistance

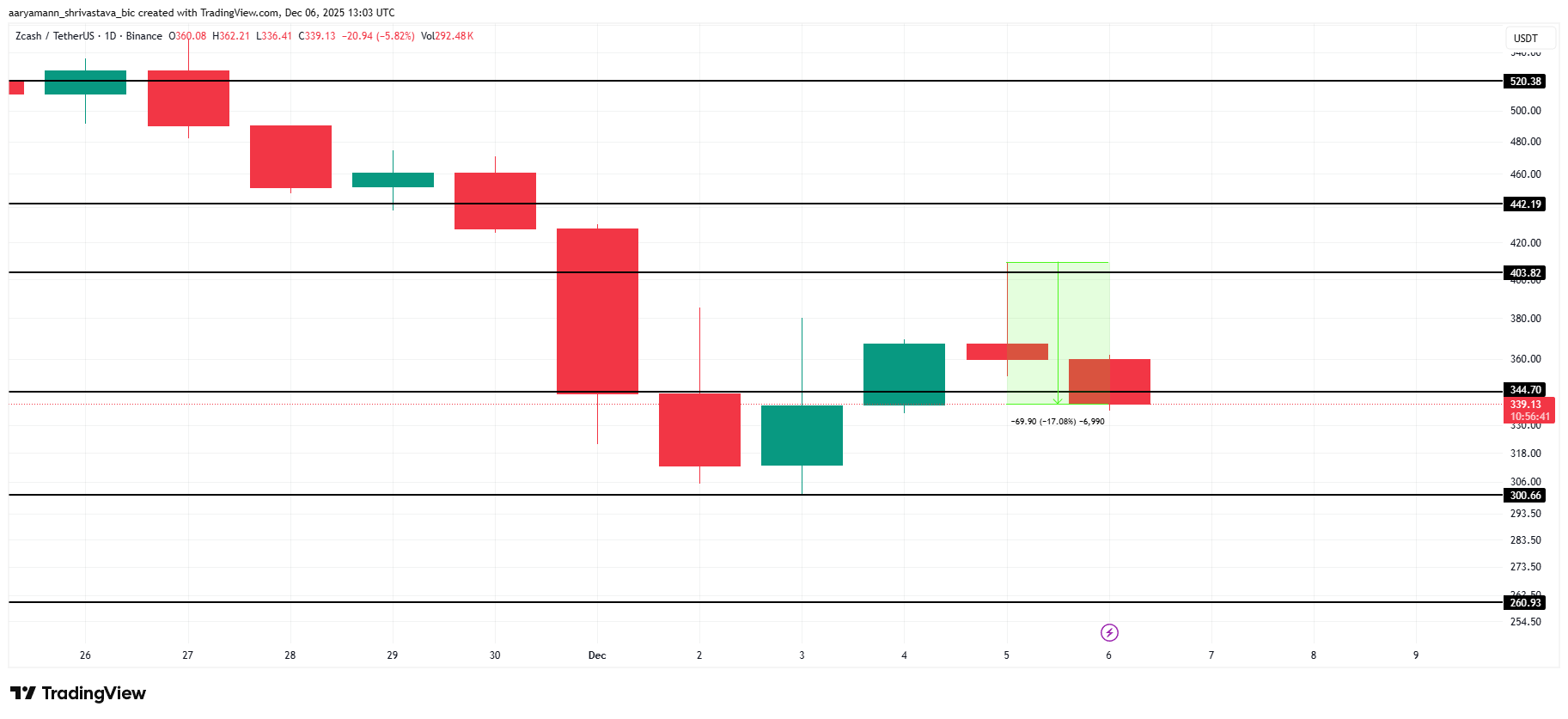

ZEC is trading at $339 and is hovering around the $344 support level after its steep decline from intra-day highs. The sharp sell-off and weakening market structure suggest that further downside is possible in the near term.

If bearish momentum continues, ZEC could fall toward the critical $300 support. Losing this level would likely trigger the $17.49 million liquidation cluster. This could potentially push the price down to $260 as forced selling intensifies.

ZEC Price Analysis. Source:

ZEC Price Analysis. Source:

However, if momentum shifts and buyers return, ZEC could stabilize at $344 and attempt a recovery toward $403. A successful breakout above this level would invalidate the bearish thesis and restore confidence among long traders.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Zcash Halving: What It Means for Cryptocurrency Investors in 2025

- Zcash's 2028 halving will reduce annual inflation to 1%, reinforcing its deflationary model after prior 50% block reward cuts in 2020 and 2024. - The 2024 halving triggered 1,172% price surge followed by 96% drop, highlighting volatility risks despite growing institutional investments like Grayscale's $137M Zcash Trust. - Privacy-focused hybrid model (shielded/transparent transactions) attracts institutional interest but faces EU MiCA regulatory scrutiny, requiring selective compliance strategies. - Inve

CleanTrade and the Evolution of Clean Energy Markets: Market Fluidity, Openness, and the Role of the CFTC

- CleanTrade, a CFTC-approved SEF, transforms clean energy markets by integrating VPPAs, PPAs, and RECs under institutional-grade transparency. - The platform unlocks liquidity through real-time pricing and centralized trading, accelerating net-zero transitions for corporations and utilities . - Enhanced transparency via project-specific REC data combats greenwashing, while regulatory alignment boosts investor confidence and market legitimacy. - By bridging traditional and renewable energy markets, CleanTr

The CFTC-Authorized Clean Energy Marketplace: An Innovative Gateway for Institutional Investors

- REsurety’s CleanTrade platform, CFTC-approved as a SEF, addresses clean energy market illiquidity and opacity by centralizing VPPAs, PPAs, and RECs. - Within two months of its 2025 launch, it attracted $16B in notional value, enabling institutional investors to streamline transactions and reduce counterparty risk. - By aggregating market data and automating compliance, CleanTrade enhances transparency, aligning with ESG priorities and regulatory certainty for institutional portfolios. - It democratizes a

SOL Drops 50%: Is This a Healthy Market Adjustment or the Onset of a Major Sell-Off?

- Solana's 50% price drop sparks debate over whether it signals a bear market correction or deeper structural selloff. - On-chain metrics show liquidity contraction and reduced exchange supply, but ETF inflows and validator activity suggest structural resilience. - Corporate transfers and the Upbit hack highlight volatility risks, while Solana's alignment with Bitcoin's trend underscores macroeconomic influence. - Key watchpoints include liquidity recovery timelines, ETF inflow sustainability, and potentia