Terra Classic Price Prediction: LUNC Recovery Slows as Outflows Pressure Market

Terra Classic ($LUNC) is trying to stabilize after a prolonged decline that pushed the token toward $0.00002500. Buyers stepped in around this zone and slowed the sell-off. The market now shows early signs of recovery, although confidence remains fragile.

The recent move above the 0.236 Fibonacci level at $0.00003000 offered a short burst of strength. It also encouraged traders to reassess short-term expectations. However, the broader structure still needs confirmation before any sustained reversal. The focus now shifts to whether momentum can build above immediate resistance.

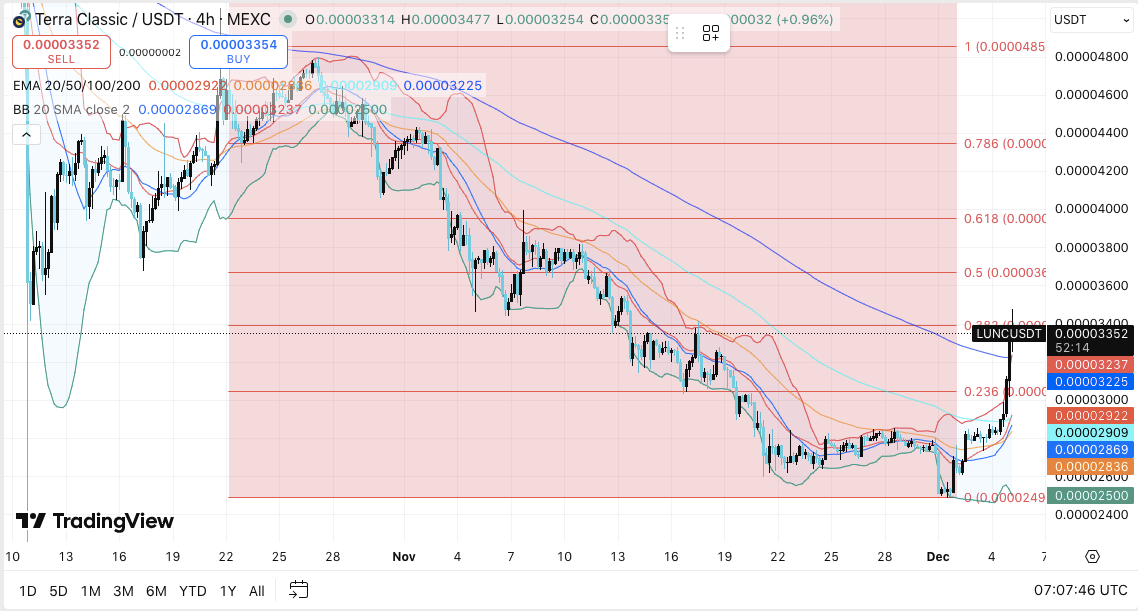

Price Tests a Critical Cluster Near the 200 EMA

Price action on the 4H chart shows $LUNC pressing against the $0.00003350 to $0.00003400 band. This area aligns with the 200 EMA, creating a difficult barrier. Additionally, this region sits near the 0.382 Fibonacci level.

Hence, it remains the first major test for bullish traders. A break above $0.00003400 could open a path toward $0.00003600. That level matches the 0.5 Fibonacci zone.

Moreover, a sustained move above this midpoint often signals stronger trend conviction. A push beyond $0.00003600 may shift the tone toward $0.00004000, where additional supply may appear.

Related: Cardano Price Prediction: Buyers Fight to Reverse a Sustained Downtrend

Support sits near $0.00003000, which now acts as the first defensive zone. A clean hold above this level helps maintain the developing structure. Moreover, the range between $0.00002830 and $0.00002890 contains short-term EMAs. A move below this range weakens the recovery attempt. Consequently, losing $0.00002500 could end the current rebound.

Derivatives Show Weaker Commitment as Open Interest Falls

Open interest also paints a cautious picture. Futures OI declined from highs above $15M earlier this year to about $5.46M on December 5. This fall shows reduced leverage and weaker speculative involvement.

Peaks in January and November failed to support a stronger trend. Moreover, the sharp decline in September signaled fading appetite for directional bets. Hence, a meaningful rise in OI will likely require clear price strength and renewed conviction.

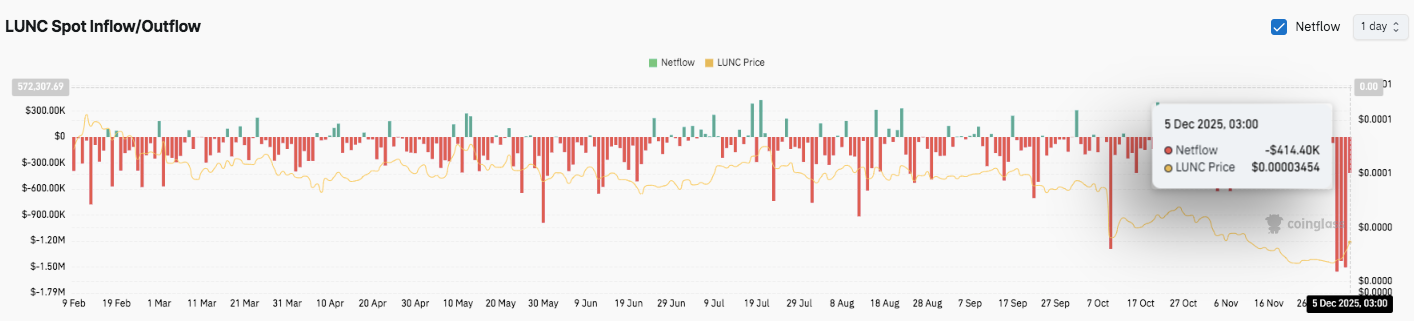

Spot Flows Reflect Persistent Outflows and Weak Demand

Spot flows show consistent outflows across the year. Red prints dominated the chart and outweighed brief inflow spikes. The latest outflow of about $414K on December 5 matched recent weakness near $0.000034.

Additionally, sustained negative netflow through November and early December shows liquidity leaving the market. Consequently, sentiment remains cautious. Traders will likely wait for stronger inflows before supporting a lasting recovery.

Technical Outlook for Terra Classic Price

LUNC trades within a tightening structure as it approaches a major decision zone on the 4H chart. Key levels remain well-defined as momentum attempts to shift after weeks of gradual decline.

Upside levels: Immediate hurdles sit at $0.00003350–$0.00003400, a zone that aligns with the 200 EMA. A breakout above this range opens the path toward $0.00003600, followed by $0.00004000, which marks the 0.618 Fibonacci level and a stronger resistance cluster.

Downside levels: Support stands at $0.00003000, which acts as the first checkpoint for buyers. Losing this level exposes the short-term EMA range between $0.00002830 and $0.00002890. A deeper breakdown targets $0.00002500, the cycle low that anchors the broader structure.

Resistance ceiling: The $0.00003400 level remains the critical barrier for restoring medium-term bullish momentum. A decisive flip of this region signals the first structural shift in months.

LUNC trades within a gradual compression zone, shaped by lower highs and solidifying support. This setup increases the probability of a volatility expansion once price breaks either side of the tightening range. The technical picture suggests a pending inflection that could define December’s trajectory.

Will Terra Classic Go Up?

LUNC’s next direction depends on whether buyers can defend $0.00003000 long enough to challenge the $0.00003350–$0.00003400 resistance band. Sustained strength above this ceiling opens the way toward $0.00003600 and $0.00004000, with momentum likely accelerating as traders regain confidence.

Related: BOB (Build on Bitcoin) Price Prediction 2025, 2026, 2027-2030

However, failure to hold $0.00003000 invites fresh pressure and raises the risk of a drop toward $0.00002830 and $0.00002500. For now, LUNC sits at a pivotal juncture where market conviction and inflow strength will determine its next major move.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

U.S. September Core PCE Price Index YoY at 2.8% (vs. 2.9% expected, 2.9% prior)

Ether vs. Bitcoin teases 170% gains as ETH price breaks 5-month downtrend

Navigating Fluctuating Markets: Insights Gained from Recent Declines in Prices

- 2023-2024 markets saw Fed rate hikes (5.25%-5.50%) then cuts, driving S&P 500/Nasdaq surges led by Magnificent Seven tech stocks. - AI euphoria and Trump-era trade uncertainty created valuation risks, with NVIDIA up 1,150% since 2023 and small-cap/crypto surges. - Historical parallels to 2000 dot-com and 2008 crises highlight dangers of overconcentration in high-growth tech and fragile diversification. - Resilient portfolios require diversification beyond tech, active management (hedge funds/private equi

Anthropological Insights into Consumer Actions in Digital Advertising: Investing Strategically in Culturally Sensitive Advertising Technology

- Digital advertising is transforming via ethnographic research and AI, driven by Farmingdale’s anthropology curriculum and IAB’s AI initiatives. - Ethnographic methods, like TESS, decode cultural behaviors in digital spaces, enabling hyper-segmented campaigns beyond demographics. - IAB’s AI-driven ad tech requires culturally rich data to train models, aligning with privacy standards and regional regulations like GDPR. - Investors should prioritize platforms integrating ethnographic insights with AI, enhan