XRP ETFs Extend Streak to 13 Days, $1 Billion Target Now in Sight

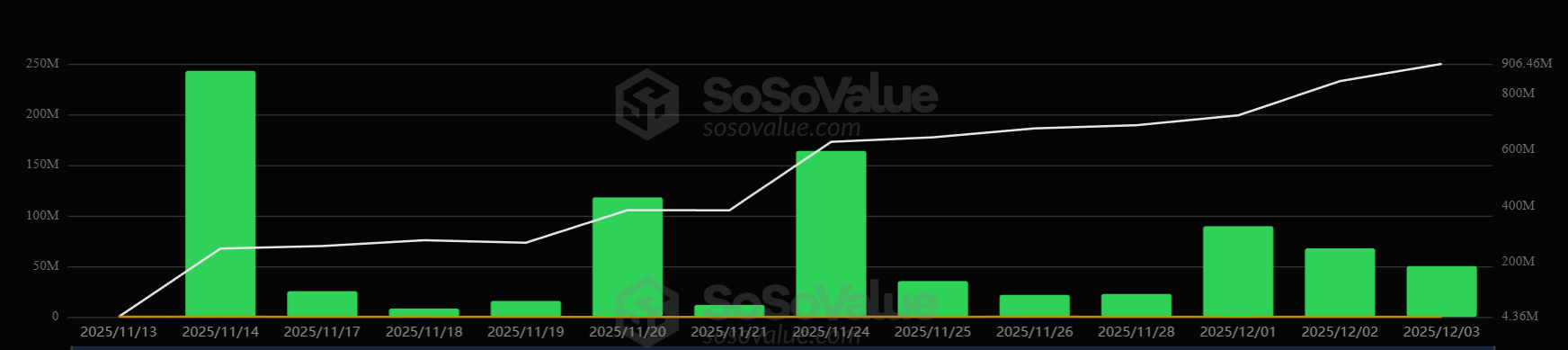

XRP spot ETFs have logged 13 consecutive days of inflows, adding another $50.27 million on December 3 and bringing cumulative inflows to $874.28 million, according to SoSoValue. Total net assets now stand at $906.46 million, placing the category within reach of the $1 billion milestone as early as this week. New Capital Continues to Flow

XRP spot ETFs have logged 13 consecutive days of inflows, adding another $50.27 million on December 3 and bringing cumulative inflows to $874.28 million, according to SoSoValue.

Total net assets now stand at $906.46 million, placing the category within reach of the $1 billion milestone as early as this week.

New Capital Continues to Flow Across All Issuers

Since launch, the ETFs have only recorded green days, marking one of the strongest adoption curves among newly listed digital-asset funds.

All four funds posted gains again this session. Franklin’s XRPZ recorded $4.76 million in fresh inflows.

US Spot XRP ETFs Total Net Assets. Source:

SoSoValue

US Spot XRP ETFs Total Net Assets. Source:

SoSoValue

Despite inflows, XRP ETF prices closed lower on the day as broader crypto markets softened. Each fund declined between 3.09% and 3.76%, showing a divergence between price performance and asset accumulation.

Still, capital movement remains firmly positive. The market has now added more than $380 million in new inflows since November 20, including major surges on November 14, November 24, and December 1.

$1 Billion in Assets Is Now a Likely Near-Term Breakpoint

XRP ETFs require less than $94 million in additional capital to reach $ 1 billion. At the current pace, that threshold could be reached in two to three sessions, assuming buying continues.

Crossing the $1 billion asset level would place XRP ETF adoption in the same league as early Ethereum ETF inflows.

It also strengthens the argument that regulated exposure to non-Bitcoin assets is gaining institutional traction.

$XRP ETF DEMAND GOING PARABOLIC‼️Every issuer flashing GREEN: Canary, Grayscale, Bitwise, Franklin.Millions flowing in DAILY.Smart money is positioning BEFORE the breakout💥

— XRP Update December 4, 2025

Persistent inflows through both rallies and pullbacks indicate growing conviction rather than speculative rotation. The data suggests investors may be using ETFs as their primary route for XRP exposure rather than switching in and out of spot markets.

A sustained uptrend could tighten supply over time, especially if ETF custodians continue accumulating XRP faster than it circulates back into exchanges.

For now, the streak remains active. With 13 days of uninterrupted inflows and less than 10% remaining before the billion mark, all eyes will be on whether XRP ETFs can finish the week above that mark.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Cryptocurrency Price Fluctuations and Technical Strategies in the Market After 2025: Assessing Immediate Momentum and Approaches to Risk Control for Tokens Such As

- Pudgy Penguins (PENGU) exhibits extreme 2025 volatility, surging 25% then retreating 30%, with 14.46% volatility metrics highlighting crypto market instability. - Technical indicators show conflicting signals: 4-hour bullish momentum vs. daily bearish patterns, while institutional inflows ($430k) contrast with bearish sentiment (Fear & Greed Index at 28). - Risk management is critical as PENGU faces key thresholds ($0.010 support, $0.014 resistance), with potential for $0.069 rebound or $0.008645 decline

Crypto Presale Activity Spikes Ahead of FED Decision: Mono Protocol and Nexchain Lead the Watchlist

Hyperliquid (HYPE) Price Fluctuations and Key Drivers: Understanding Market Emotions and Liquidity Challenges in DeFi

- Hyperliquid (HYPE) faces liquidity risks amid $372M TVL and 0.89 Bitcoin price correlation, exposing it to systemic crypto downturns. - Institutional confidence grows as Nasdaq-listed Hyperliquid Strategy stakes $420M HYPE tokens, reducing short-term selling pressure. - Market analysis shows HYPE rebounding to $33.84 with 8.8% 24-hour gains, but $37 resistance remains critical for bullish momentum validation. - Speculative trading patterns reveal mixed signals: 40% restaked tokens indicate conviction, wh

The Cultural Dynamics of Technology: How Insights into Society Drive Innovation and Investment Achievements

- Cultural anthropology is reshaping tech innovation by integrating human behavior insights into AI design, education, and investment strategies. - STEM programs at institutions like Morehouse and Howard use culturally responsive curricula to boost Black student retention and drive inclusive innovation. - Mentorship initiatives like AUGMENT and Google's programs link cultural intelligence to 2-3x higher success rates in tech transformations, generating $4.50 ROI per dollar invested. - AI-first companies em