What Actually Changed with the Ethereum Fusaka Upgrade

Ethereum has activated Fusaka, an upgrade that expands network capacity, reduces rollup costs, and improves long-term scalability. Here’s what changed, why it matters, and what ETH holders should expect next.

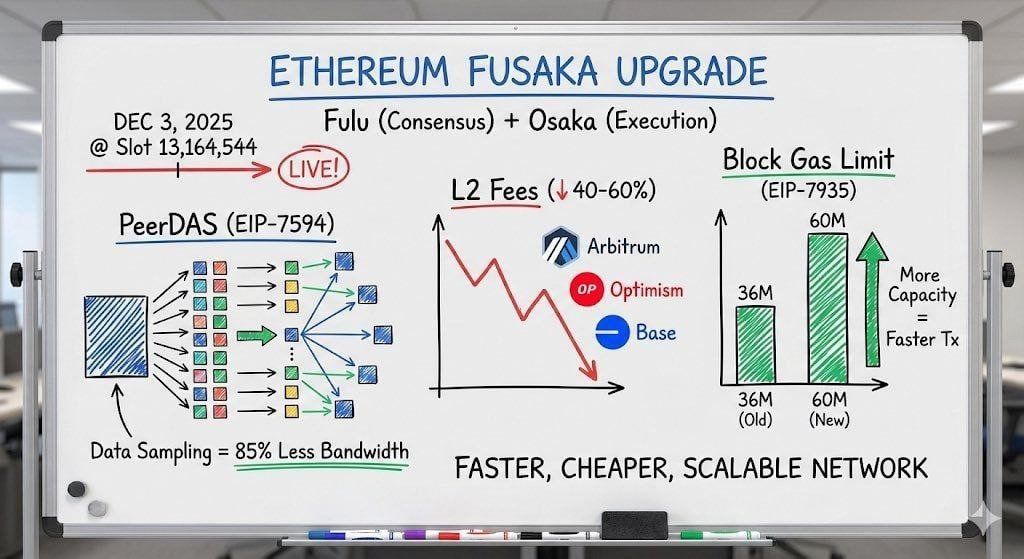

Ethereum just completed the Fusaka upgrade, a hard fork designed to prepare the network for larger scale and cheaper use. While technical on paper, the change touches the core functions of Ethereum — how data is stored, how transactions fit into blocks, and how Rollups like Arbitrum, Base, and Optimism interact with the main chain.

For anyone holding ETH, this upgrade forms the groundwork for lower fees, better network efficiency, and a more resilient long-term ecosystem.

A Larger Network With More Room to Breathe

The biggest change arrived in how Ethereum handles data.

Every transaction, NFT mint, DeFi swap, or Layer-2 batch needs block space, and until now, that space was limited. Fusaka increases Ethereum’s capacity so blocks can carry more information at once.

Missed the Fusaka network upgrade?13 Ethereum Improvement Proposals (EIPs) are now live on Mainnet.Here’s Fusaka in 35 seconds. pic.twitter.com/DlUh1ATA55

— Ethereum (@ethereum) December 4, 2025

This does not make the chain instantly faster, but it removes pressure when demand spikes, such as during market volatility or popular token launches.

In simple terms, Ethereum can absorb more activity without struggling.

Cheaper Rollups Through Expanded Blob Capacity

A large portion of today’s Ethereum traffic comes from Rollups. These networks batch thousands of user transactions and settle them on Ethereum as compressed data called “blobs.”

Before Fusaka, blob space was constrained. When demand surged, fees climbed. Fusaka expands the room available for blob submissions and introduces a flexible system for raising or lowering capacity without a full upgrade.

As rollups scale into this new space, users should experience lower transaction costs and smoother application activity.

The end goal is simple: more transactions, less friction.

Ethereum Fusaka Upgrade Explained. Source:

X/Bull Theory

Ethereum Fusaka Upgrade Explained. Source:

X/Bull Theory

PeerDAS: A Simpler Way to Verify Data

Another major improvement is how Ethereum nodes verify data. Previously, nodes had to download large sections of block data to confirm that nothing was missing or hidden.

Fusaka introduces PeerDAS, a system that checks small, random pieces of data rather than the entire load.

It works like inspecting a warehouse by opening a few random boxes instead of checking every single one.

PeerDAS in Fusaka is significant because it literally is sharding.Ethereum is coming to consensus on blocks without requiring any single node to see more than a tiny fraction of the data. And this is robust to 51% attacks – it's client-side probabilistic verification, not… pic.twitter.com/OK81xBteER

— vitalik.eth (@VitalikButerin) December 3, 2025

This reduces bandwidth and storage requirements for validators and node operators, making it easier — and cheaper — for more people to run infrastructure.

A wider validator base strengthens decentralization, which ultimately strengthens Ethereum’s security and resilience.

Higher Block Capacity Means More Throughput

Alongside scaling capacity, Fusaka also raises the block gas limit. A higher limit means more work can fit inside each block, allowing more transactions and smart-contract calls to settle without delay.

It doesn’t increase block speed, but it increases throughput. DeFi activity, NFT auctions, and high-frequency trading will have more room to breathe in peak hours.

Better Wallet Support and Future UX Improvements

Fusaka also includes improvements to Ethereum’s cryptography and virtual machine. The upgrade adds support for P-256 signatures, which are used in modern authentication systems, including those behind password-less login on smartphones and biometric devices.

This opens a path for future wallets that act more like Apple Pay or Google Passkeys rather than seed-phrase-based apps. Over time, this could make Ethereum access simpler for mainstream users.

Ethereum is about to 10x the wallet UX.The Fusaka upgrade includes EIP-7951 – support for the signature scheme that the iPhones use to power things like Face ID.Meaning you'll soon be able to sign transactions with your face.Huge win for bringing normal people on-chain. pic.twitter.com/7Ad38m4Oxz

— Jarrod Watts (@jarrodwatts) November 27, 2025

What Fusaka Means for ETH Holders

The impact for ETH holders is gradual but meaningful. Fees on Layer-2 networks should ease as data capacity expands. Network congestion should become less common. More validators can participate due to lower hardware demands.

Most importantly, Ethereum now has room to grow without sacrificing security or decentralization. If adoption increases, settlement volume grows with it — and so does ETH’s role as the asset that powers, secures, and settles everything on top.

$ETH is still consolidating around the $3,000 level.Not much price action due to weekends, but next week could be interesting.QT is ending on December 1st, Powell's speech is on December 1st, and the Fusaka upgrade is coming on December 3rd.If Ethereum holds above the… pic.twitter.com/pxgmrOHyah

— Ted (@TedPillows) November 30, 2025

A Foundational Upgrade, Not a Flashy One

Fusaka does not rewrite Ethereum’s economics or make ETH suddenly deflationary, but it strengthens the foundation that future demand depends on. Cheaper rollup fees invite usage.

A more scalable base layer invites developers. A more accessible node environment invites participation. These are structural upgrades, the kind that do little in a day but transform the network over time.

Ethereum widened the highway, improved the toll system, and made it easier for new drivers to join. That is the real meaning of Fusaka — a quiet shift with long-term weight.

As Layer-2 networks expand and applications multiply, the effects should move from technical discussion into user experience, transaction cost, and ultimately, ETH value itself.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Key Bitcoin price levels to watch ahead of 2025’s last FOMC meeting

Navigating the Fluctuations of Bitcoin in Late 2025: Adaptive Risk Management Approaches for an Evolving Cryptocurrency Landscape

- Bitcoin's November 2025 price swung between $80,553 and $91,000, eroding 25% of value amid macroeconomic and regulatory pressures. - Volatility stemmed from technical breakdowns, leveraged liquidations, and market makers' gamma exposure shifts below $85,000. - U.S. GENIUS Act and EU MiCA framework provided regulatory clarity, boosting institutional adoption through compliant ETPs and stablecoins. - Investors adopted risk-rebalance strategies: options hedging, macro-adjusted DCA, and diversified crypto tr

Bitcoin Experiences Steep Drop: What Causes the Sudden Sell-Off?

- Bitcoin plummeted 30% in November 2025, erasing $1 trillion in market cap amid macroeconomic pressures and institutional profit-taking. - Central bank uncertainty (Fed, ECB) and leveraged liquidations amplified the selloff, with ETF outflows exceeding $3.79 billion. - Bitcoin's 0.90 correlation with the S&P 500 highlighted its shift from "digital gold" to risk-on asset, contrasting gold's 55% surge. - On-chain metrics revealed structural weaknesses: hash rate declines, miner revenue drops, and divergent

PENGU USDT Sell Alert and Stablecoin Price Fluctuations: Evaluating Algorithmic Dangers Amid Changing Cryptocurrency Markets

- PENGU USDT's 2025 volatility reignited debates on algorithmic stablecoin fragility amid regulatory uncertainty and post-UST market skepticism. - Technical analysis showed conflicting signals: overbought MFI vs bearish RSI divergence, with critical support/resistance levels at $0.010-$0.013. - $66.6M team wallet outflows and 32% open interest growth highlighted liquidity risks, while UST's collapse legacy exposed algorithmic design flaws. - Investors increasingly favor fiat-backed alternatives like USDC ,