Gensler calls out crypto hype—again: Bitcoin aside, ‘it’s a risk asset’

Former SEC Chair Gary Gensler isn’t letting crypto enthusiasts off the hook anytime soon.

- Gary Gensler doubles down on skepticism, calling most cryptocurrencies (beyond Bitcoin and USD-backed stablecoins) speculative assets lacking fundamental value.

- Investor caution is key, as Gensler warns that political narratives and ETF hype don’t reduce the underlying volatility or risk.

- Regulation vs. innovation: Gensler maintains that protecting investors and fostering crypto innovation can coexist, despite ongoing sector mistrust.

In a recent Bloomberg interview , he reminded the market that most digital tokens remain speculative, volatile, and poorly understood by retail investors—even as the Trump administration and politicians increasingly talk up the sector.

“Look, I think it’s a risk asset,” Gensler said . “And the American public and the worldwide public have been fascinated with cryptocurrencies, but it’s a highly speculative, volatile asset.”

He reiterated a long-standing refrain: outside of Bitcoin and dollar-backed stablecoins, most tokens lack real value drivers like cash flows, dividends, or intrinsic utility. In other words, don’t mistake flashy headlines or political narratives for a sound investment.

Gensler’s tone echoes warnings he issued throughout his SEC tenure, when he flagged thousands of tokens as risky and spotlighted frauds, including the collapse of Sam Bankman-Fried’s empire.

Even as Bitcoin ETFs gain traction, Gensler pointed out the irony: markets are gravitating toward “centralized” structures—like ETFs—despite crypto’s decentralized promise. He frames this as a natural evolution akin to gold and silver investing: investors want accessibility, regulation, and some reassurance.

Through it all, Gensler maintains that regulation and innovation aren’t enemies. Protecting investors, he argues, is a prerequisite for the sector’s long-term survival.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Chicago Tribune files lawsuit against Perplexity

All the major highlights from AWS’s flagship tech event re:Invent 2025

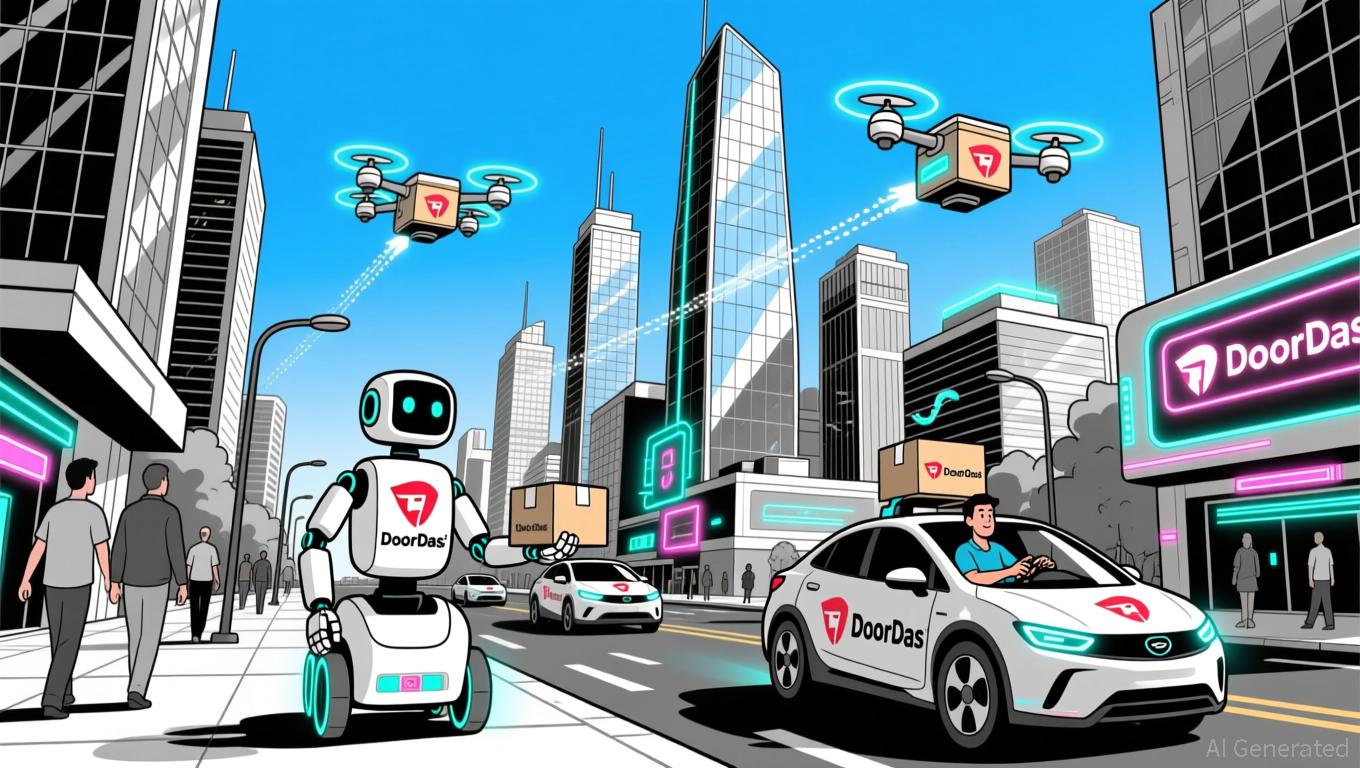

DASH Gains 5.78% Following DoorDash’s Expansion of Delivery Network and New Partnerships

- DoorDash's DASH stock surged 5.78% in 24 hours amid Q3 2025 results showing $3.4B revenue and $244M profit, driven by 27% YoY growth. - Strategic expansions include grocery delivery partnerships with Kroger/Family Dollar and robot delivery via Serve Robotics , enhancing its 68% U.S. food delivery market share. - Long-term investments in automation (Waymo, Dot robot) and $1.2B SevenRooms acquisition aim to boost efficiency but caused a 20% post-earnings stock pullback. - Favorable regulatory shifts (Prop

BCH sees a 32.36% increase over the past year as the network undergoes upgrades and mining adjustments

- Bitcoin Cash (BCH) surged 32.36% in a year due to network upgrades, mining shifts, and positive market sentiment. - Price hit $574.7 on Dec 5, 2025, with 6.34% 30-day and 0.03% 24-hour gains. - 2024 protocol upgrade boosted transaction throughput, fees, and real-world payment adoption. - Mining pools shifted hashrate to BCH, enhancing security and decentralization. - Institutional support and fixed supply model drive BCH’s appeal as a scalable payment alternative.