- PEPE increased by 17.0% in 24 hours and traded at $0.0547 and went close to resistance of $0.054773.

- The token was above the level of support of $0.054003 where price action was limited within a tight intraday range.

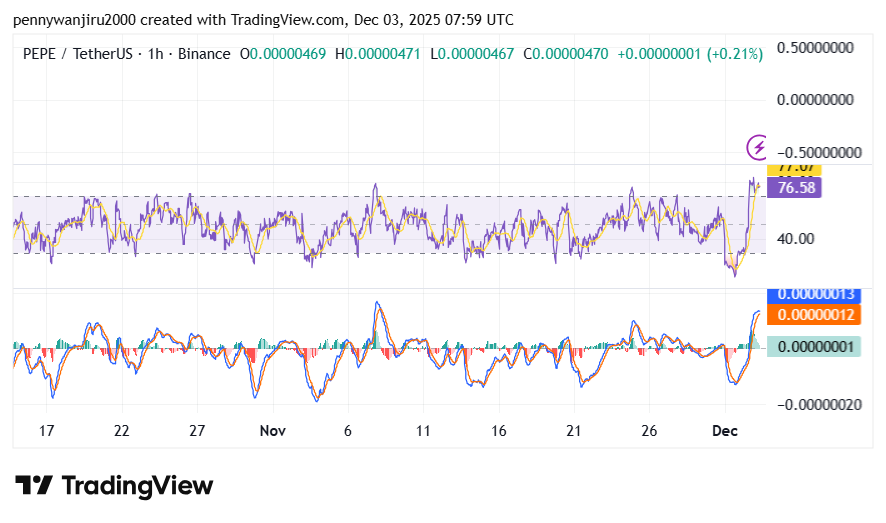

- The one-hour RSI stood at 77.06 and it indicated a good short-term momentum after a quick upward shift after declining at the previous lows.

PEPE recorded a strong daily performance as the market shifted toward its upper trading band. The token traded at $0.0547 after gaining 17.0 percent in the past 24 hours . This advance placed the asset near the top of its stated 24-hour range, which extended to a resistance level of $0.054773. The chart also showed large intraday volatility as momentum moved sharply from earlier lows.

That movement aligned with a broader rise across lower-timeframe indicators, which displayed a steep climb toward the overbought region. The market therefore entered the day with elevated activity, and this created a defined structure that framed immediate price behavior while guiding traders to watch nearby reaction zones.

PEPE Trades Near Resistance While Support Holds Steady Amid Narrow Range

PEPE hovered just below its resistance at $0.054773, which marked the upper boundary of the current session’s range. The token’s daily high remained close to that level and reflected persistent buying interest within the last several hours.

The token maintained support at $0.054003, which marked the key level beneath the current range. This number represented the lower anchor that contained the day’s earlier retracements. However, the token remained slightly above that point throughout the session, which created a narrow separation between the support level and the prevailing price.

PEPE Exhibits Strong Upward Momentum Amid Overbought Conditions Within Its Range

However, the chart’s indicators also showed the price touching stretched conditions, notably with the RSI reaching 77.06 on the one-hour timeframe. This reading placed the asset near the overbought territory. This provided a natural transition toward the price data that defined the lower boundary of the day’s structure.

Source: TradingView

Source: TradingView

Moreover, the Moving Average Convergence Line was trading above the signal line showing bullish momentum. The chart showed fast-moving oscillator readings, with values at $0.00000014 and $0.00000012 marking the upper signal points. This movement aligned with the visual spike seen during the latest hourly candle.

The combination of rising oscillators and a high RSI reading supported the observation that PEPE experienced strong upward momentum within its defined range. However, the asset remained between its support and resistance levels, which continued to frame the trading environment. This placement kept market attention concentrated on these same levels as PEPE traded near the highest point of its 24-hour performance.