Bank of America Recommends Crypto Allocation for Clients

- Bank of America introduces crypto allocation for wealth clients in 2026.

- Recommendation includes 1%-4% allocation.

- Focus on regulated Bitcoin ETFs.

Bank of America has recommended a 1% to 4% cryptocurrency allocation for clients at Merrill, the Private Bank, and Merrill Edge, starting January 2026.

This official endorsement signals a growing acceptance of digital assets, aligning with industry trends and potentially boosting Bitcoin ETF inflows within regulated wealth management.

Bank of America’s New Recommendation

Bank of America has announced a recommendation for a 1% to 4% cryptocurrency allocation for its wealth clients. Starting January 2026, advisors can suggest regulated crypto products. This decision involves over 15,000 advisors across Merrill, the Private Bank, and Merrill Edge. Key figures include Chris Hyzy and Nancy Fahmy, who emphasize innovation and client demand.

Institutional Impact

Immediate effects include a significant shift in institutional endorsement of digital assets. Advisors now guide clients toward regulated Bitcoin ETFs , impacting asset exposure strategies. Market impact includes a potential increase in Bitcoin ETF inflows. The decision aligns with peers like Morgan Stanley and BlackRock, reflecting broader acceptance and regulatory compliance.

Expanding Crypto Adoption

Institutional endorsement could bolster crypto adoption across markets. The focus on regulated ETFs provides a stable entry for conservative investors. Financial outcomes may involve improved portfolio diversification with Bitcoin as “digital gold.” Historical trends suggest ETFs lower direct coin risk, increasing mainstream financial access.

Chris Hyzy, Chief Investment Officer, Bank of America Private Bank, said: “For investors with a strong interest in thematic innovation and comfort with elevated volatility, a modest allocation of 1% to 4% in digital assets could be appropriate. The guidance emphasizes regulated vehicles, thoughtful allocation, and a clear understanding of both the opportunities and risks.”

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

ETH Traders Turn Bold as $6,500 Calls Take Over Deribit

Quick Take Summary is AI generated, newsroom reviewed. Traders push $6,500 ETH calls to $380M in open interest Strong clusters form at $4K, $5.5K, and $6K call strikes Market confidence rises despite a 26% quarterly ETH drop ETH price outlook strengthens as crypto market sentiment turns bullishReferences 🚨DERIBIT TRADERS CALL FOR $6,500 ETH! The $6.5K strike leads with $380 MILLION in open interest, with $4K, $5.5K and $6K calls also active. Despite a 26% quarterly drop, BIG REBOUND bets are in

Crypto Market Ignites as Bitcoin and SUI Drive Massive Trading Activity

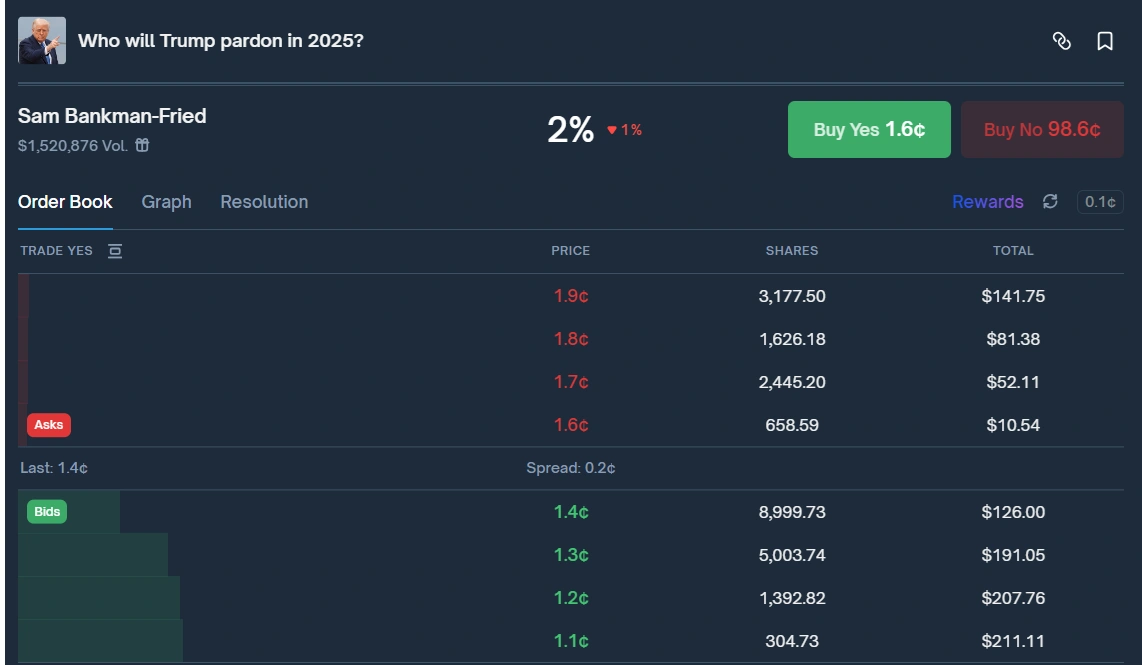

Trump continues to overlook SBF as president issues fresh pardons

Ledger Finds Popular Smartphone Chip Vulnerable to Unpatchable Attacks