Bitcoin Tests Key Ichimoku Cloud Resistance as $220M in Shorts Get Liquidated

Bitcoin is testing resistance on the daily Ichimoku Cloud while liquidation data shows heavy pressure on short sellers during its latest rebound.

Bitcoin is maintaining a strong upward bias following a fresh intraday advance, trading near the upper end of its 24-hour range. Over the past session, BTC has moved between $87,186 and $93,928, holding firm after a series of higher lows that reinforced the rebound structure.

The latest run places the market leader up roughly 6.5% over the last 24 hours, adding to a broader 7-day gain of about 6.8%. On the 14-day window, performance remains modest but positive with an increase of roughly 1.8%, reflecting slow but persistent accumulation after recent volatility.

With price now consolidating near the daily highs, traders are watching to see whether bullish pressure can extend into a clearer breakout. Will Bitcoin break out?

Bitcoin Price Analysis

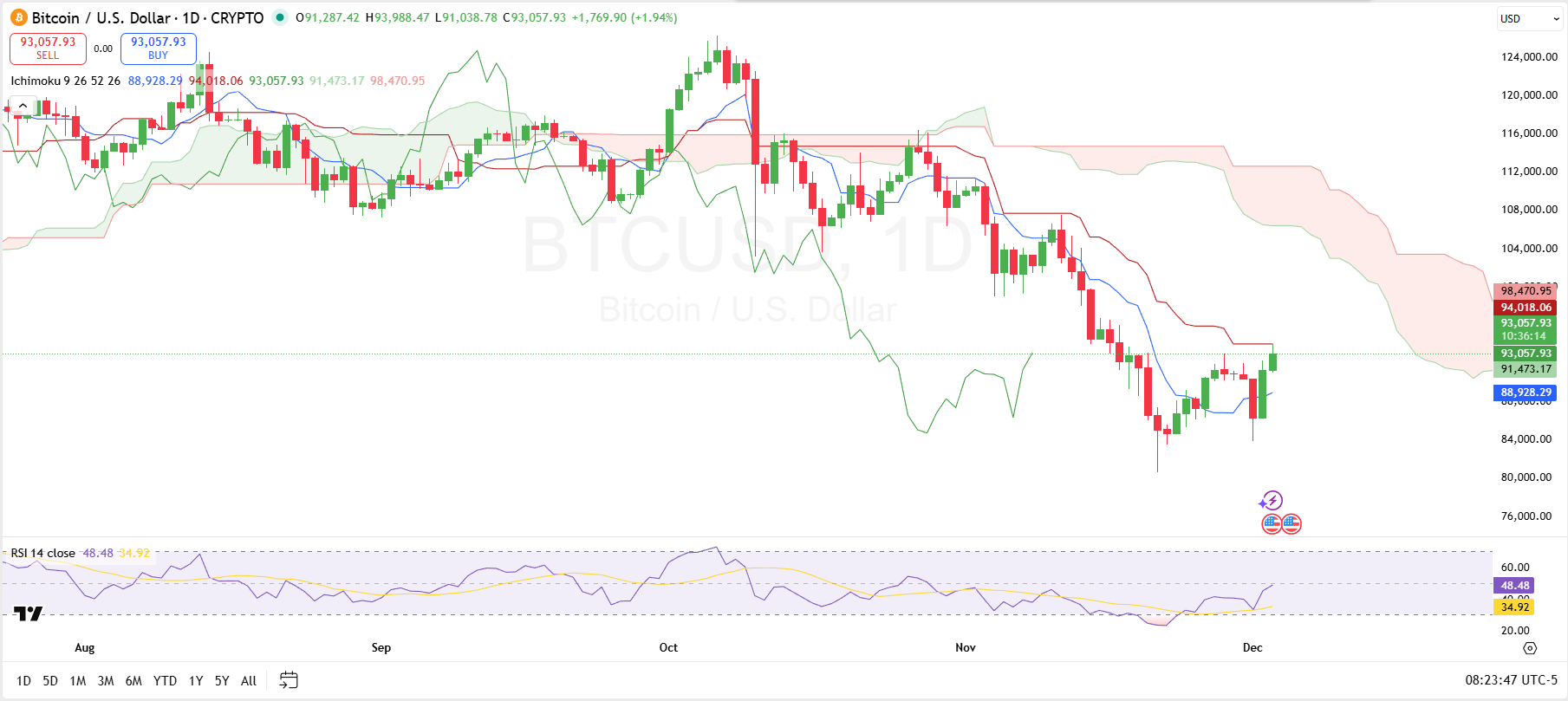

Bitcoin’s daily chart shows the price attempting to build a recovery structure after its November decline, with current action testing the Ichimoku cloud that had a lower boundary at $91,473. This cloud base had represented the first major resistance zone, acting as the point where bearish structure began to transition toward neutral conditions.

Until Bitcoin secures a full candle close above that lower cloud line, the overall trend bias remains cautious. Immediate resistance exists at the red base line at $94,018, while further resistance stands at the upper boundary of the cloud at $98,470.

On the support side, the blue conversion line provides short-term structural backing for the recovery. This conversion line sits just under current price action and will act as the first downside level to defend if momentum turns soft.

Further, RSI momentum offers modest reinforcement for bulls, with the indicator lifting away from bearish territory and trending toward mid-range alignment.

Taken together, price now sits at a sensitive juncture: a sustained break into or above the cloud base would solidify the upward shift, while failure to hold above the conversion line would risk eroding the confidence behind Bitcoin’s current recovery attempt.

Bitcoin Liquidation Data

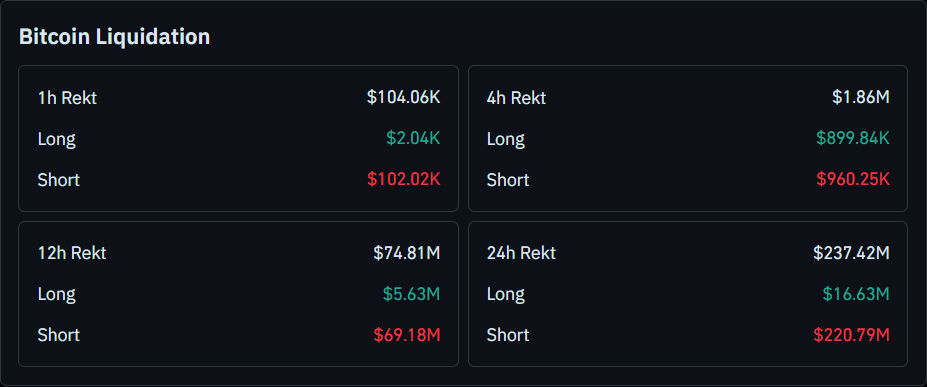

Bitcoin’s liquidation data confirms that the latest move higher has been due to pressure on short sellers. Over the past 24 hours, total liquidations reached about $237.4 million, with an overwhelming $220.8 million coming from short positions versus just $16.6 million from longs.

The pattern is similar on the 12-hour view, where roughly $74.8 million in positions faced liquidation, including $69.2 million in shorts and only $5.6 million in longs. This skew toward short liquidations suggests that traders betting against the rally have been forced to cover as price pushed higher.

Short-term readings echo the same dynamic, though at a smaller scale. In the last 4 hours, around $1.86 million in positions were liquidated, split between $899,800 in long and $960,000 in short exposure, while the 1-hour window shows approximately $104,000 in total liquidations, almost all of it ($102,000) from shorts.

Overall, the data indicates that Bitcoin’s upswing is being amplified by a series of short squeezes across multiple timeframes.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Zcash Halving: What It Means for Cryptocurrency Investors in 2025

- Zcash's 2028 halving will reduce annual inflation to 1%, reinforcing its deflationary model after prior 50% block reward cuts in 2020 and 2024. - The 2024 halving triggered 1,172% price surge followed by 96% drop, highlighting volatility risks despite growing institutional investments like Grayscale's $137M Zcash Trust. - Privacy-focused hybrid model (shielded/transparent transactions) attracts institutional interest but faces EU MiCA regulatory scrutiny, requiring selective compliance strategies. - Inve

CleanTrade and the Evolution of Clean Energy Markets: Market Fluidity, Openness, and the Role of the CFTC

- CleanTrade, a CFTC-approved SEF, transforms clean energy markets by integrating VPPAs, PPAs, and RECs under institutional-grade transparency. - The platform unlocks liquidity through real-time pricing and centralized trading, accelerating net-zero transitions for corporations and utilities . - Enhanced transparency via project-specific REC data combats greenwashing, while regulatory alignment boosts investor confidence and market legitimacy. - By bridging traditional and renewable energy markets, CleanTr

The CFTC-Authorized Clean Energy Marketplace: An Innovative Gateway for Institutional Investors

- REsurety’s CleanTrade platform, CFTC-approved as a SEF, addresses clean energy market illiquidity and opacity by centralizing VPPAs, PPAs, and RECs. - Within two months of its 2025 launch, it attracted $16B in notional value, enabling institutional investors to streamline transactions and reduce counterparty risk. - By aggregating market data and automating compliance, CleanTrade enhances transparency, aligning with ESG priorities and regulatory certainty for institutional portfolios. - It democratizes a

SOL Drops 50%: Is This a Healthy Market Adjustment or the Onset of a Major Sell-Off?

- Solana's 50% price drop sparks debate over whether it signals a bear market correction or deeper structural selloff. - On-chain metrics show liquidity contraction and reduced exchange supply, but ETF inflows and validator activity suggest structural resilience. - Corporate transfers and the Upbit hack highlight volatility risks, while Solana's alignment with Bitcoin's trend underscores macroeconomic influence. - Key watchpoints include liquidity recovery timelines, ETF inflow sustainability, and potentia