Key Market Intelligence on December 3rd, How Much Did You Miss?

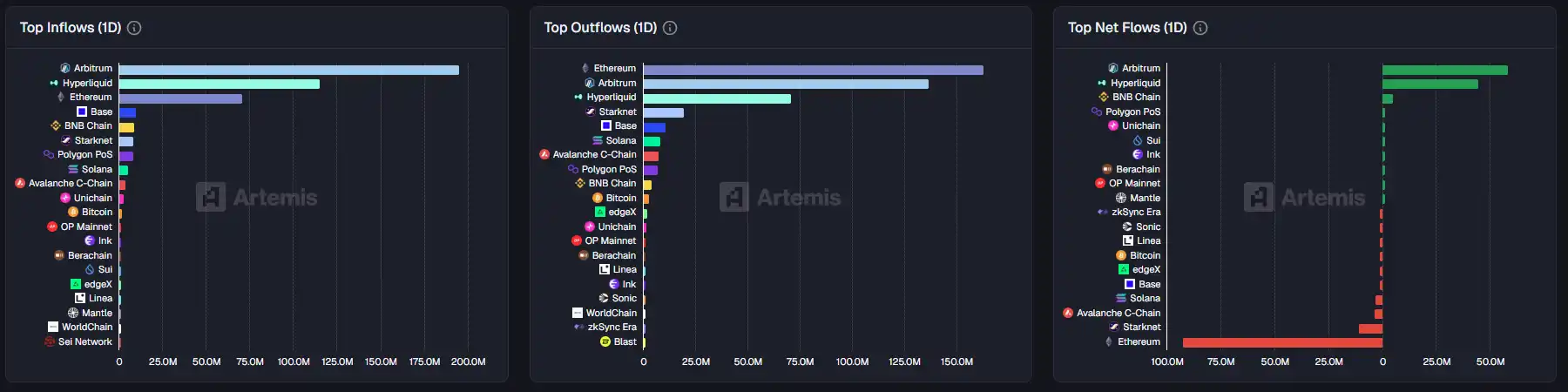

1. On-chain Funds: $58.5M USD inflow to Ethereum today; $92.5M USD outflow from Hyperliquid 2. Largest Price Swings: $BOB, $LUX 3. Top News: Farcaster Founder's Post Announces First-time Clanker Platform IDO Presale this Friday at 1:30

Featured News

2. SOL On-Chain Meme Surge, USELESS Up 30% in 24 Hours

4. Pre-market Crypto Concept Stocks in the U.S. Soar, BMNR Up 4.01%

5. Binance Co-Founder He Yi Appointed Co-CEO, Nearly 300 Million Registered Users on the Platform

Featured Articles

1. "New Fed Chair Could Bring on a Frenzied Bull Market"

On the prediction market Polymarket, the probability of Hassett being elected as the new Chair of the Federal Reserve has risen to 86%, far ahead of other potential candidates. It is highly likely that Kevin Hassett will be the next Chair of the Federal Reserve, Trump's favorite.

2. "The Rise and Fall of HUINENG in Phnom Penh: The 'Cambodian Alipay' Met Its Demise Last Night"

December 1, 2025, dawn, Sihanouk Boulevard. The once-'never-sleeping' financial totem, HUINENG headquarters building, lost its heartbeat overnight. The roar of the cash-carrying vehicles that used to come and go disappeared, replaced by a cold 'Withdrawal Suspension Notice' posted on the glass door, and in front of the main entrance, hundreds of East Asian faces gradually stiffened in fear.

On-chain Data

On-chain Fund Flow for the Week of December 3rd

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Solana's Abrupt Plunge: Is This a Warning Sign for Cryptocurrency Traders?

- Solana's 2025 crash saw 11% price drop to $125.94 amid $19B liquidation, exposing systemic risks in high-speed blockchain ecosystems. - Technical vulnerabilities like centralized validator sets and thin liquidity amplified volatility, contrasting with Bitcoin/Ethereum's resilient infrastructure. - Governance flaws including token distribution bottlenecks and speculative attacks highlighted Solana's susceptibility to sudden supply shocks. - Macroeconomic pressures and leveraged positions triggered cascadi

The Federal Reserve's Change in Policy and Its Growing Influence on Cryptocurrencies Such as Solana

- Fed's 2025 policy shift (rate cuts, halted QT) boosted crypto liquidity but amplified altcoin volatility, particularly for Solana (SOL). - Solana's 14% late-2025 price correction highlighted altcoin fragility amid macro uncertainty, despite regulatory clarity and institutional adoption growth. - GENIUS Act's stablecoin reserves mandate and Solana's technical advantages drove $11B stablecoin expansion, linking macro policy to on-chain activity. - Future crypto resilience depends on Fed easing pace and ext

From ETH to SOL: Why L1 Will Ultimately Lose to Bitcoin?

It is expected that the L1 sector will continue to lose market share in the future, further squeezed by BTC.

Chicago Tribune files lawsuit against Perplexity