8 Million MONAD Sold By Whales In 24 Hours, Could Price Suffer?

Monad is facing renewed pressure after a sharp dip in price triggered by broader market weakness led by Bitcoin. The pullback has shaken investor confidence, resulting in notable selling activity across key cohorts. As sentiment shifts, the question now is whether MONAD can stabilize or whether deeper losses are ahead. Monad Whales Turn To Selling

Monad is facing renewed pressure after a sharp dip in price triggered by broader market weakness led by Bitcoin. The pullback has shaken investor confidence, resulting in notable selling activity across key cohorts.

As sentiment shifts, the question now is whether MONAD can stabilize or whether deeper losses are ahead.

Monad Whales Turn To Selling

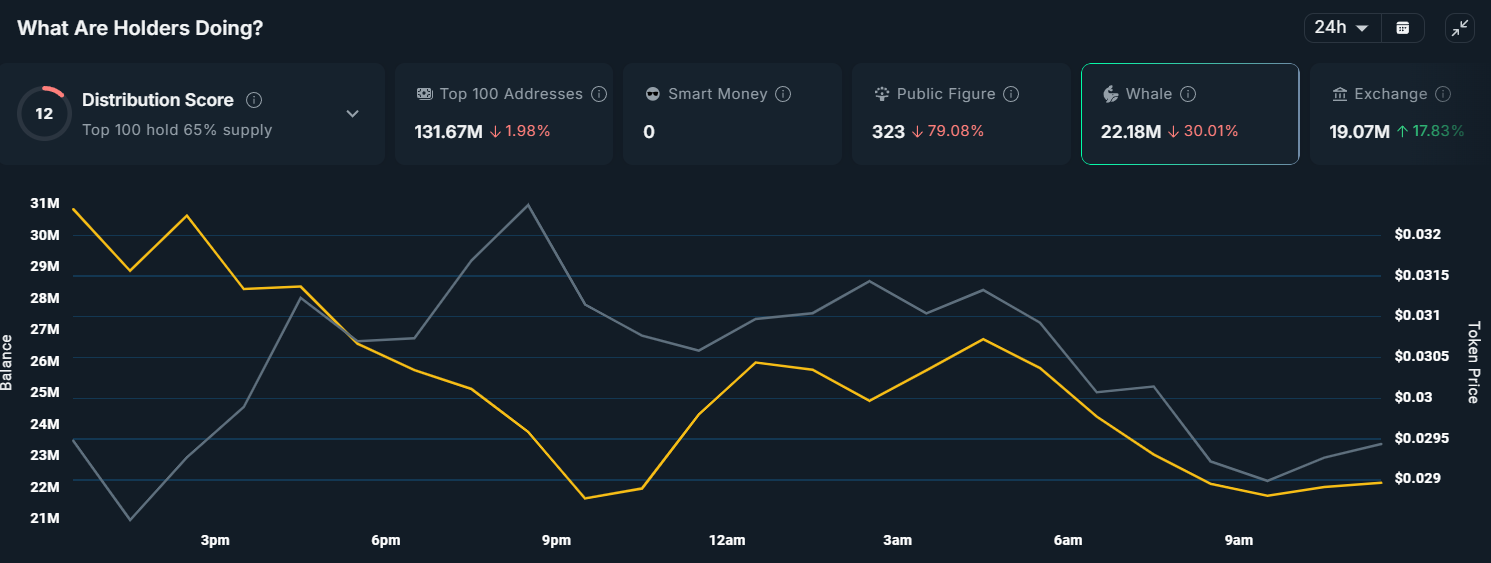

Whale activity has become a major concern for MONAD holders this week. On-chain data shows that large wallets holding more than $1 million worth of MONAD — excluding exchanges — sold over 8 million tokens in just 24 hours. This scale of distribution signals a clear decline in confidence among influential holders, who often drive major price movements.

Their exit from the asset could create additional downward pressure if the trend accelerates.

Such aggressive whale selling typically reflects expectations of further decline or a desire to reduce exposure during periods of volatility. Since these wallets hold a significant supply, their collective moves can sway price direction sharply.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter

Monad Whale Activity. Source:

Monad network analytics

Monad Whale Activity. Source:

Monad network analytics

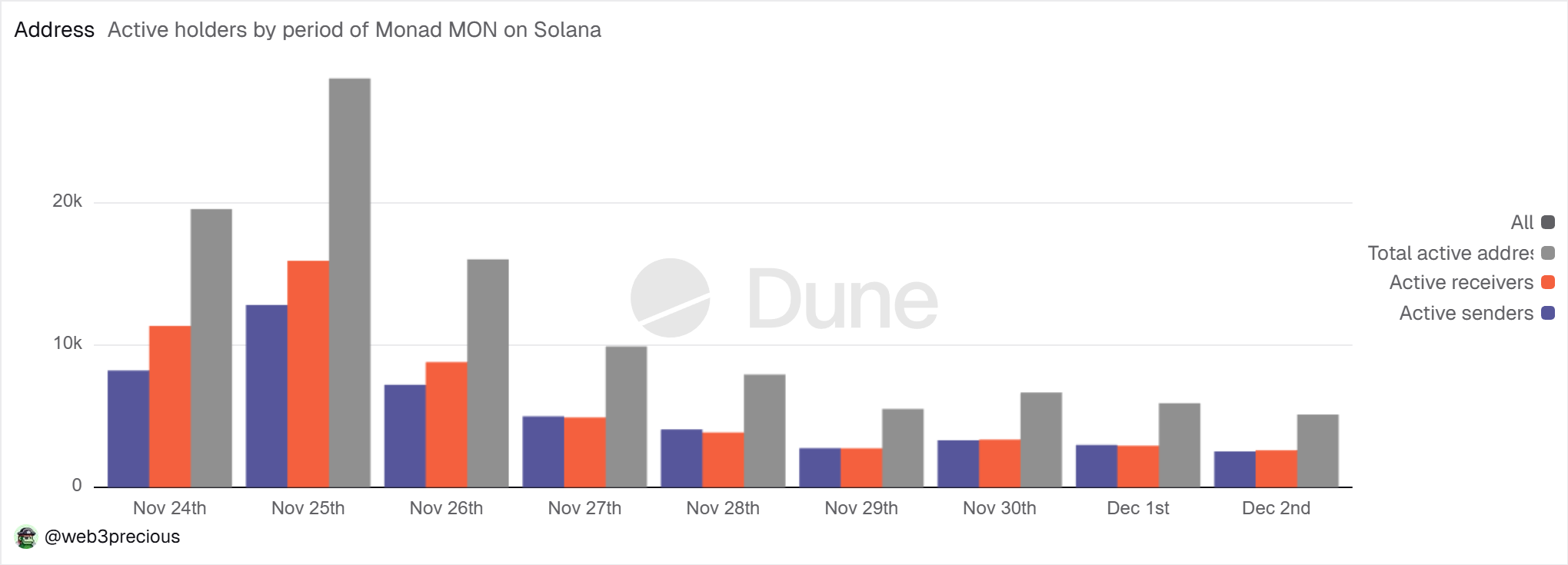

The broader activity on the Monad network also paints a cautious picture. Active addresses have been steadily falling over the past week, with activity nearly flatlining in the last few days. Active addresses represent users interacting with the chain, whether through sending, receiving, or executing transactions.

This drop in activity reflects uncertainty among MONAD holders. As long as market conditions remain unfavorable, user engagement may stay muted, limiting the organic demand needed to support price recovery. A revival in active addresses is essential for regaining momentum.

Monad Active Addresses. Source:

Monad network analytics

Monad Active Addresses. Source:

Monad network analytics

MONAD Price Might See Decline

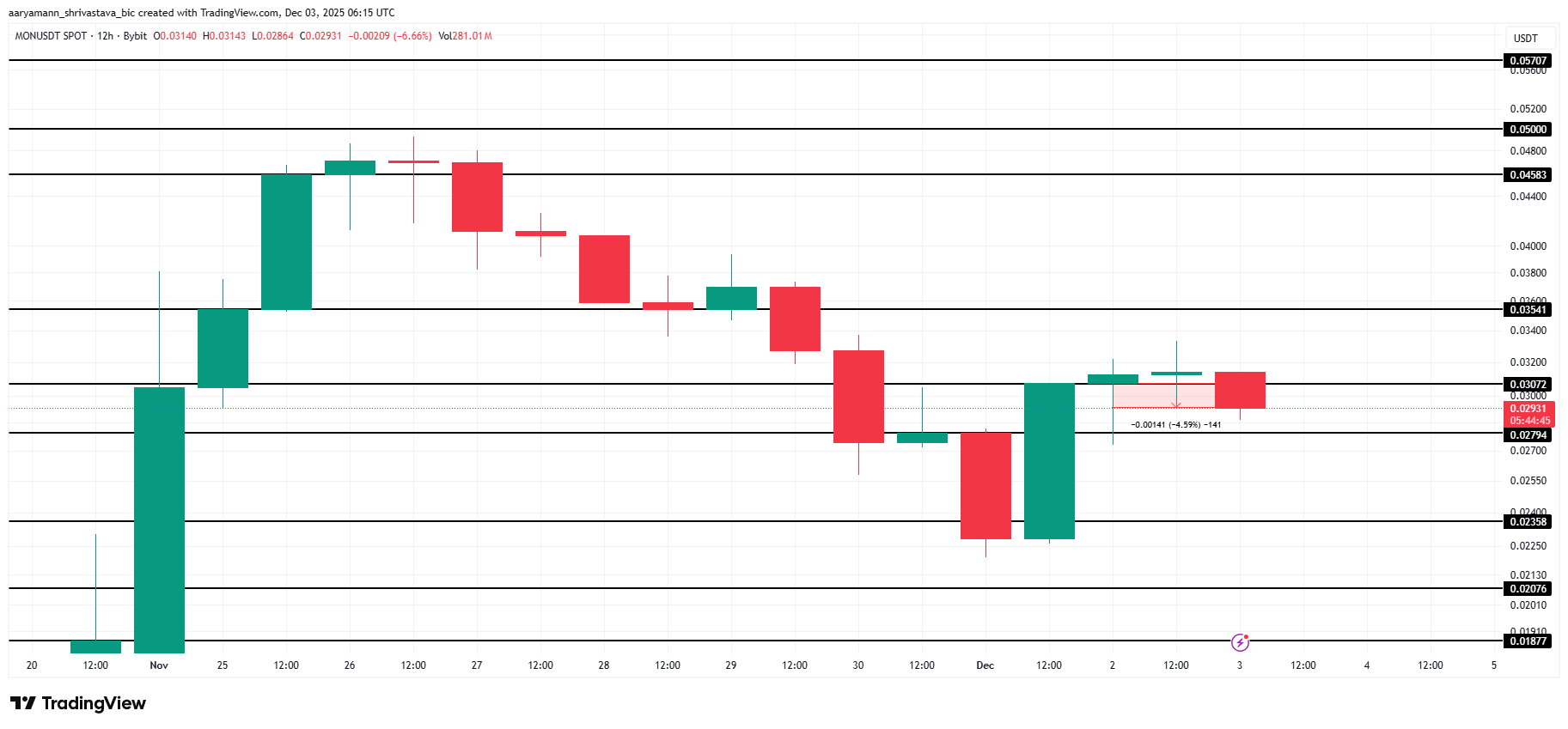

Monad’s price is down 5% in the past 24 hours, trading at $0.029 at the time of writing. The altcoin is attempting to establish short-term support within the $0.027 to $0.030 range as it searches for stability.

However, the pressures highlighted above suggest further downside risk. If whale selling continues and network participation weakens further, MONAD could fall toward the key support at $0.023, deepening losses for holders.

Monad Price Analysis. Source:

Price analytics

Monad Price Analysis. Source:

Price analytics

On the positive side, if bullish momentum returns and whales pause their distribution, MONAD could recover. A bounce from $0.030 would allow the token to target $0.035, with a potential extension to $0.045. A move into this zone would invalidate the bearish outlook and restore investor confidence.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Short the dip and buy the rip? What FOMC outcomes reveal about Bitcoin price action

Bitcoin Leverage Liquidation: Does It Pose a Systemic Threat to Retail Crypto Investors?

- October 2025's Bitcoin crash triggered $19B in leveraged liquidations, exposing crypto derivatives' fragility amid extreme retail leverage and thin liquidity. - High leverage (up to 1,001:1) and perpetual futures dominated by platforms like Hyperliquid amplified volatility, creating self-reinforcing downward spirals. - Behavioral biases (FOMO, overconfidence) and social media echo chambers drove irrational leveraged bets, while regulators paused risky ETFs and warned of systemic risks. - The crisis highl

LUNA up 46.13% in 24 hours as network improvements increase investor optimism

- LUNA surged 46.13% in 24 hours, driven by a pending network upgrade and rising investor confidence. - Futures open interest for LUNC rose to $25.55M, signaling new capital inflows and bullish momentum. - The terrad v3.6.1 upgrade, set for Dec 18, aims to enhance security and resolve legacy contract issues after successful testnet trials. - Technical indicators and analyst projections suggest continued upward momentum, targeting $0.000098 weekly if the 50-week EMA is sustained.

LUNA up 24.4% in 24 hours: Surge Fueled by Upgrades and Increased Inflows

- LUNA surged 24.4% in 24 hours on Dec 10, 2025, driven by rising on-chain activity, capital inflows, and anticipation of a major network upgrade. - The terrad v3.6.1 upgrade, set for Dec 18, aims to resolve legacy contract issues and enhance security, with successful testnet trials and rollback options in place. - Futures open interest rose to $25.55M, while technical indicators suggest continued bullish momentum, targeting $0.000098 resistance if the 50-week EMA is sustained. - Legal proceedings against