Bitcoin traders hit peak unrealized pain as ETFs start to turn positive

Bitcoin may be nearing a make-or-break point as short-term traders sit on the steepest unrealized losses of the current bull cycle.

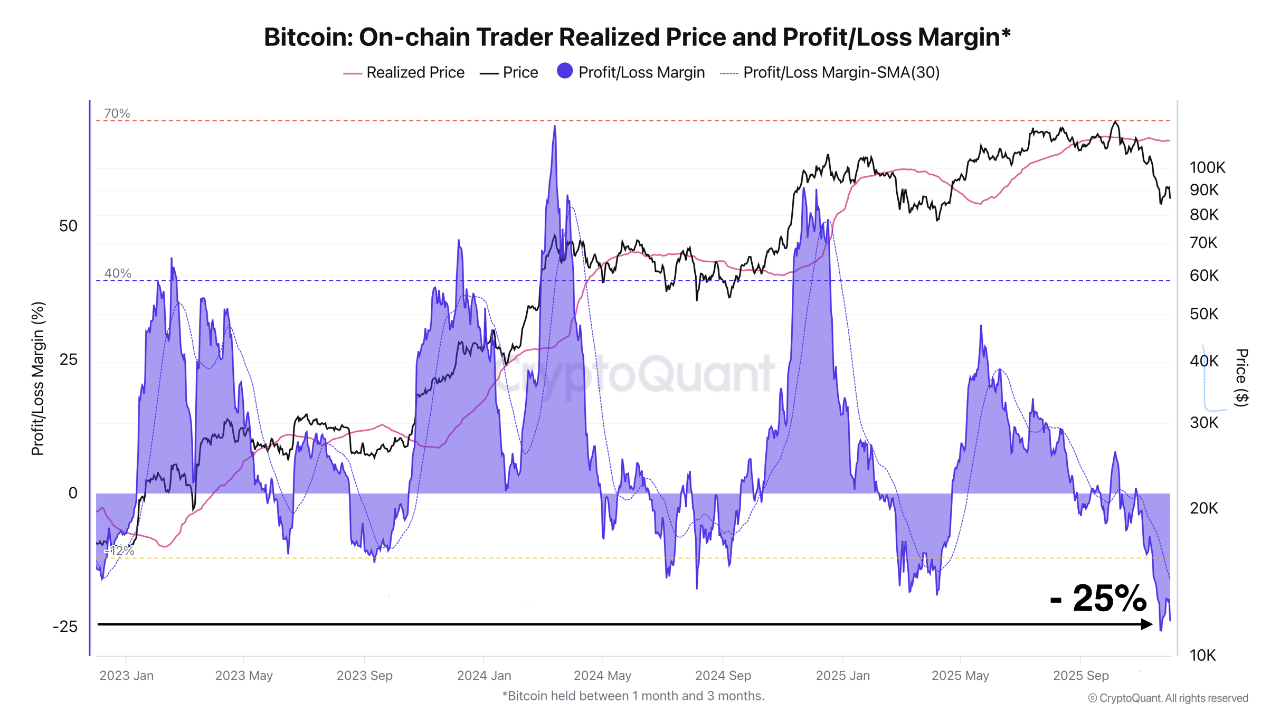

Short-term Bitcoin (BTC) traders who have held BTC between one to three months have been sitting on losses ranging from 20% to 25% for over two weeks, marking the highest pain point of the current market cycle, according to CryptoQuant analyst Darkfrost.

“Once a large portion of them has capitulated, as we have seen in recent weeks, that is usually when the opportunity to accumulate becomes interesting,” he wrote in a Monday note.

This cohort will remain underwater until BTC trades back above its realized price of about $113,692, Darkfrost added.

Some of the largest financial institutions remain optimistic about Bitcoin’s trajectory in 2026, despite the current correction.

On Monday, asset management giant Grayscale said that Bitcoin’s current drawdown points to a local bottom ahead of a recovery in 2026 — a development that will invalidate the four-year cycle theory, according to the company.

Related: Cathie Wood still bullish on $1.5M Bitcoin price target: Finance Redefined

Bitcoin ETF only accounted for up to 3% of selling pressure: ETF analyst

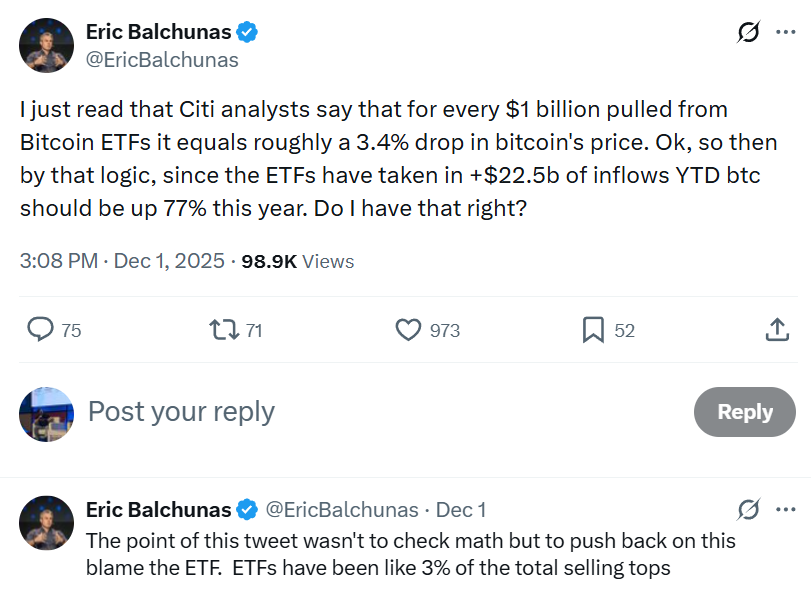

Despite previous concerns about the large-scale sales from spot Bitcoin exchange-traded fund (ETF) holders, these funds were only a fraction of the selling pressure behind Bitcoin’s price decline.

“I just read that Citi analysts say that for every $1 billion pulled from Bitcoin ETFs it equals roughly a 3.4% drop in Bitcoin's price. Ok, so then by that logic, since the ETFs have taken in +$22.5b of inflows YTD BTC should be up 77% this year,” wrote Bloomberg ETF analyst Eric Balchunas, in a Monday X post.

“ETFs have been like 3% of the total selling tops.”

Related: Bank of America backs 1%–4% crypto allocation, opens door to Bitcoin ETFs

Meanwhile, Bitcoin ETFs have started to recover from the $3.48 billion of cumulative outflows recorded during November, marking their second-worst month on record.

The Bitcoin ETFs recorded $58 million worth of net positive inflows on Tuesday, staging their fifth consecutive day of positive inflows, according to Farside Investors data.

Those modest inflows could continue as Bitcoin trades back above the roughly $89,600 flow-weighted cost basis for ETF buyers, meaning the average holder is no longer sitting on paper losses.

Looking at the other US crypto funds, spot Ether (ETH) ETFs saw $9.9 million in outflows on Tuesday, while the Solana (SOL) ETFs recorded $13.5 million of net negative outflows, according to Farside Investors.

Magazine: Mysterious Mr Nakamoto author — Finding Satoshi would hurt Bitcoin

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

U.S. November ADP employment change at -32K, vs. 10K expected and 42K prior.

Hyperliquid (HYPE) Price Fluctuations: Unraveling Blockchain Hazards and Institutional Confidence for 2025

- Hyperliquid (HYPE) dominates 73% of Perp DEX market share in 2025 through $5B TVL, BlackRock/Stripe partnerships, and 11% HLP returns despite security breaches. - Repeated 2025 security incidents ($4.9M POPCAT attack, $21M private key breach) triggered 20%+ price drops and $4B TVL decline amid liquidity flight. - Institutional trust persists as TVL/open interest grew post-March 2025, but circulating supply unlocks and Lighter/Aster competition threaten HYPE's $34 price stability. - Platform's success hin

Strategic Property Investment in the Revitalization of the Former Xerox Campus: Infrastructure-Led Renewal in Webster, NY

- Webster , NY, is transforming its post-Xerox campus via $14.3M in state infrastructure grants for industrial upgrades and public-private partnerships. - Road, sewer, and electrical improvements reduced industrial vacancy to 2%, attracting $650M fairlife® dairy plant and 250 jobs. - Residential values rose 10.1% annually as NEAT corridor targets $1B in development by 2026 with $283M public-private investment. - Strategic infrastructure funding de-risks development, creating a scalable model for post-indus

3 Key Signals That Hint at a Near-Term Shiba Inu Upswing