Bitcoin posted one of the finest recoveries, printing a huge bullish candle and rising by over $5,000 in a day. Following the bullish close, the price sustained gains, hinting at the revival of strong upside action. The BTC price flips the persistent bearish pressure after weeks of uncertainty and renewed selling pressure. With the market sentiments improving and liquidity flowing back into crypto, traders are now eyeing the next big question.

‘Can BTC price finally surge above the long-awaited $100K mark?’

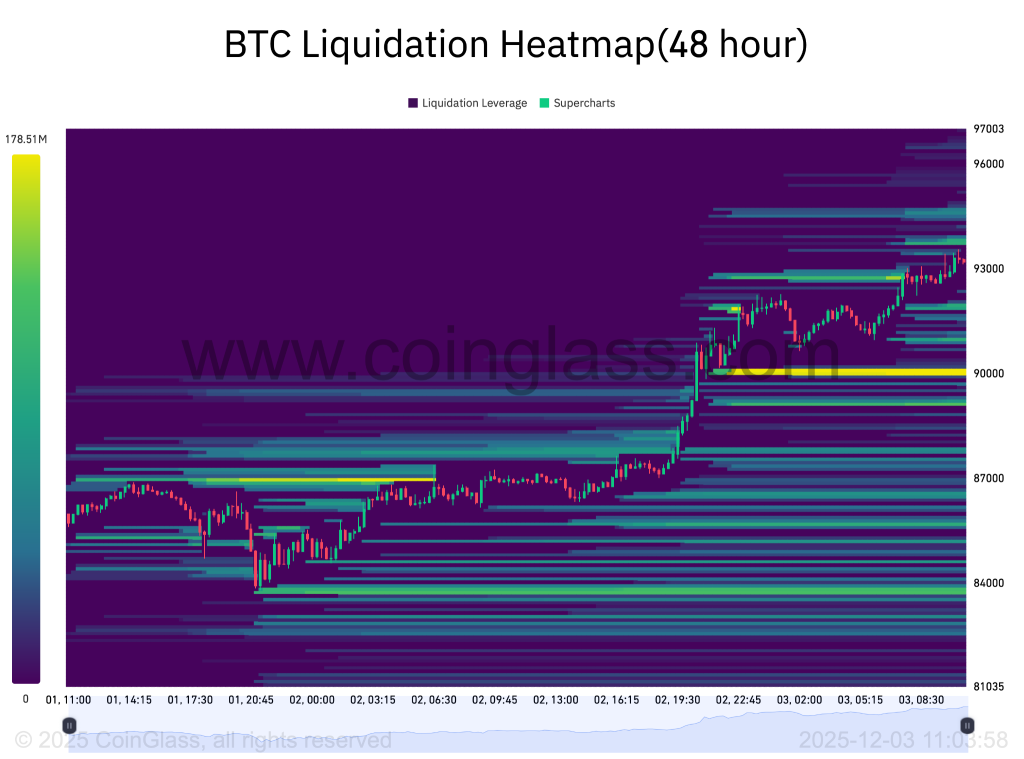

The latest upswing is fueled by over $387 million in short liquidations in the past 24 hours, of which $223 million is for Bitcoin. With this, over $160 billion was added to the market cap, providing strong bullish momentum. Moreover, after clearing almost all the short-term upside liquidity, the BTC price is trying to clear the cluster around $93,000.

The upside liquidity on BTC seems to have cleared the $93,000 cluster level and also risen above the pivotal resistance zone. The buyers are trying hard to absorb the liquidity, but the interesting price range for the Market Makers could be around $90,000. Therefore. There is a strong chance the price revisits this range and consumes nearly $400 million in accumulated liquidity.

The Bitcoin price is surging aggressively, a phenomenon that has not occurred in recent times. On the first day of the US open of the Vanguard lifted the ETF ban, noting IBIT traded over a billion in volume in the first 30 minutes. This indicates either the big money just clocked in or the existing demand was finally allowed to use their preferred platform. With the bullish trajectory to be set in place, here is what to expect from the BTC price is the next few days.

As seen in the above chart, the BTC price has surged above the crucial resistance zone between $91,210 and $92,043 and is trying to secure the range. The RSI is incremental after rebounding from the lows after rising from the oversold zone. On the other hand, the Bollinger bands have begun to squeeze, hinting towards the token preparing for a massive price action in a short while.

Previously, this squeeze has resulted in a bearish action, but now that the technicals are bullish, an ascending trend may continue to help the price break the descending trend line and head to higher targets.

As the markets are heading towards the last phase of trade this year, the volatility seems to be on the rise. With this, there is a strong chance that the Bitcoin (BTC) price may maintain a strong ascending trend but is required to rise above a certain range. A popular analyst, ALI , suggests the next 2 resistances, one at $99,070 and $122,060 based on the pricing bands, need to be cleared for the token to mark new highs.

Therefore, it would be interesting to watch how the trade unfolds in the coming days with the year-end trade volatility that has struck the BTC price & crypto markets.