How Will the 2026 Federal Reserve Affect the Crypto Space?

To transition from the Powell era's technocratic caution to a more explicit policy framework aimed at reducing borrowing costs and advancing the President's economic agenda.

Original Article Title: 2026: The Year of the Fed's Regime Change

Original Article Author: @krugermacro

Translation: Peggy, BlockBeats

Editor's Note: In 2026, the Federal Reserve may experience a true "regime change." If Hassett becomes the chair, monetary policy may shift from the Powell era's cautious approach to a more aggressive rate-cutting path and a "growth-first" framework. Short-term rates, long-term expectations, and cross-asset pricing will all be forced to reassess. This article outlines the key logic and market impact of this potential turning point. Next year's trading theme is not just about rate cuts but about a whole new Fed.

Below is the original text:

The Federal Reserve as we know it will come to an end in 2026.

The most important driver of asset returns next year will be the "New Fed" – more specifically, the policy paradigm shift brought about by a newly appointed chair by Trump.

Kevin Hassett has become the most likely candidate for Fed chair that Trump is likely to nominate (as of December 2, the Kalshi prediction market gives a 70% probability). Hassett is the current Director of the National Economic Council, a supply-side economist, and a long-time loyal supporter of Trump. He advocates for the idea of "growth first," believing that since the war against inflation has largely been won, maintaining high real interest rates is no longer economically rational but a politically stubborn stance. If he takes office, this will signify a decisive regime change: the Fed will shift from Powell's era of technocratic caution to a policy framework more explicitly aimed at lowering borrowing costs and advancing the president's economic agenda.

To understand the policy regime he will establish, one can look directly at his public statements this year on rates and the Fed:

"If the Fed doesn't cut rates in December, the only explanation is anti-Trump partisan bias." (November 21)

"If I were on the FOMC, I would be more likely to vote for a rate cut, while Powell would be less likely." (November 12)

"I agree with Trump: rates can be significantly lowered." (November 12)

"The expected three rate cuts are just the beginning." (October 17)

"I hope the Fed continues to aggressively cut rates." (October 2)

“The Fed's direction of interest rate cuts is correct, rates should be lower.” (September 18)

“Powell and Trump's views on rates are correct.” (June 23)

If the stance is mapped on a 1–10 scale from Dovish to Hawkish (1 = most Dovish, 10 = most Hawkish), Hassett is probably around 2.

If nominated, Hassett will take over Milan's position as a Fed Governor in January, as Milan's short term is due to end. Then in May, as Powell's term is up, he will be promoted to Chair; with Powell expected to resign his Governor seat after announcing his intent, creating a vacancy for Trump to nominate Warsh.

While Warsh is currently Hassett's main competitor for the Chair, this text assumes he will ultimately be assimilated into the system, acting as part of the reformist force. As a former Fed Governor, Warsh has been publicly “campaigning” for a platform of structural reform, explicitly calling for a reconstruction of a “new Treasury–Fed accord” and criticizing the current Fed leadership for “surrendering to the tyranny of the status quo.” Crucially, Warsh believes the current AI-driven productivity boom is inherently deflationary, implying that the Fed is making a policy error in maintaining a tightening stance.

New Power Equilibrium

In this architecture, the Trump version of the Fed will form a dominant dovish core team, with a viable path to securing votes on most easing issues. However, this is not a done deal, as consensus will still need to be reached, and the degree of dovishness is also uncertain.

➤ Dovish Core (4 individuals):

Hassett (Chair), Warsh (Governor), Waller (Governor), Bowman (Governor)

➤ Contestables (6 individuals):

Cook (Governor), Barr (Governor), Jefferson (Governor), Kashkari (Minneapolis), Williams (New York), A. Paulson (Philadelphia)

➤ Hawkish (2 individuals):

Hammack (Cleveland), Logan (Dallas)

However, if Powell chooses not to resign his Governor seat (though historically, it is highly unlikely—a departing Chair almost always resigns, e.g., Yellen resigned 18 days after Powell was nominated), that would be an extremely bearish scenario. Because this would not only block Warsh's vacancy, but also make Powell a “shadow Chair,” exerting stronger attraction and influence over the FOMC members outside the dovish core.

Timeline: Four Stages of Market Reaction

Based on all of the above factors, the market's reaction will generally go through four distinct stages:

1. (December / January of the following year) Immediate optimism after Haslett's nomination. In the weeks following confirmation, risk assets will welcome a new chair who is seen as decisive, dovish, and loyal.

2. If Powell does not announce his resignation within three weeks, a growing sense of unease will set in. Each day of delay will reactivate the tail risk of "what if he doesn't resign?"

3. When Powell announces his resignation, the market will see a wave of euphoria.

4. As the June 2026 FOMC meeting, chaired by Haslett for the first time, approaches, market sentiment will tense up again.

Investors will be highly attuned to all public remarks from FOMC members (who will speak frequently, providing clues to their thought processes and leanings).

Risk: A Divided Committee

In a scenario where the Chair's supposed "swing vote" (which doesn't actually exist) is not present, Haslett must win debates within the FOMC to secure a majority.

If every 50bp rate cut decision is only passed by a slim 7–5 margin, this will be erosive for institutions: signaling to the market that the Chair is more of a political proxy than an independent economist.

A more extreme scenario would be: a tie at 6–6, or a 4–8 vote against rate cuts

That would be catastrophic.

The specific voting details will be released in the FOMC meeting minutes three weeks after each meeting, making the minutes release a significant market-moving event.

As for what happens after the initial meeting, that remains a huge unknown.

My basic assessment is that with a stable support of 4 votes and a credible path to garnering 10 votes, Haslett will be able to shape a dovish consensus and advance his agenda.

Implication: The market cannot fully front-run the new Fed's dovish tilt.

Interest Rate Repricing

The "dot plot" is an illusion.

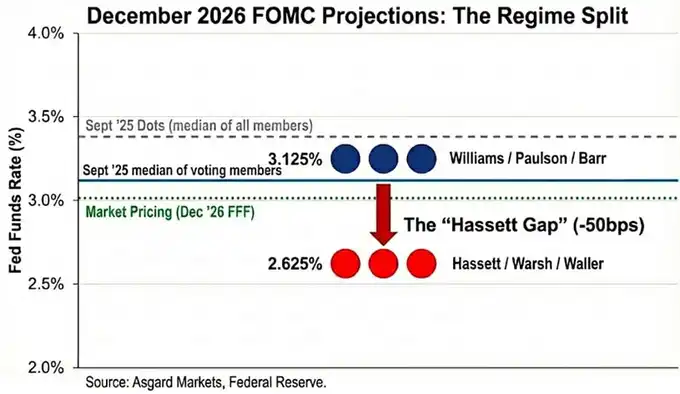

While the median forecast for the December 2026 interest rate released in September is 3.4%, this number represents the median of all participants (including non-voting hawkish members).

Based on attribution analysis of public remarks, I estimate that the true median of the voting members is significantly lower at 3.1%.

When replacing Powell and Milan with Hassett and Warsh, the picture changes further.

With Milan and Waller serving as proxies for a "dovish rate-cutting bias" new regime, the 2026 voting distribution still exhibits a bimodal shape, but both peaks are lower:

Williams / Paulson / Barr → 3.1%

Hassett / Warsh / Waller → 2.6%

I anchor the new leadership's target at 2.6% to align with Milan's official forecast; however, it is worth noting that Milan has publicly stated that the "neutral rate" should be between 2.0% and 2.5%, implying that the new regime's preference may be more dovish than indicated by the "dot plot".

The market has already begun to reflect this change, with the current (as of December 2nd) pricing for the December 2026 interest rate at 3.02%, but it has not fully priced in the upcoming regime shift. If Hassett successfully pushes the committee to further lower rates, the short end of the yield curve still has approximately 40 basis points of downside.

Furthermore, if Hassett's assessment of "Supply-Side Disinflation" is correct, inflation will decline faster than market consensus, forcing the Fed to cut rates further to avoid "passive tightening" due to rising real rates.

Cross-Asset Implications

While the market's initial reaction to Hassett's nomination should be "risk-on," a more precise characterization of this institutional transition is Reflationary Steepening:

Short end: Betting on aggressive rate cuts

Duration Play: Reflecting Higher Nominal Growth (and Inflation Risk)

1. Rates

Hasset's aim is to marry a “recessionary aggressive rate cut” with “3%+ boom-time growth.”

If this policy bears fruit: the 2-year yield will collapse to front-run the cuts; the 10-year yield could stay higher due to structural growth and higher inflation risk premium.

In simple words: front-end collapse, back-end resilience, and a steepening yield curve.

2. Equities

In Hasset's view, the current policy stance is suppressing AI-driven productivity booms.

Once in office: he would push down real discount rates, prompting growth stocks into a melt-up rally driven by valuation expansion.

The biggest risk is not a recession but a spike in the long end yields, possibly triggering a bond market “rebellion.”

3. Gold

When the Fed is politically in sync with the government and explicitly prioritizes growth over inflation targets, it is the classic bull case for hard assets.

Therefore: gold should outperform treasuries as markets hedge for a replay of the ‘70s-style “over-easing, policy error” in the new regime.

4. Bitcoin

Under normal circumstances, Bitcoin would be the purest expression of this “Regime Change” trade.

However, post the October 10 event, Bitcoin has exhibited: a clear downside skew; lackluster rallies in macro bullish times; cataclysmic drops in bearish times; fear of “four-year cycle tops”; a narrative identity crisis.

I believe that by 2026, Hasset’s monetary policy alongside Trump’s deregulatory agenda will be potent enough to override this self-reinforcing pessimism.

Tech Note: About Tealbook (Fed Internal Forecasts)

Tealbook is the official economic forecasting of the Fed research department and forms the statistical baseline for FOMC debates.

It is overseen by the Division of Research & Statistics, which has over 400 economists and is led by Director Tevlin.

Like most team members, Tevlin is a Keynesian, and the Fed's core model, FRB/US, is explicitly New Keynesian.

Hasset could appoint a supply-side economist to lead the division through a Board vote.

Replacing Keynesian modelers who "think growth will bring inflation" with supply-siders who "think AI prosperity will bring deflationary pressure" would significantly change forecasts.

For example, if the model predicts inflation will drop from 2.5% to 1.8% due to productivity gains,

those FOMC members who were not originally as dovish would also be more inclined to support aggressive rate cuts.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

AAVE Climbs 1.1% Amid Whale Movements and Anticipation for V4 Update

- A major whale transferred $59.34M to Aave V3 from Kraken, boosting AAVE token holdings to 310,617 and signaling confidence in decentralized liquidity. - Aave partners with Babylon to enable native BTC-backed lending via trustless vaults in 2026, aiming to unlock deeper Bitcoin liquidity in DeFi without custodial intermediaries. - Aave DAO is streamlining multi-chain strategy by phasing out zkSync/Metis deployments, prioritizing chains with $2M+ annual revenue to enhance financial sustainability. - AAVE t

Uber and Avride introduce autonomous taxi service in Dallas