Zcash (ZEC) Price Loses A Chunk of Its 1,442% Rise, Was It A Bubble?

Zcash is facing one of its harshest corrections of the year as the altcoin’s price continues to slide, erasing a major portion of its October surge. The sharp drop has raised an important question among investors: was the recent “privacy tokens” hype an unsustainable bubble, or is there still long-term value behind ZEC’s fundamentals? Zcash

Zcash is facing one of its harshest corrections of the year as the altcoin’s price continues to slide, erasing a major portion of its October surge.

The sharp drop has raised an important question among investors: was the recent “privacy tokens” hype an unsustainable bubble, or is there still long-term value behind ZEC’s fundamentals?

Zcash Suffers Losses

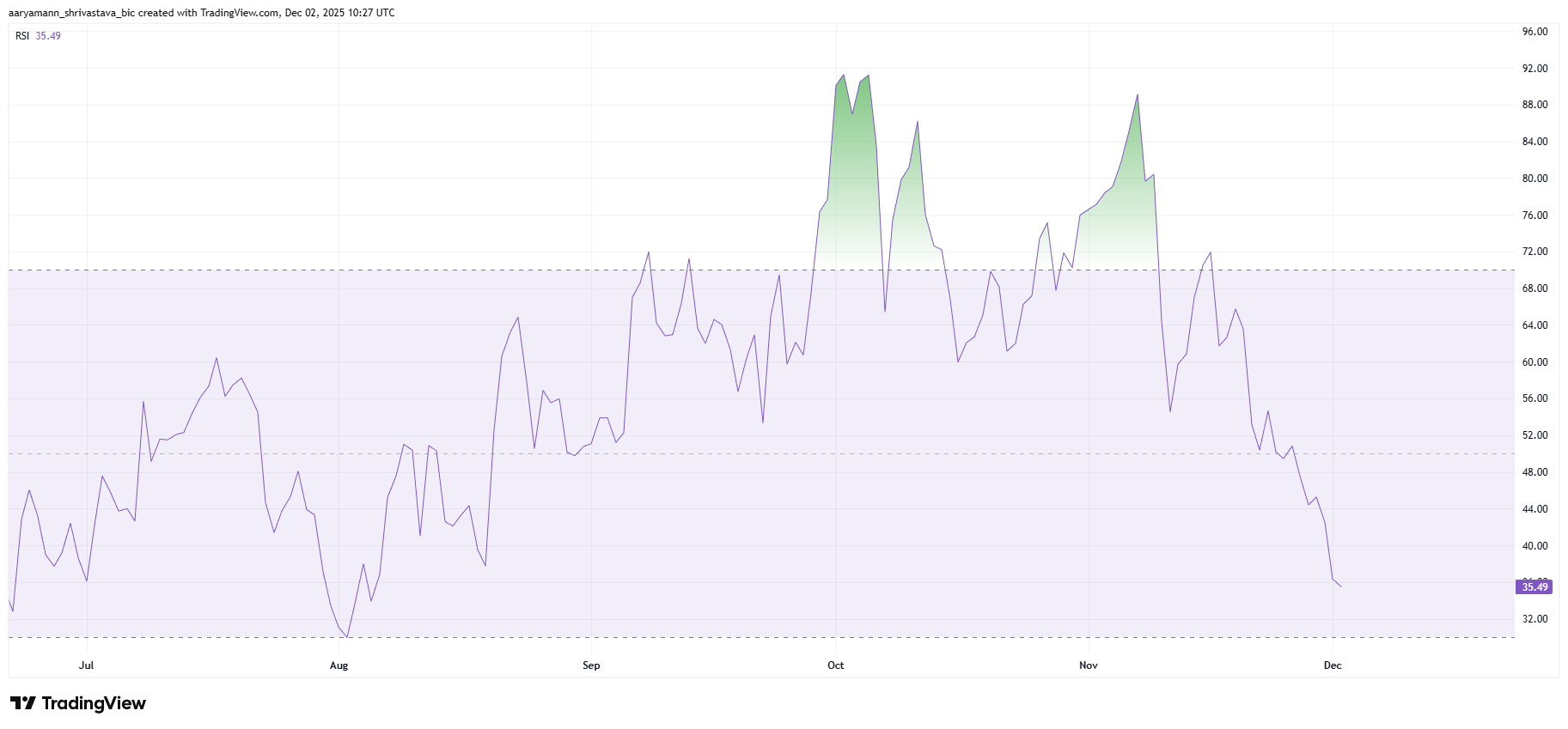

The Relative Strength Index (RSI) reflects the heavy bearish pressure surrounding Zcash. The indicator has slipped below the neutral 50.0 mark into negative territory, a sign that sellers are firmly in control.

This downward shift is often associated with weakening recovery potential, especially when momentum continues to build on the bearish side. For ZEC to show any meaningful reversal signal, the RSI would need to hit oversold conditions, where a bounce becomes statistically more likely.

However, ZEC has not yet reached that stage, leaving its trajectory vulnerable to further downside. The lack of clear reversal signals highlights the current uncertainty, suggesting that buyers remain hesitant to re-enter despite the steep discount from recent highs.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

ZEC RSI. Source:

ZEC RSI. Source:

ZEC RSI. Source:

ZEC RSI. Source:

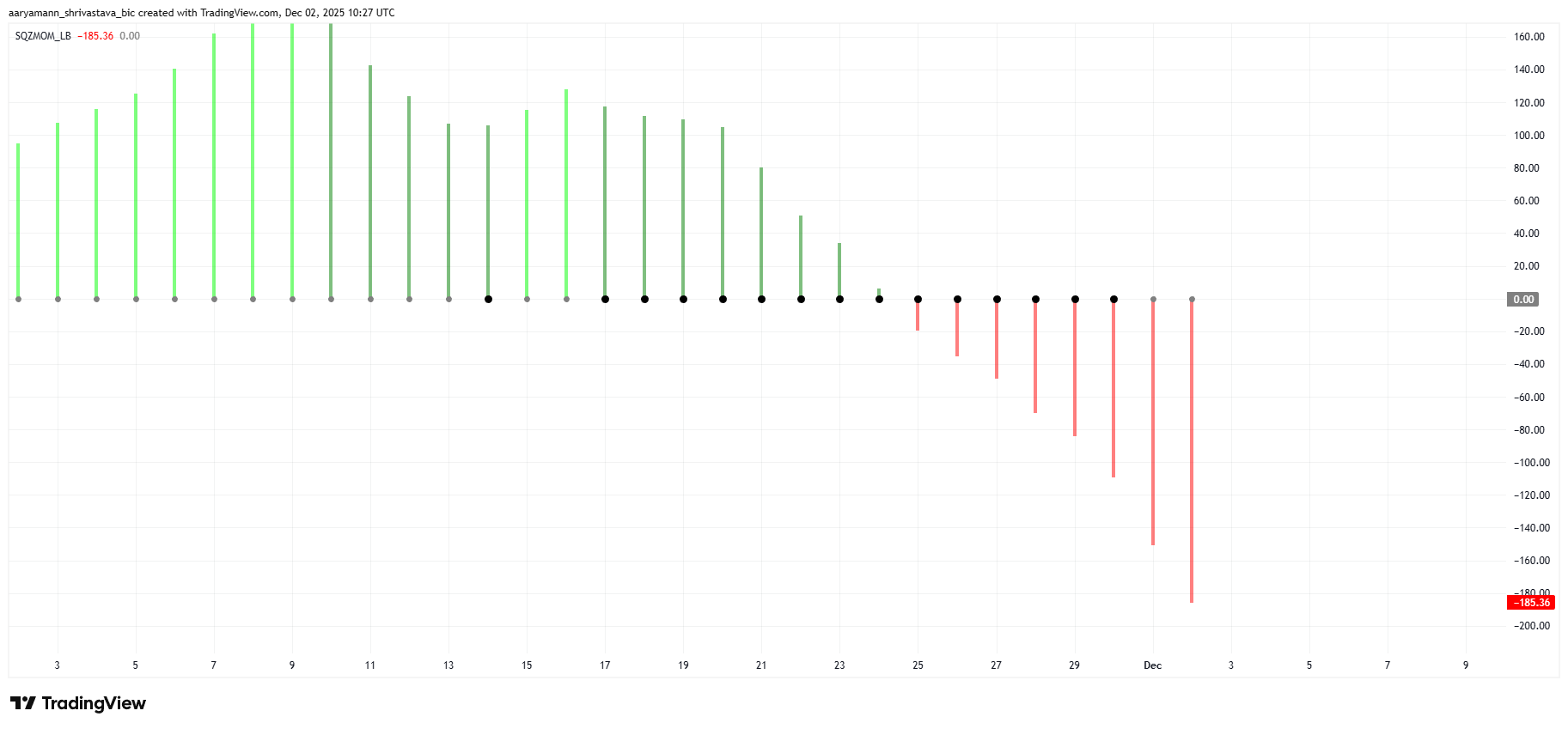

The Squeeze Momentum Indicator adds another layer of concern. Earlier this month, the indicator showed a buildup of compression, typically a prelude to major volatility. That squeeze has now released to the downside, aligning with a strong wave of bearish momentum. When a squeeze release happens during a downtrend, it often accelerates losses rather than stabilizing price action.

This shift confirms that bearish forces are present and also intensifying. Combined with the market-wide cooling of the privacy-coin narrative, the indicator suggests more volatility and downward pressure may lie ahead for Zcash.

ZEC Squeeze Momentum Indicator. Source:

ZEC Squeeze Momentum Indicator. Source:

ZEC Squeeze Momentum Indicator. Source:

ZEC Squeeze Momentum Indicator. Source:

ZEC Price May See Further Declines

ZEC previously posted a massive 1,442% rally during the peak of the privacy-token narrative. That momentum faded at the start of November, and the altcoin has since crashed 56% from its highs.

A staggering 43% of that loss occurred in just the last week, pushing ZEC down to $323. If this trend continues, Zcash is likely to break below the $300 support level and fall toward $260, or even $204, erasing more of its earlier gains.

ZEC Price Analysis. Source:

ZEC Price Analysis. Source:

ZEC Price Analysis. Source:

ZEC Price Analysis. Source:

However, Arthur Hayes believes crypto markets follow distinct yearly narratives. According to him, 2025 revolved around AI-linked tokens and the rapid expansion of stablecoins, but 2026 will center on privacy. He says this pivot could spark renewed interest in privacy-driven cryptocurrencies and the underlying tech that supports them.

Thus, if buyers return at these discounted levels, ZEC could attempt a bounce from the $344 area. A recovery toward $442 and eventually $520 would be needed to invalidate the current bearish outlook.

Read the article at BeInCryptoDisclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Hyperliquid's Growing Popularity and Trading Volume: Evaluating Its Potential as a Lasting DeFi Investment

- Hyperliquid dominates 2025 DeFi perpetuals with $2.74T volume, rivaling Coinbase via HyperBFT's 200k TPS and sub-second finality. - Market share dropped from 73% to 38% as competitors like Aster emerged, though Hyperliquid maintains 62-63% Perp DEX open interest. - Governance innovations (HIP-1/3) enable permissionless listings while 93% fee buybacks and $5B TVL boost HYPE token value. - Regulatory risks and $4.9M security loss highlight vulnerabilities despite BlackRock/Stripe partnerships and SEC ETF a

PENGU Token's Latest Price Rally and Technical Evaluation

- PENGU token surged past $0.0100 in late 2025, driven by Bitcoin rebound, whale accumulation, and Pudgy Penguins' project developments. - Technical analysis shows overbought RSI (73.76) and key support/resistance levels at $0.012-$0.0135, signaling potential volatility. - Market psychology blends speculative FOMO with strategic utility growth through "Pudgy Party" and NHL partnerships, though macro risks like Fed policy remain critical. - Analysts caution investors to balance short-term momentum with long

The PENGU USDT Sell Indicator and What It Means for the Stability of Stablecoins

- The 2025 PENGU USDT sell signal exposed algorithmic stablecoins' fragility, triggering systemic risks through reflexivity and eroded trust. - The U.S. GENIUS Act excludes algorithmic stablecoins from regulatory frameworks, pushing them into a legal gray area with limited consumer protections. - Technical flaws like smart contract vulnerabilities and oracle dependencies exacerbate instability, compounding market confidence erosion during crises. - Investors now prioritize fiat-backed stablecoins, CBDCs, a

Bitcoin Experiences Sharp Decline: Essential Information for Investors

- Bitcoin's 2025 slump, driven by U.S. tariffs on Chinese rare earths, Fed rate hikes, and China's crypto ban, triggered a 20% price drop to below $100,000. - The Fed's 75-basis-point hike exacerbated the selloff, with Bitcoin falling 18%—outpacing the S&P 500's 12% decline. - China's 2025 crypto ban erased 5% of Bitcoin's value, reinforcing global crackdowns after its 2021 ban caused a 40% drop. - Analysts note Bitcoin's $83,000–$95,000 trading range reflects a correction within a broader bull cycle, not