XRP Price Sits 3% From Breakdown, but A Rare On-Chain Hope Appears

XRP has been one of the weakest large-cap movers this week. The XRP price dropped about 1.1% since yesterday and is now down almost 11% over the last 7 days. The move comes as the chart shows a heavy breakdown structure, but one rare on-chain signal has flipped and now stands between XRP and a

XRP has been one of the weakest large-cap movers this week. The XRP price dropped about 1.1% since yesterday and is now down almost 11% over the last 7 days. The move comes as the chart shows a heavy breakdown structure, but one rare on-chain signal has flipped and now stands between XRP and a deeper fall.

This mix keeps both sides open as XRP trades near a major decision point.

Breakdown Structure Tightens as Critical Support Zone Surfaces

XRP continues to move under a descending trend line. This trend line has formed the upper boundary of a broad triangle-type structure, with the $1.94 level acting as the base. This is a typical bearish pattern.

If the price falls under $1.94, it would break through the base of this descending structure and confirm another downside extension. XRP is only about 3% away from testing that zone.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter.

XRP’s Bearish Structure:

TradingView

XRP’s Bearish Structure:

TradingView

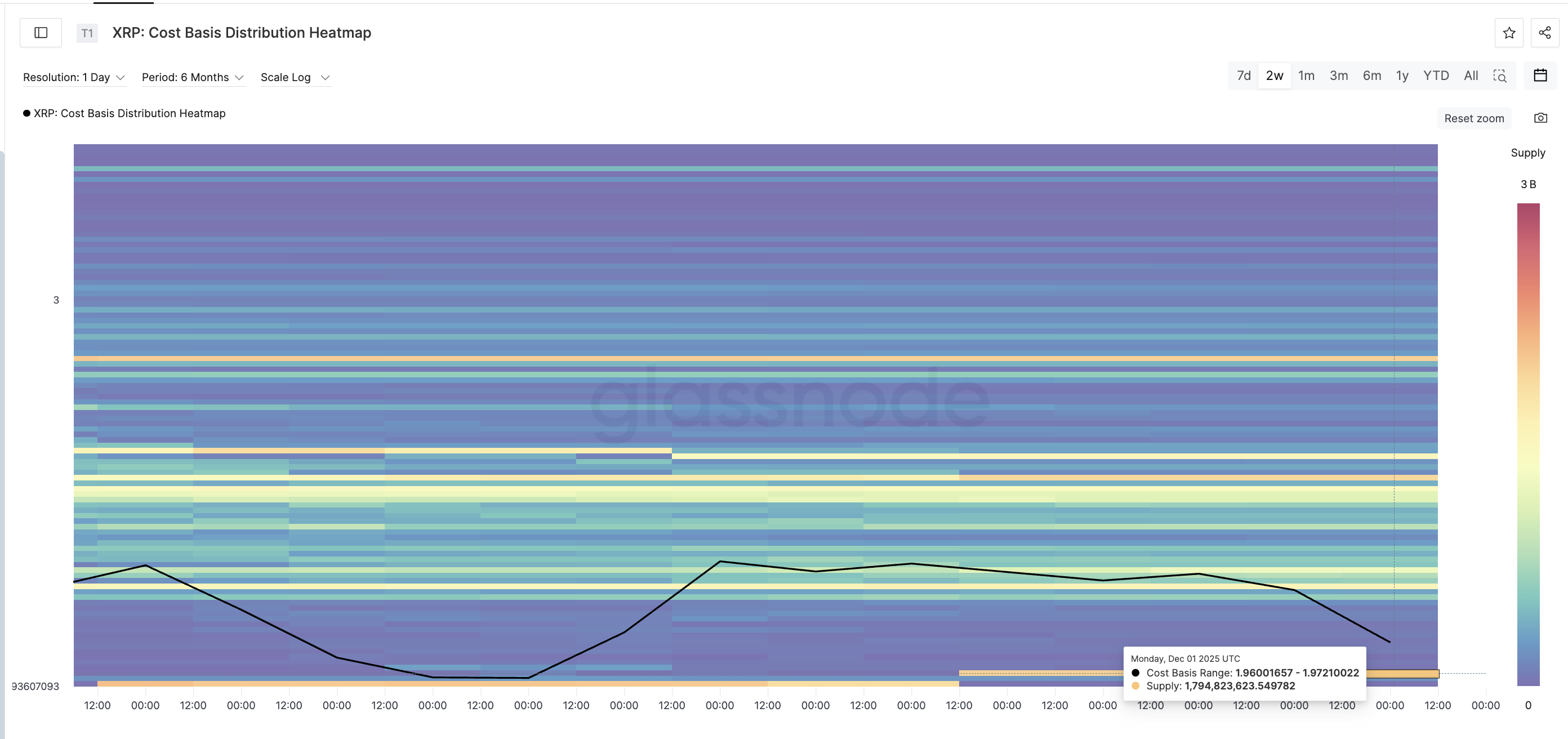

The cost-basis heatmap reinforces this level.

A cost-basis heatmap shows where most tokens were originally bought. These areas act like strong support or resistance.

Right now, the strongest cluster sits between $1.96 and $1.97. Around 1.79 billion XRP sit in this range. If XRP falls below $1.96, especially $1.94, the entire cluster gets forced underwater, and the price can fall much faster toward the next major zone, highlighted later in the piece.

This is the cleanest technical and on-chain overlap on the chart.

Key Support Cluster:

Glassnode

Key Support Cluster:

Glassnode

Holder Net Position Change Flips Green — A Rare Shift After 29 Days

One sudden and rare on-chain shift has now appeared.

The Holder Net Position Change tracks how long-term wallets add or remove tokens. Red bars mean they are sending tokens out (distribution). Green bars mean they are accumulating. For 29 straight days, this metric was red. XRP long-term holders were exiting every day.

On December 1, it flipped green for the first time in a month.

The metric moved from –83.9 million XRP on November 30 to +42.05 million XRP, which is roughly a 150% swing from net outflows to net inflows.

XRP Holders Finally Start Buying:

Glassnode

XRP Holders Finally Start Buying:

Glassnode

This is the first clear sign that long-term investors are testing the support zone and could be preparing for a rebound attempt. That’s the rare hope we mentioned earlier.

XRP Price Levels: What Happens Next Depends on $1.94

As mentioned, the XRP continues to move under a descending trend line. This trend line forms the upper boundary of the triangle, with Fibonacci levels acting as the base. The price has already broken through several levels. The first critical breakdown came under the 0.5 Fibonacci line near $2.19, followed by another under $2.10. The next key floors sit between $1.99 and $1.94.

A close below $1.94 confirms the breakdown. That would open the path toward $1.81, which is the next major support zone.

XRP Price Analysis:

TradingView

XRP Price Analysis:

TradingView

If the long-term holders continue adding and the $1.94–$1.97 cluster holds, XRP could attempt a rebound.

The first recovery barrier sits at $1.99. The XRP price needs to hold above it to avoid a deeper correction.

A stronger rebound forms only if XRP can break above $2.28, which is where it would flip above the descending trend line and neutralize the constant sell pressure.

The XRP price is now pinned between its strongest near-term support and the trendline that provides resistance. Whether the new long-term accumulation is enough to stop a fresh breakdown will decide the next move.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Short the dip and buy the rip? What FOMC outcomes reveal about Bitcoin price action

Bitcoin Leverage Liquidation: Does It Pose a Systemic Threat to Retail Crypto Investors?

- October 2025's Bitcoin crash triggered $19B in leveraged liquidations, exposing crypto derivatives' fragility amid extreme retail leverage and thin liquidity. - High leverage (up to 1,001:1) and perpetual futures dominated by platforms like Hyperliquid amplified volatility, creating self-reinforcing downward spirals. - Behavioral biases (FOMO, overconfidence) and social media echo chambers drove irrational leveraged bets, while regulators paused risky ETFs and warned of systemic risks. - The crisis highl

LUNA up 46.13% in 24 hours as network improvements increase investor optimism

- LUNA surged 46.13% in 24 hours, driven by a pending network upgrade and rising investor confidence. - Futures open interest for LUNC rose to $25.55M, signaling new capital inflows and bullish momentum. - The terrad v3.6.1 upgrade, set for Dec 18, aims to enhance security and resolve legacy contract issues after successful testnet trials. - Technical indicators and analyst projections suggest continued upward momentum, targeting $0.000098 weekly if the 50-week EMA is sustained.

LUNA up 24.4% in 24 hours: Surge Fueled by Upgrades and Increased Inflows

- LUNA surged 24.4% in 24 hours on Dec 10, 2025, driven by rising on-chain activity, capital inflows, and anticipation of a major network upgrade. - The terrad v3.6.1 upgrade, set for Dec 18, aims to resolve legacy contract issues and enhance security, with successful testnet trials and rollback options in place. - Futures open interest rose to $25.55M, while technical indicators suggest continued bullish momentum, targeting $0.000098 resistance if the 50-week EMA is sustained. - Legal proceedings against