Bitcoin Price Trapped In ‘Indecision’ Zone As Downside Break Becomes More Likely

Bitcoin has traded almost flat this week. It is up about 1% in the last 24 hours but still down nearly 21% over the past 30 days. Over the past 7 days, the Bitcoin price has barely moved at all. This tight behavior reflects a clear range: Bitcoin has been stuck inside the same 6%

Bitcoin has traded almost flat this week. It is up about 1% in the last 24 hours but still down nearly 21% over the past 30 days. Over the past 7 days, the Bitcoin price has barely moved at all. This tight behavior reflects a clear range: Bitcoin has been stuck inside the same 6% zone while buyers and sellers continue to cancel each other out.

Under the surface, the balance looks fragile. And the combination of technicals and on-chain metrics keeps the downside risk open unless conditions shift very quickly.

Triangle Range Holds, But Bitcoin Sits Near The Breakdown Line

The Bitcoin price has been moving inside a broad triangle on the 12-hour chart. The upper trend line rejected all breakout attempts on November 28 and November 30. A breakdown attempt also showed up briefly on December 1, but buyers managed to recover before the candle closed.

Now the price sits very close to the rising lower trend line, which aligns almost perfectly with the $85,664 support. From the current zone around $86,949, Bitcoin needs only a 1.5% drop to break the structure. In comparison, a breakout requires a 5% move toward $91,637, which makes the upside path much harder in the short term.

BTC Price In 6% Range:

BTC Price In 6% Range:

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter.

Money-flow adds more context.

Chaikin Money Flow (CMF), which tracks whether big money is flowing in or out, has been climbing since November 21. It is still forming higher lows and remains above zero. This is the main reason the Bitcoin price has not broken down yet. This could reflect ETF inflows or large-wallet buying.

But CMF is also sitting close to its own rising trend line. If it slips under that line or falls back below zero, the breakdown risk increases sharply.

CMF Flow Needs To Hold:

CMF Flow Needs To Hold:

Until then, Bitcoin continues to bounce between $85,664 and $91,637, the boundaries of its 6% indecision zone.

Short-Term Buyers And Long-Term Sellers Create A Delicate Tug-Of-War

On-chain data also explains why the Bitcoin price remains stuck.

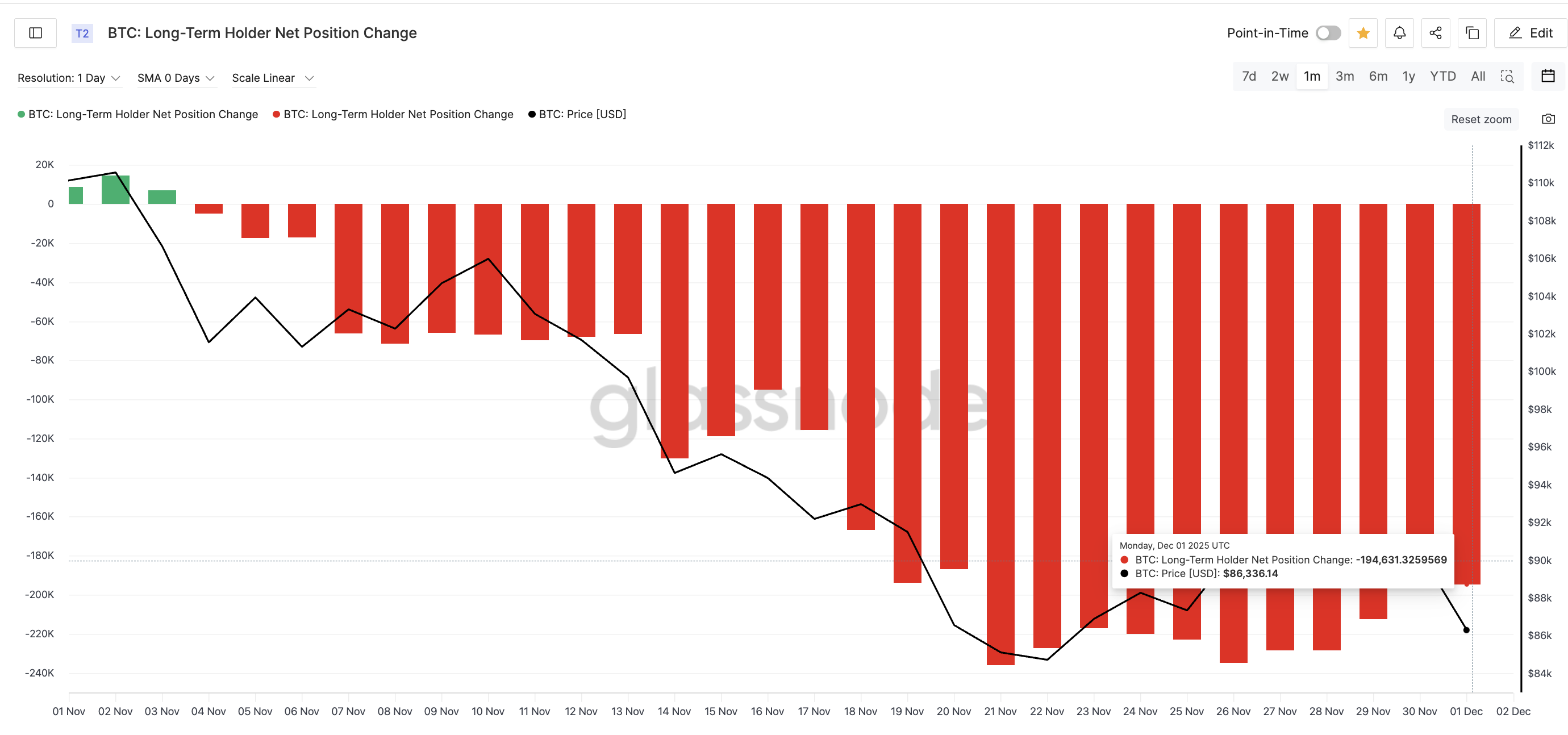

Long-term holders continue to sell. The Long-Term Holder Net Position Change stayed red all month and has worsened since early November. On November 4, net outflows sat near 48,620 BTC. By December 1, the value had climbed to roughly 194,600 BTC, more than 300% higher than the earlier reading. This means conviction-based holders are still reducing exposure.

Long-Term Holders Keep Selling:

Long-Term Holders Keep Selling:

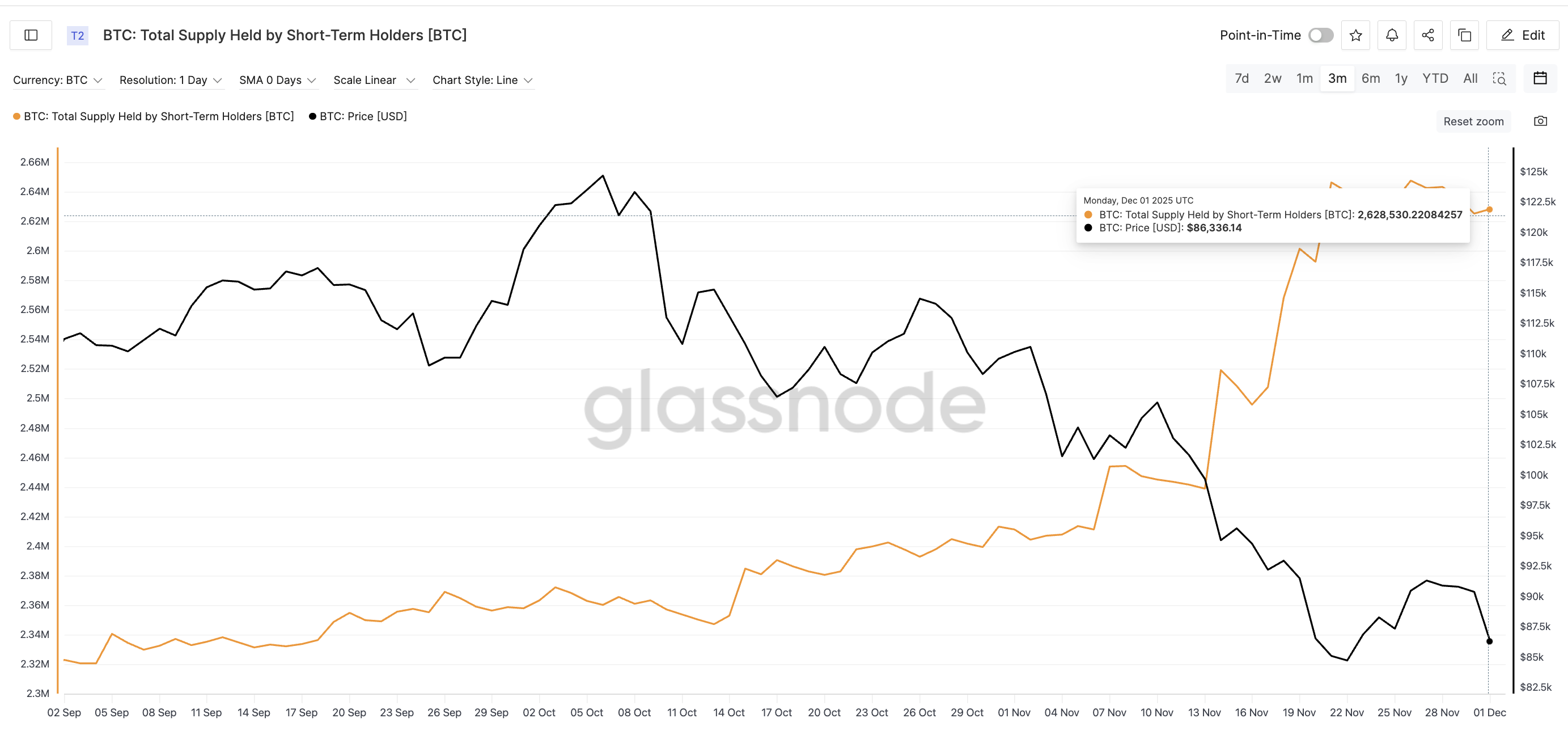

Short-term holders, however, keep adding.

The Total Supply Held by Short-Term Holders has risen to about 2.63 million BTC, sitting less than 1% below its three-month high. Sounds bullish, right? Well, not exactly.

Short-Term Holders Keep Adding:

Short-Term Holders Keep Adding:

This group is made up of speculative traders. They can exit very quickly, which often amplifies downside moves.

So the tug-of-war looks like this: Long-term holders are selling (bearish). Short-term holders are buying (strong but speculative). And, CMF rising (supporting the range but close to invalidation).

This keeps Bitcoin locked between both sides instead of trending strongly.

Key Bitcoin Price Levels: A Small Drop Can Trigger A Larger Move

From here, the Bitcoin price can move either way:

Downside path: A 12-hour close below $85,664 breaks the triangle, and likely pulls Bitcoin toward $83,811. If the selling continues, the next zone sits at $80,599, the current cycle low.

Upside path: A break above $91,637 is the minimum trigger for upside strength. If the price clears it while CMF rises toward the 0.11 zone, Bitcoin can attempt a move toward $93,780. But this path requires more work and more buyer strength than the downside level requires from sellers.

Bitcoin Price Analysis:

Bitcoin Price Analysis:

Right now, the chart leans slightly toward the downside: long-term holders keep selling, speculative buyers dominate, the price sits near the lower trend line, and CMF — while supportive — is just above its own limit.

Unless the upper range breaks first, Bitcoin likely stays inside its 6% indecision zone, with the risk of a sharper move if $85,664 fails.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Zcash Halving: What It Means for Cryptocurrency Investors in 2025

- Zcash's 2028 halving will reduce annual inflation to 1%, reinforcing its deflationary model after prior 50% block reward cuts in 2020 and 2024. - The 2024 halving triggered 1,172% price surge followed by 96% drop, highlighting volatility risks despite growing institutional investments like Grayscale's $137M Zcash Trust. - Privacy-focused hybrid model (shielded/transparent transactions) attracts institutional interest but faces EU MiCA regulatory scrutiny, requiring selective compliance strategies. - Inve

CleanTrade and the Evolution of Clean Energy Markets: Market Fluidity, Openness, and the Role of the CFTC

- CleanTrade, a CFTC-approved SEF, transforms clean energy markets by integrating VPPAs, PPAs, and RECs under institutional-grade transparency. - The platform unlocks liquidity through real-time pricing and centralized trading, accelerating net-zero transitions for corporations and utilities . - Enhanced transparency via project-specific REC data combats greenwashing, while regulatory alignment boosts investor confidence and market legitimacy. - By bridging traditional and renewable energy markets, CleanTr

The CFTC-Authorized Clean Energy Marketplace: An Innovative Gateway for Institutional Investors

- REsurety’s CleanTrade platform, CFTC-approved as a SEF, addresses clean energy market illiquidity and opacity by centralizing VPPAs, PPAs, and RECs. - Within two months of its 2025 launch, it attracted $16B in notional value, enabling institutional investors to streamline transactions and reduce counterparty risk. - By aggregating market data and automating compliance, CleanTrade enhances transparency, aligning with ESG priorities and regulatory certainty for institutional portfolios. - It democratizes a

SOL Drops 50%: Is This a Healthy Market Adjustment or the Onset of a Major Sell-Off?

- Solana's 50% price drop sparks debate over whether it signals a bear market correction or deeper structural selloff. - On-chain metrics show liquidity contraction and reduced exchange supply, but ETF inflows and validator activity suggest structural resilience. - Corporate transfers and the Upbit hack highlight volatility risks, while Solana's alignment with Bitcoin's trend underscores macroeconomic influence. - Key watchpoints include liquidity recovery timelines, ETF inflow sustainability, and potentia