Hedera Price Stays Weak While Its Fate Remains Tied to Bitcoin

Hedera’s price has struggled to recover over the past week, even as broader market conditions briefly improved before turning bearish again. HBAR attempted to climb back toward recent highs, but the market-wide pullback dragged it down, revealing how heavily the altcoin relies on Bitcoin’s movement. Hedera Has A Problem Named Bitcoin HBAR’s correlation with Bitcoin

Hedera’s price has struggled to recover over the past week, even as broader market conditions briefly improved before turning bearish again.

HBAR attempted to climb back toward recent highs, but the market-wide pullback dragged it down, revealing how heavily the altcoin relies on Bitcoin’s movement.

Hedera Has A Problem Named Bitcoin

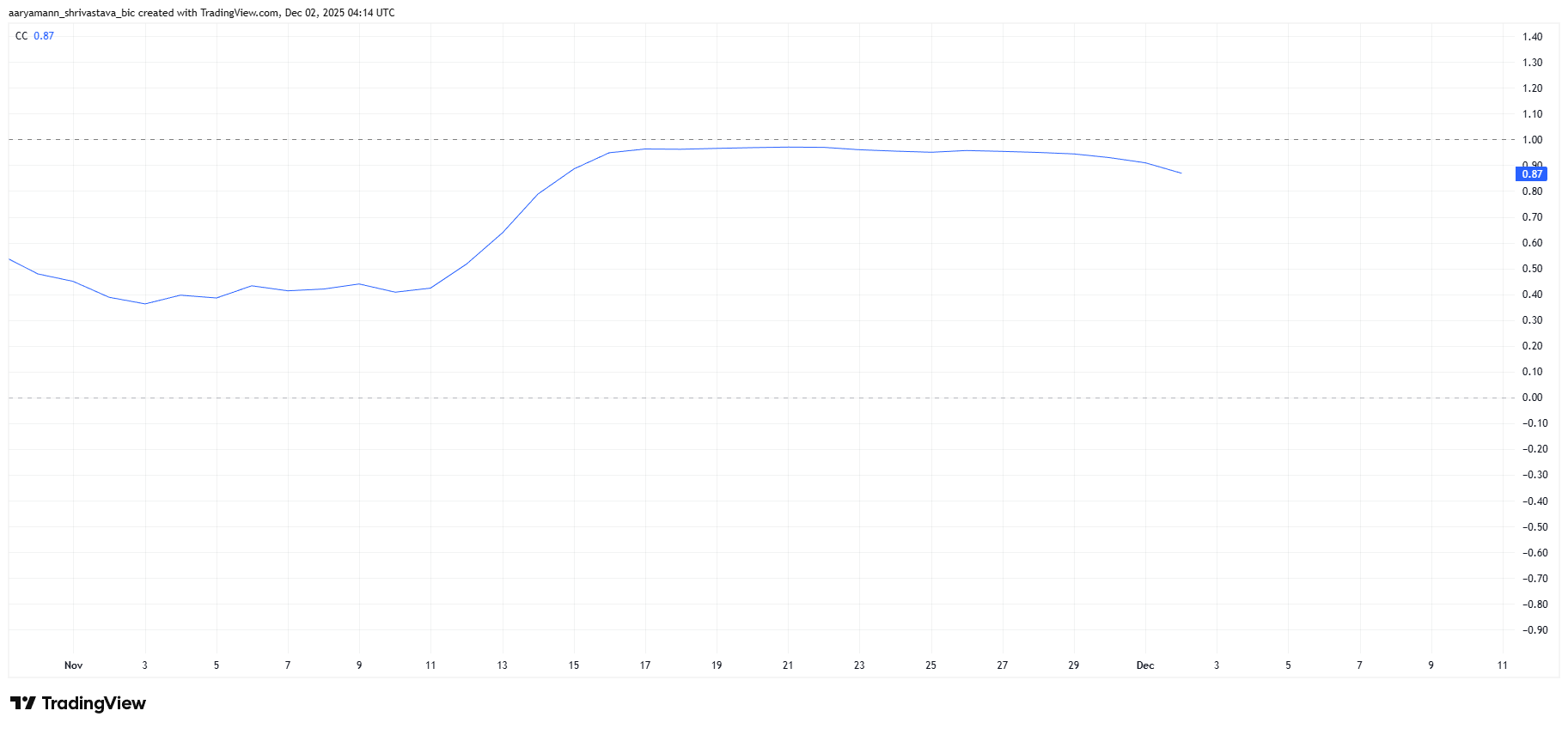

HBAR’s correlation with Bitcoin remains extremely strong at 0.87, dipping only slightly from last week’s peak. This tight correlation means Hedera is closely shadowing BTC’s price action, which is not ideal at a time when Bitcoin itself is stuck near $86,000.

Bitcoin’s struggle to reclaim bullish momentum has directly impacted Hedera, preventing any meaningful rebound. The lack of independent strength makes HBAR more vulnerable to Bitcoin-led volatility.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

HBAR Correlation To Bitcoin. Source:

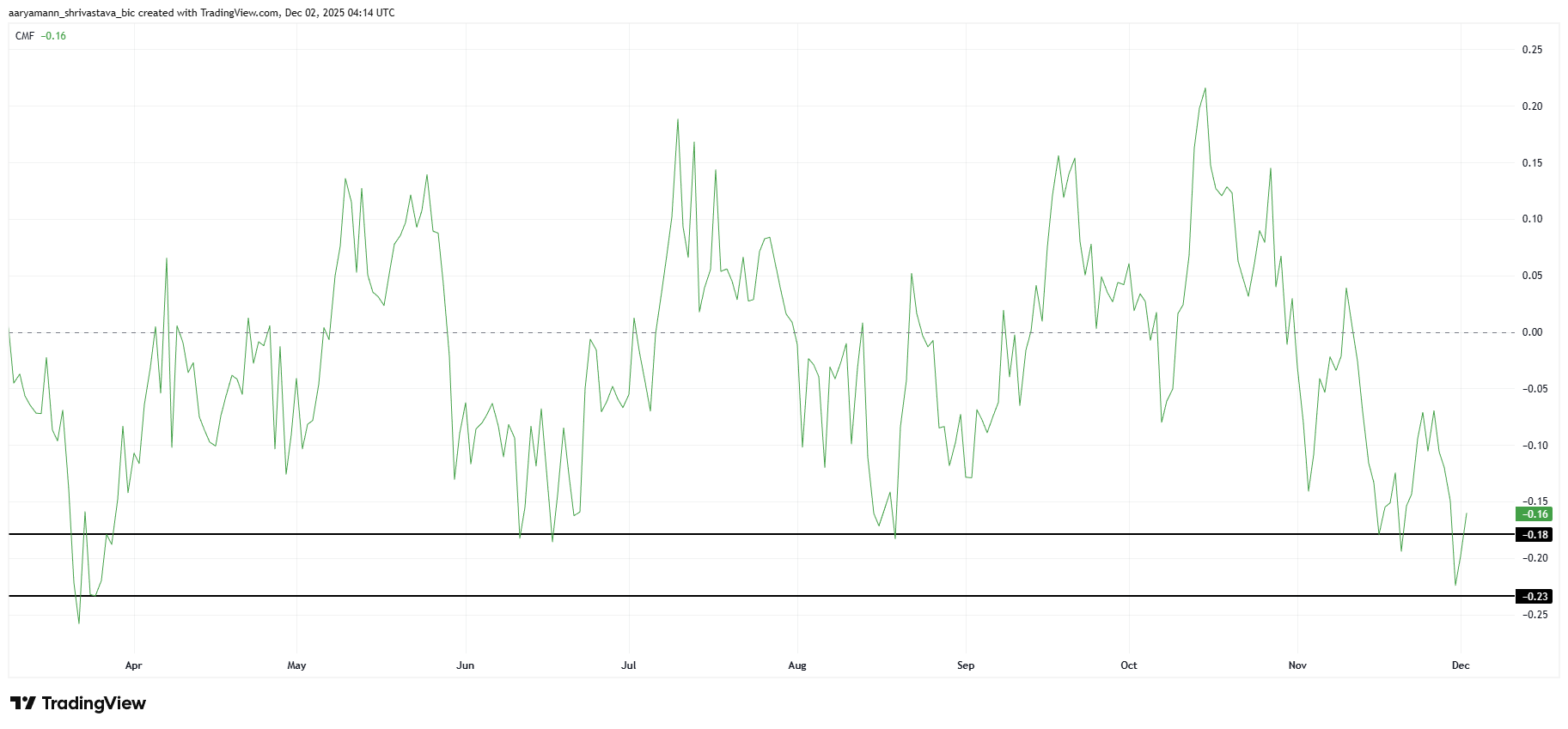

HBAR’s macro momentum shows further weakness, particularly in the Chaikin Money Flow (CMF), which recently dropped to a seven-month low. The indicator slipped into the 0.18 to 0.23 range, typically an area where outflows slow and inflows begin, offering altcoins a chance to stabilize.

HBAR Correlation To Bitcoin. Source:

HBAR’s macro momentum shows further weakness, particularly in the Chaikin Money Flow (CMF), which recently dropped to a seven-month low. The indicator slipped into the 0.18 to 0.23 range, typically an area where outflows slow and inflows begin, offering altcoins a chance to stabilize.

However, this cycle has been different. Broader market bearishness appears to be overriding usual reversal signals as CMF dipped below 0.18 before climbing only slightly. This demonstrates that investors are still pulling capital from HBAR despite historically favorable conditions for a bounce.

HBAR CMF. Source:

HBAR CMF. Source:

HBAR Price Needs A Push

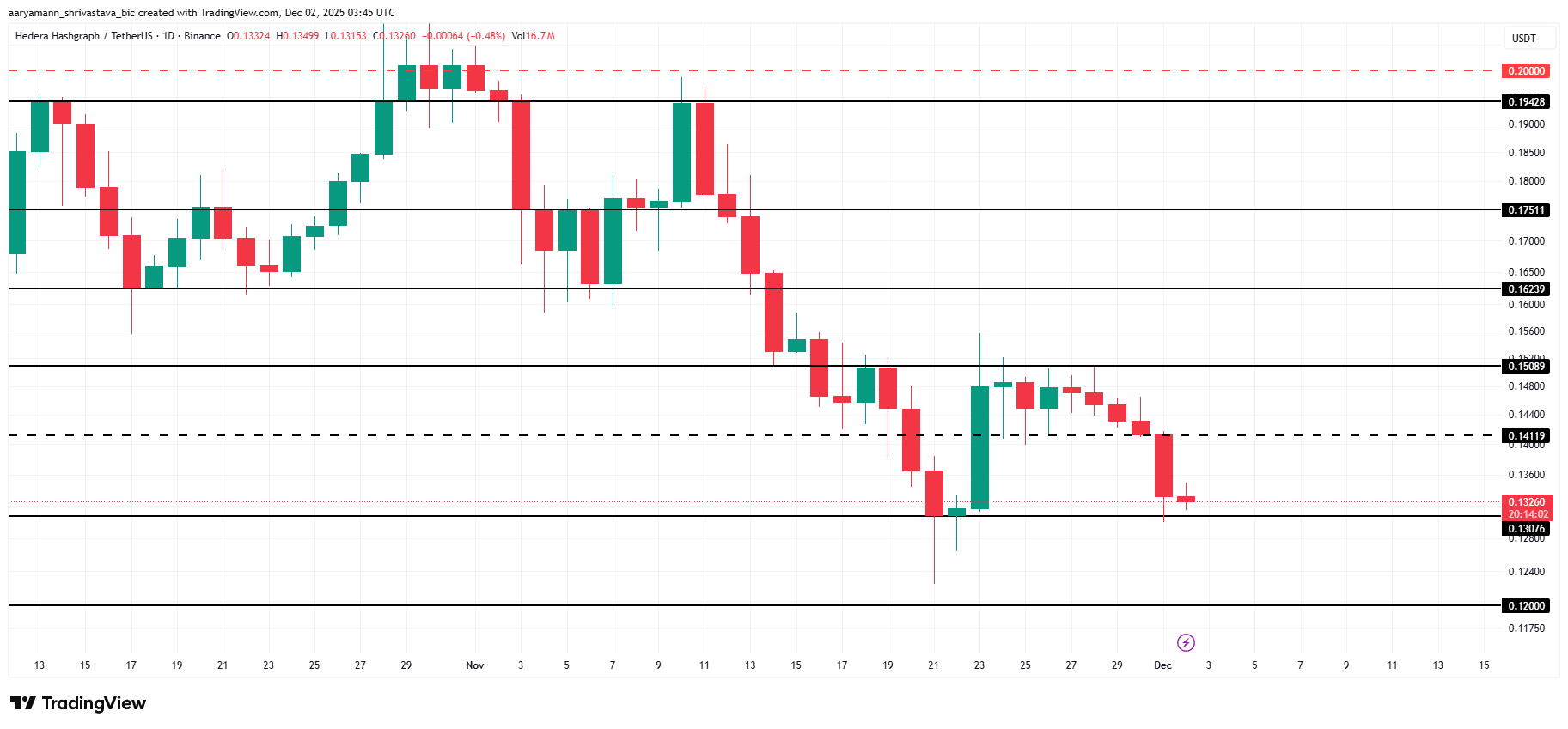

HBAR is trading at $0.132 at the time of writing, holding slightly above the $0.130 support level. This level has acted as a critical floor and remains essential in preventing a deeper decline.

If market weakness persists — especially if Bitcoin drops further — HBAR could continue consolidating between $0.130 and $0.150. A breakdown below $0.130 would likely send the price toward $0.120, extending the bearish trend.

HBAR Price Analysis. Source:

HBAR Price Analysis. Source:

However, if Bitcoin manages to recover, HBAR could rebound as well. A bounce off $0.130 may send the altcoin back to $0.150. Flipping this resistance into support would open the path toward $0.162, invalidating the bearish outlook.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Short the dip and buy the rip? What FOMC outcomes reveal about Bitcoin price action

Bitcoin Leverage Liquidation: Does It Pose a Systemic Threat to Retail Crypto Investors?

- October 2025's Bitcoin crash triggered $19B in leveraged liquidations, exposing crypto derivatives' fragility amid extreme retail leverage and thin liquidity. - High leverage (up to 1,001:1) and perpetual futures dominated by platforms like Hyperliquid amplified volatility, creating self-reinforcing downward spirals. - Behavioral biases (FOMO, overconfidence) and social media echo chambers drove irrational leveraged bets, while regulators paused risky ETFs and warned of systemic risks. - The crisis highl

LUNA up 46.13% in 24 hours as network improvements increase investor optimism

- LUNA surged 46.13% in 24 hours, driven by a pending network upgrade and rising investor confidence. - Futures open interest for LUNC rose to $25.55M, signaling new capital inflows and bullish momentum. - The terrad v3.6.1 upgrade, set for Dec 18, aims to enhance security and resolve legacy contract issues after successful testnet trials. - Technical indicators and analyst projections suggest continued upward momentum, targeting $0.000098 weekly if the 50-week EMA is sustained.

LUNA up 24.4% in 24 hours: Surge Fueled by Upgrades and Increased Inflows

- LUNA surged 24.4% in 24 hours on Dec 10, 2025, driven by rising on-chain activity, capital inflows, and anticipation of a major network upgrade. - The terrad v3.6.1 upgrade, set for Dec 18, aims to resolve legacy contract issues and enhance security, with successful testnet trials and rollback options in place. - Futures open interest rose to $25.55M, while technical indicators suggest continued bullish momentum, targeting $0.000098 resistance if the 50-week EMA is sustained. - Legal proceedings against