3 Meme Coins To Watch In The First Week Of December

Meme coins have had a volatile week, with many tokens observing gains while many others suffer losses. The cascading effect of the broader market’s crash could further impact the meme coins that are noting losses. BeInCrypto has identified three meme coins that investors should watch, considering the market’s movement. Pippin (PIPPIN) PIPPIN has delivered one

Meme coins have had a volatile week, with many tokens observing gains while many others suffer losses. The cascading effect of the broader market’s crash could further impact the meme coins that are noting losses.

BeInCrypto has identified three meme coins that investors should watch, considering the market’s movement.

Pippin (PIPPIN)

PIPPIN has delivered one of the strongest performances of the week, soaring 451% over seven days. The meme coin now trades at $0.152, marking a 10-month high.

PIPPIN is holding above the $0.136 support level, and the Parabolic SAR indicates a continuing uptrend with markers positioned below the candlesticks. This setup could drive the price toward $0.193 and potentially $0.255 if bullish momentum remains intact.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter.

PIPPIN Price Analysis. Source:

PIPPIN Price Analysis. Source:

If the rally loses strength due to profit-taking, PIPPIN could slip below $0.136 and retreat toward $0.100. Such a move would invalidate the bullish thesis and signal the start of a deeper correction.

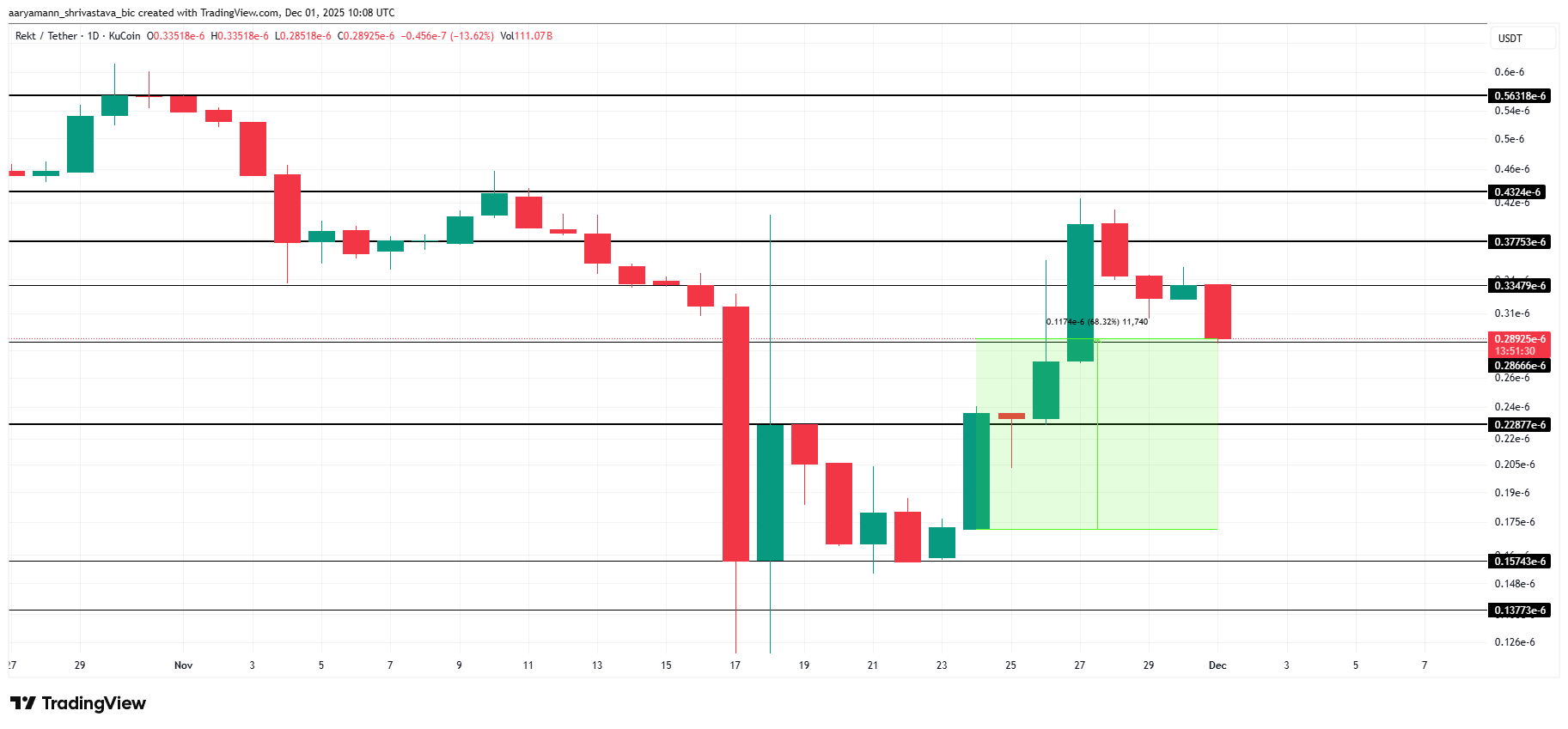

Rekt (REKT)

REKT has emerged as a strong performer despite volatile market conditions, climbing 68% in the past day. The meme coin now trades at $0.0000002892, showing resilience even as broader sentiment leans bearish.

REKT is holding above the $0.0000002866 support level and may attempt an upward bounce if investors provide sufficient backing. A move past $0.0000003347 and $0.0000003775 is essential for the meme coin to revisit the $0.0000004324 local peak.

REKT Price Analysis. Source:

REKT Price Analysis. Source:

If market conditions deteriorate further, REKT could lose its immediate support and drop toward $0.0000002287. Such a decline would invalidate the bullish thesis and signal a deeper correction.

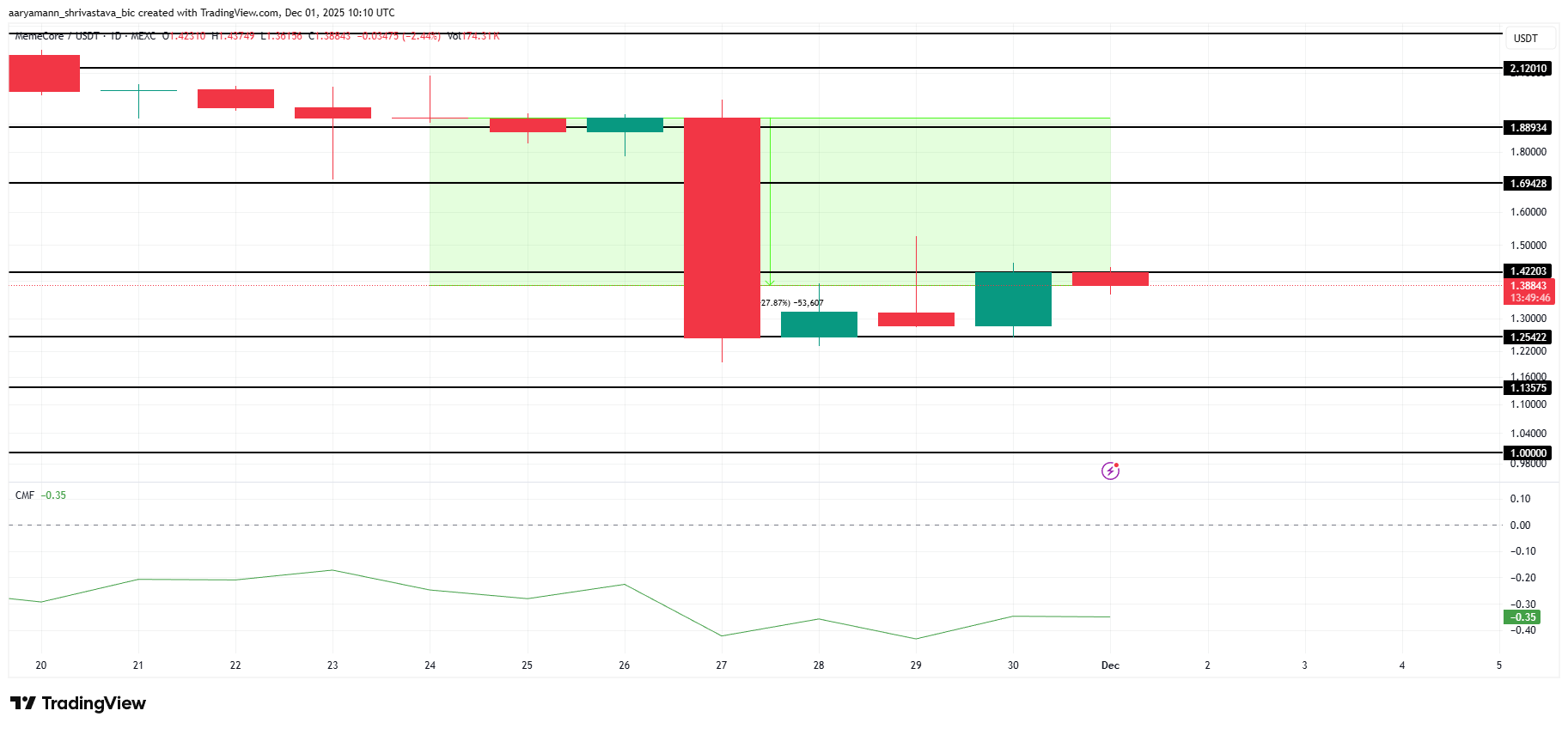

MEMECORE (M)

Memecore fell 27% over the past week and is now trading at $1.38, sitting just below the $1.42 resistance level. The meme coin is struggling to regain momentum after sustained market weakness.

Current CMF readings show strong outflows dominating Memecore, signaling fading investor confidence. If this continues, M could lose the $1.25 support and drop toward $1.13 or even $1.00.

Memecore Price Analysis. Source:

Memecore Price Analysis. Source:

However, if bullish momentum returns, Memecore could rebound and push toward $1.69. Clearing this barrier may open the path to $1.88, which would invalidate the bearish outlook and support a stronger recovery.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

DASH rose by 8.58% on December 3, 2025, driven by insider purchases and upcoming earnings schedule

- DoorDash director Alfred Lin’s $100M stock purchase boosts shares 8.58% on Dec 3, 2025, signaling confidence in long-term growth. - DASH shows mixed short-term trends (11.72% weekly drop vs. 35.93% annual gain) amid broader market volatility and earnings season uncertainty. - Analysts project 2.22 EPS for DoorDash, with ratings split between "Strong Buy" and "Hold," reflecting cautious optimism about revenue growth and macroeconomic risks. - Insider buying contrasts with CEO’s $56.5M share sale, highligh

U.S. November ADP employment change at -32K, vs. 10K expected and 42K prior.

Hyperliquid (HYPE) Price Fluctuations: Unraveling Blockchain Hazards and Institutional Confidence for 2025

- Hyperliquid (HYPE) dominates 73% of Perp DEX market share in 2025 through $5B TVL, BlackRock/Stripe partnerships, and 11% HLP returns despite security breaches. - Repeated 2025 security incidents ($4.9M POPCAT attack, $21M private key breach) triggered 20%+ price drops and $4B TVL decline amid liquidity flight. - Institutional trust persists as TVL/open interest grew post-March 2025, but circulating supply unlocks and Lighter/Aster competition threaten HYPE's $34 price stability. - Platform's success hin

Strategic Property Investment in the Revitalization of the Former Xerox Campus: Infrastructure-Led Renewal in Webster, NY

- Webster , NY, is transforming its post-Xerox campus via $14.3M in state infrastructure grants for industrial upgrades and public-private partnerships. - Road, sewer, and electrical improvements reduced industrial vacancy to 2%, attracting $650M fairlife® dairy plant and 250 jobs. - Residential values rose 10.1% annually as NEAT corridor targets $1B in development by 2026 with $283M public-private investment. - Strategic infrastructure funding de-risks development, creating a scalable model for post-indus