Bitcoiners accuse JPMorgan of rigging the game against Strategy, DATs

Members of the Bitcoin community and supporters of Strategy, the largest corporate holder of BTC, are criticizing JPMorgan’s proposed Bitcoin-backed notes, accusing the bank of spreading fear, uncertainty and doubt about Strategy and other crypto treasury firms.

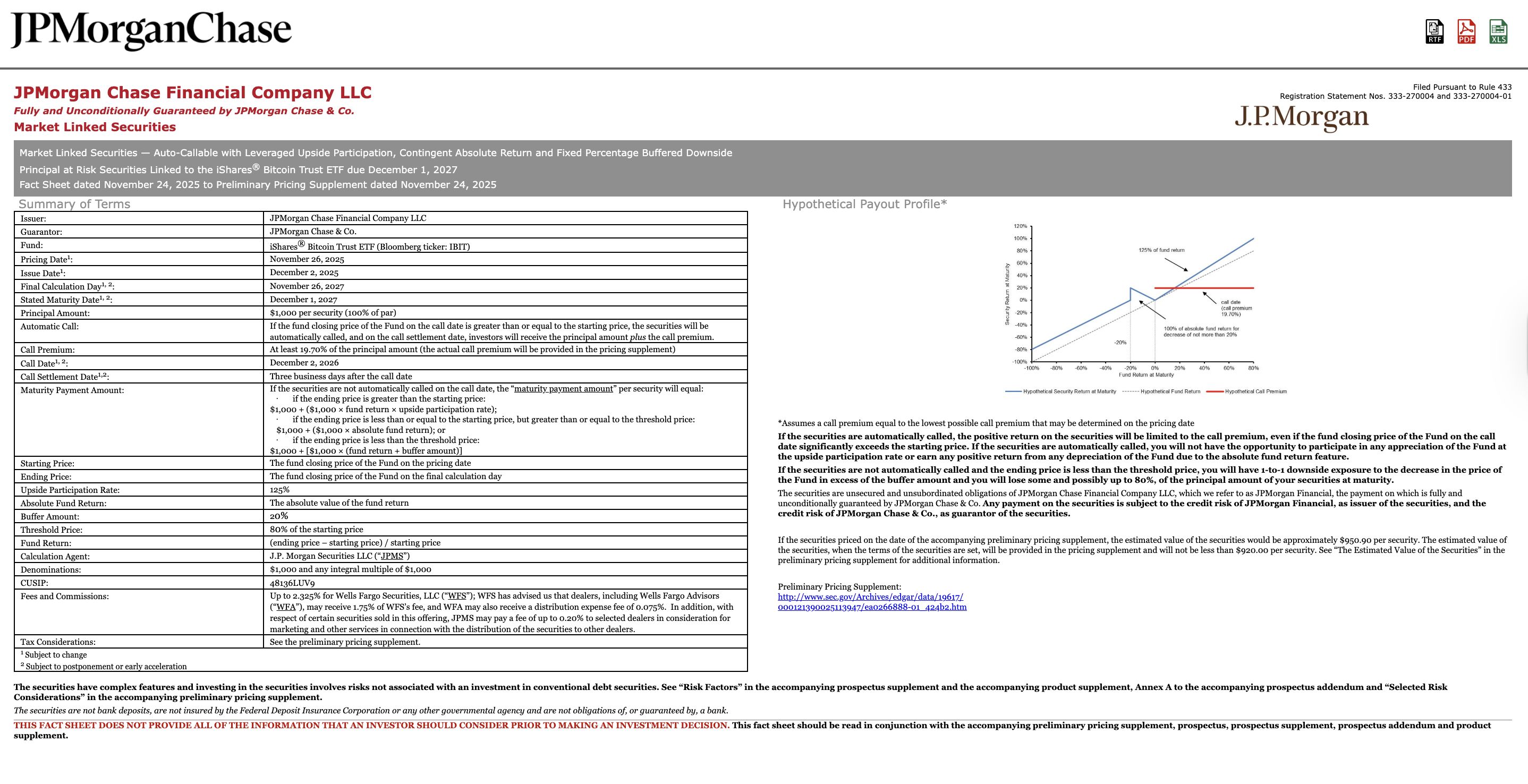

JPMorgan’s notes are a leveraged investment product tied to the price of Bitcoin (BTC). The product tracks BTC but amplifies the outcome, giving holders 1.5 times the gains — or the losses — through December 2028. The notes are slated for a December 2025 launch, according to an SEC filing.

The move drew sharp criticism from the Bitcoin community, with many saying that JPMorgan is now a direct competitor to BTC treasury companies and has an incentive to marginalize companies like Strategy to promote its own structured financial product.

“Saylor opened the door to the $300 trillion bond market and $145 trillion fixed income market. Now, JP Morgan is launching Bitcoin-backed bonds to compete,” said a Bitcoiner on X, adding that “the same institutions attacking MSTR are copying the strategy.”

Bitcoin advocate Simon Dixon also noted that JPMorgan’s upcoming product exists “to trigger margin calls on Bitcoin-backed loans,” claiming that it will “force sell pressure from Bitcoin treasury companies in down markets.”

On X, crypto enthusiasts and Strategy supporters are now calling for a boycott of JPMorgan, encouraging fellow Bitcoiners to close accounts at the financial services giant and sell any shares in the company they might own.

MSCI rule change proposal triggers clash

The backlash against JPMorgan began when MSCI, formerly Morgan Stanley Capital International, a company that manages stock indexes and sets the criteria for index inclusion, proposed a policy shift excluding treasury companies from its products.

The proposed shift, set to take effect in January, bars crypto treasury companies with 50% or more of their assets in cryptocurrencies from inclusion in the index.

JPMorgan shared the proposed policy shift in a November research note, drawing sharp criticism from the BTC community and Strategy investors.

Excluding crypto treasury companies from stock indexes deprives them of passive capital flows and could force these companies to sell off their crypto holdings to qualify for index inclusion, driving asset prices down further.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Ethereum News Today: Ethereum’s Fusaka Update: Scaling Goals Face Challenges From Validator Compromises

- Ethereum's Fusaka upgrade (Dec 3, 2025) introduces PeerDAS to enhance scalability by verifying rollup data without full dataset downloads. - BPO forks enable incremental blob capacity increases (e.g., 14 blobs/block by Jan 7, 2026), avoiding disruptive hard forks while supporting 100k+ TPS via L2 solutions. - L2 data fees may drop 40%-60% with PeerDAS, but validators face trade-offs between reduced storage demands and increased upload requirements as blob capacity grows. - Market reactions remain mixed:

Bitcoin Updates: Challenges in Blockchain Infrastructure Drive Growth of Mixed Sustainability Approaches

- Blockchain networks show mixed fee revenue, with only 11 surpassing $100K weekly thresholds, highlighting structural inefficiencies and speculative challenges. - Lumint's hybrid staking model combines AI-driven tools with decentralized rewards to address PoW/PoS flaws, aiming for sustainability and reduced energy waste. - Bitcoin rebounded to $87,000 amid 2% market growth, but extreme fear persists (index at 20), with $380M in liquidations and mixed retail sentiment. - Hybrid solutions like Lumint priori

DASH drops 4.37% within 24 hours following Australian wage agreement

- DoorDash's stock fell 4.37% in 24 hours amid a 25% wage hike agreement for Australian delivery workers, including mandatory accident insurance. - The deal raises near-term cost concerns as operating margins stand at 5.5%, but reflects improved labor standards and regional commitment. - Institutional ownership rose to 90.64% with major investors increasing stakes, signaling long-term confidence despite recent volatility. - Analysts maintain a "Moderate Buy" rating ($275.62 target) as DoorDash shows strong

Ethereum Updates Today: Privacy First: Buterin Backs Messaging’s Fundamental Transformation

- Vitalik Buterin donates 128 ETH ($390K) to Session and SimpleX to advance metadata privacy and permissionless design. - Platforms use decentralized infrastructure and cryptographic IDs to protect communication metadata, resisting censorship and AI surveillance risks. - Donation counters regulatory threats like EU's Chat Control while promoting privacy-focused innovation in encrypted communication. - Experts emphasize permissionless account creation as critical for digital freedom, despite trade-offs like