On-chain Rebound, Sniper Tool OCR Reaches New Heights with Hundredfold ROI Myth

What Kind of Black Technology is OCR?

The Monad TGE has been live on the mainnet for 3 days now, and finally last night, a 10M-level Gold Dog $CHOG appeared on this new chain.

This is a somewhat expected Gold Dog, as the Chog character is Monad's mascot. When Monad first launched on the testnet, there was a testnet NFT craze around this character, which has always been one of the most popular NFT series in the Monad ecosystem, from whitelist-only to skyrocketing.

What sets the Chog team apart is the way they released the Contract Address (CA) this time. They released it through an official tweet, but embedded the CA within an image to avoid many monitoring sniper bots.

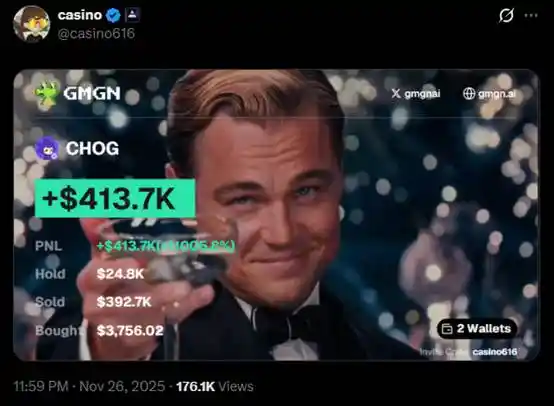

However, this didn't deter some snipers with "black technology." @casino616 successfully sniped when the $CHOG market cap was only about $40,000, spending around $3,756 to buy about 9% of the total $CHOG supply. In the end, they accumulated profits exceeding $410,000, creating another story of a single coin achieving over a hundredfold return in the crypto world.

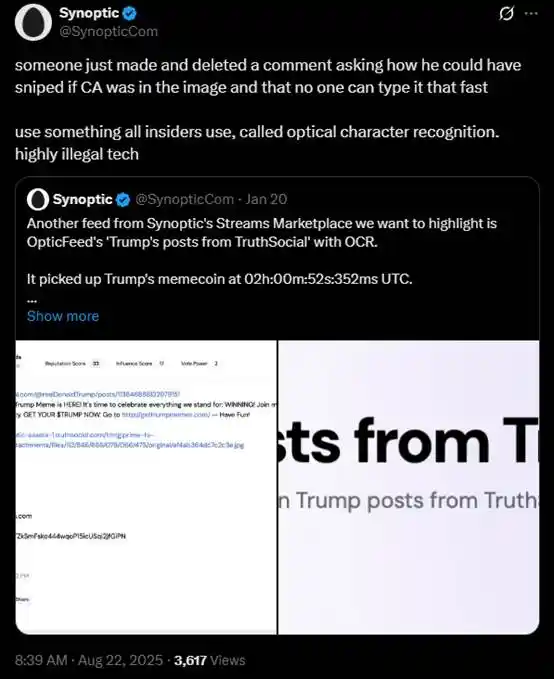

This successful event once again brought attention to "OCR" black technology. OCR technology, short for Optical Character Recognition, is a technology that uses optical techniques and computer algorithms to recognize and convert text in images. It can convert scanned documents, photos, books, or other text-containing images into editable digital text formats like searchable content in Word, TXT, or PDF.

Although embedding the token contract address in an image can filter out snipers who only capture tweet text content, it cannot stop snipers using OCR technology. In fact, this is not the first time OCR technology has been discussed by crypto players, particularly those specialized in on-chain token sniping.

The last time OCR was discussed was probably around Kanye West's coin release $YZY. At that time, the first sniper to purchase $YZY, Naseem, was questioned because he had also successfully sniped $TRUMP and made a profit of $109 million. One explanation was that Naseem used OCR technology to directly extract and buy any CA embedded in images without manual input.

As on-chain participants' technical skills become more advanced, the information gap has been almost eliminated. Just like in the case of $CHOG's contract tweet, everyone can see the tweet at the same time. Therefore, the key to success has become who can process information more efficiently. Eliminating the need to manually enter the token contract address can greatly reduce the cost of buying in. The level of understanding of the Monad ecosystem determines whether players dare to buy into this new token and the size of the position they are willing to take.

In a narrative-failing market environment, the difficulty of making money is indeed increasing.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Solana’s User Boom Meets Selling Pressure

Australia’s Far-Right Populists Overtake Main Opposition in Survey

Why Effective Capital Allocation Is Currently More Important Than Profits