Bitcoin Updates: Blockrise's Bitcoin Lending Reflects Growing Institutional Confidence in Regulated Digital Asset Finance

- Blockrise, a Dutch Bitcoin-only firm, launched €20,000 crypto-backed loans after securing EU MiCA regulatory approval, enabling cross-border EU operations. - The service targets corporate clients, allowing Bitcoin collateralization while retaining asset ownership, with 8% interest rates adjusted monthly. - Its semi-custodial model uses hardware-secured vaults and joint transaction authorization, managing €100M in client assets under this structure. - The move aligns with rising institutional demand for B

Blockrise, a financial services company from the Netherlands that focuses exclusively on Bitcoin, has introduced a

The MiCA authorization,

This launch comes as institutional interest in Bitcoin treasury management continues to rise. As more European businesses add Bitcoin to their balance sheets, credit solutions backed by on-chain assets are likely to become more popular. By expanding its services from custody and trading into business lending, Blockrise is positioning itself to benefit from this growing trend. The company is seeking to raise

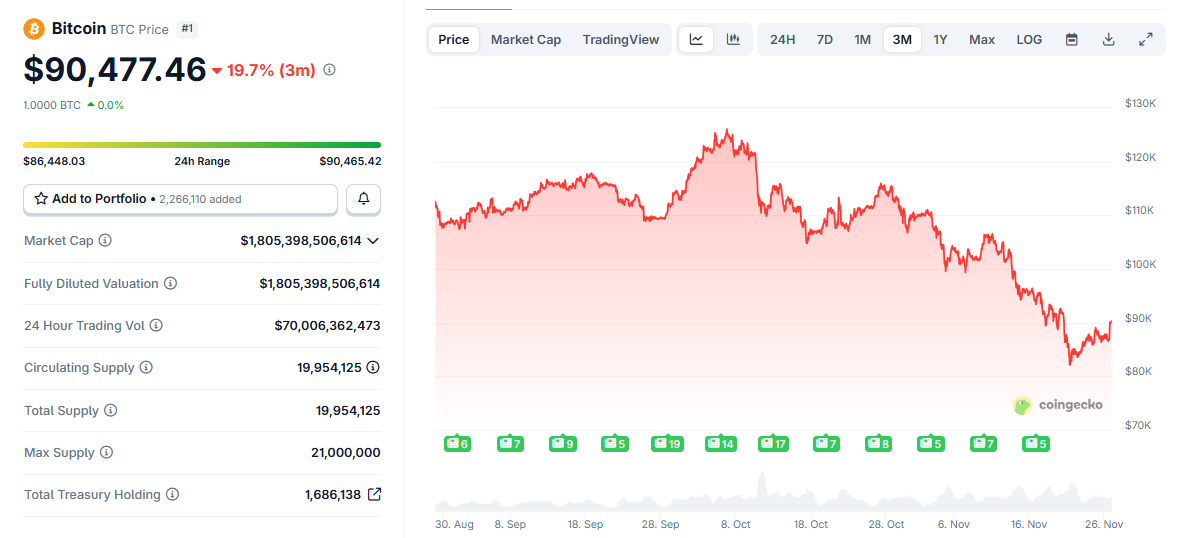

Clearer regulations under MiCA have increased trust in the crypto sector. Although the current rules do not yet cover lending or decentralized finance, Lazet expects future updates to address these areas. Blockrise’s commitment to regulatory compliance fits well with Europe’s rapidly changing crypto environment, where institutional adoption is advancing faster than traditional banking. With Bitcoin prices stabilizing after a post-2025 decline, regulated providers like Blockrise are in a strong position to connect institutional investors with digital assets .

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Are Digital Asset Treasuries (DATs) Just a Fading Fad?

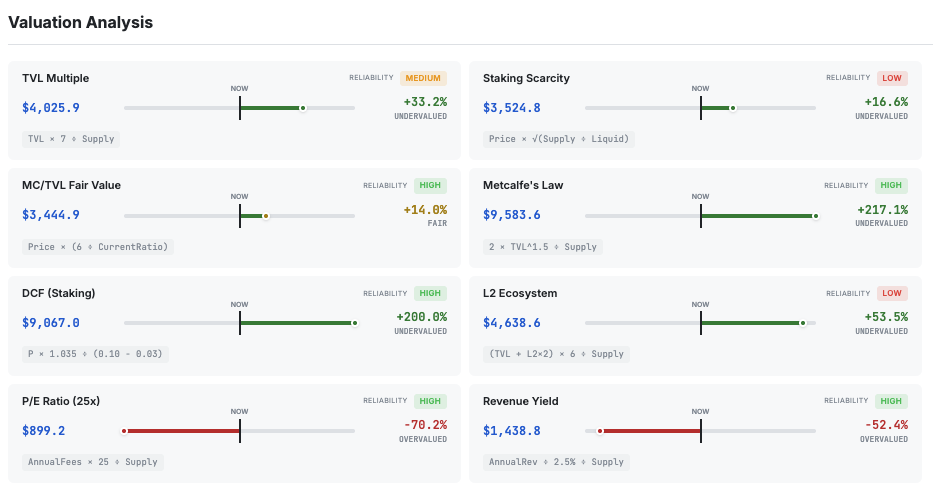

Hashed’s Simon Kim Says Ethereum Is 57% Undervalued

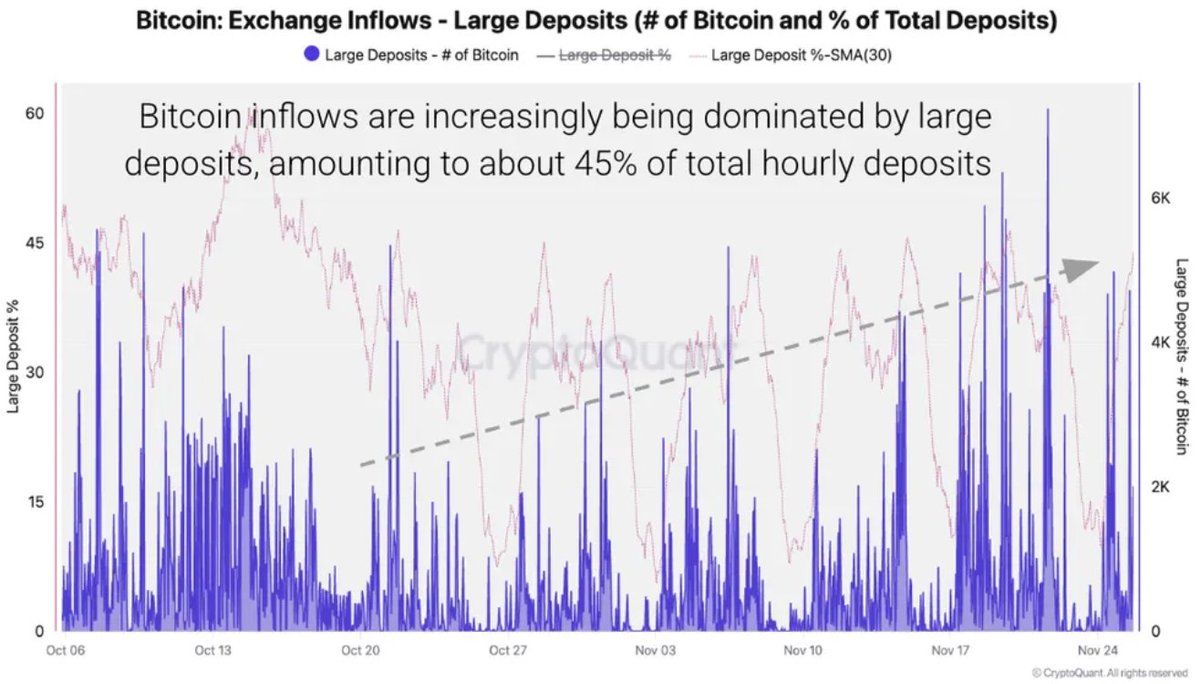

Bitcoin Breaks $90K but Exchange Data Shows Rising Selling Pressure

Global Exchanges Urge SEC to Curb Broad Crypto Exemptions, Warn on Tokenized Stock Risks