XRP Price Still Holds Its Green, But One Group Is Slowly Turning Into a Red Flag

The XRP price trades near $2.20, flat on the day and up about 1.5% in the past week. On the surface, the trend still looks steady compared to the broader market. But when you dig deeper into holder behavior, one group is quietly shifting from supportive to risky. Short-Term Holders Stay Positive, But Long-Term Holders

The XRP price trades near $2.20, flat on the day and up about 1.5% in the past week. On the surface, the trend still looks steady compared to the broader market.

But when you dig deeper into holder behavior, one group is quietly shifting from supportive to risky.

Short-Term Holders Stay Positive, But Long-Term Holders Turn Risky

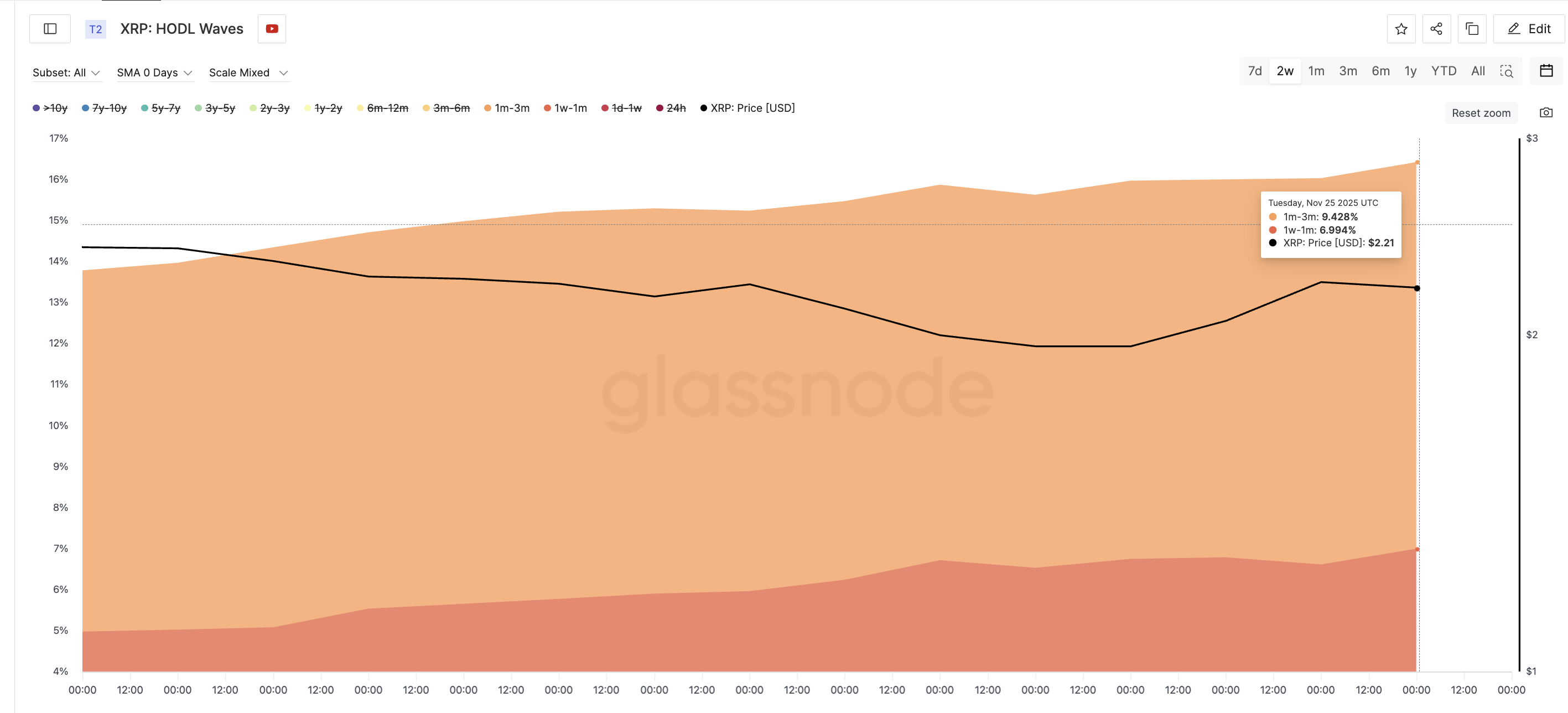

HODL Waves track how much supply sits in different holding-time bands. They show that short-term XRP holders are still steady. The one-to-three-month band has increased the stash from 8.80% to 9.48% since November 11. The one-week-to-one-month band also increased from 4.97% to 6.99%.

These groups usually sell fast when pressure hits, yet they have been accumulating instead.

Short-Term Holders:

Glassnode

Short-Term Holders:

Glassnode

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

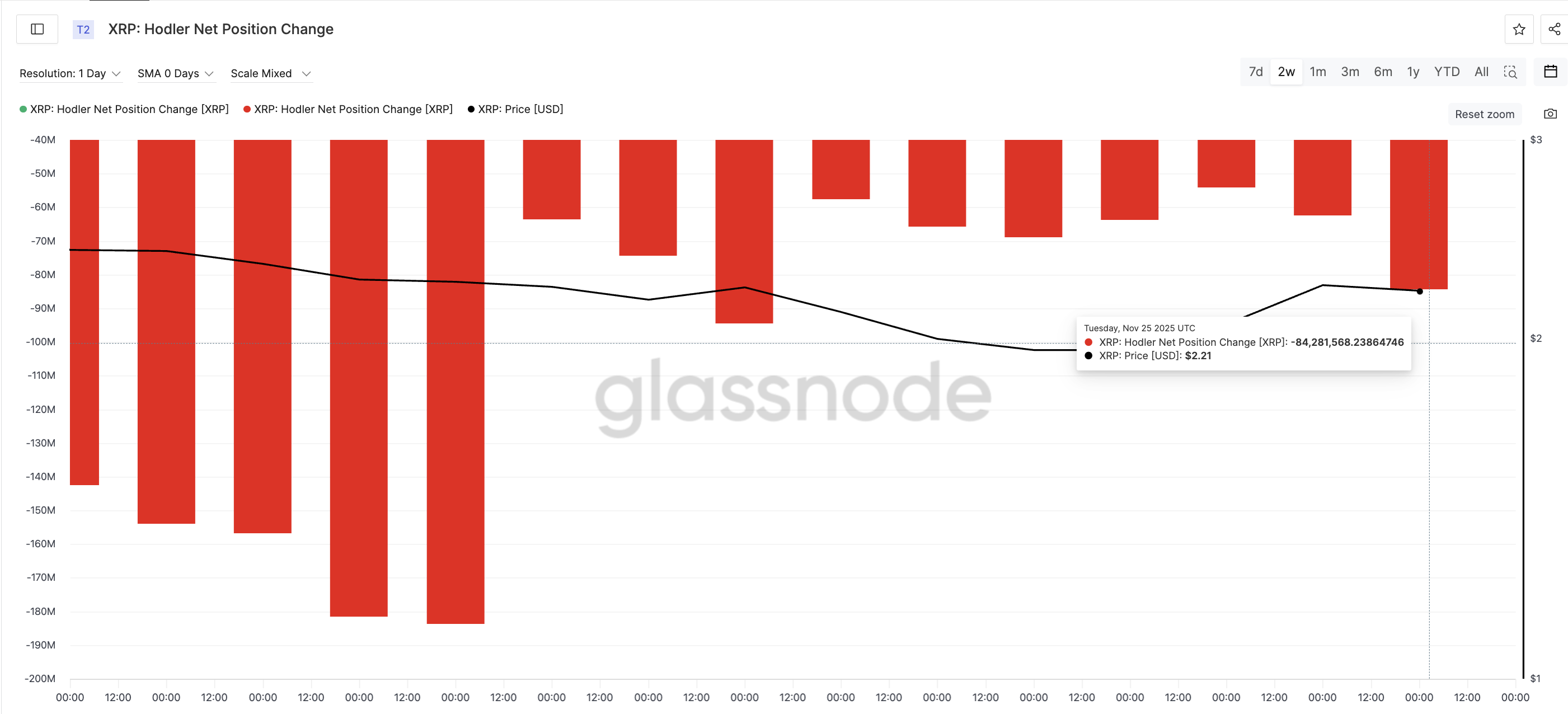

The pressure point sits with long-term holders. Hodler Net Position Change measures whether long-term holder wallets, on net, gain or lose coins.

On November 23, long-term holders were selling around 54 million XRP. By November 25, that number increased to 84 million XRP, a jump of about 56%.

Long-Term XRP Holders Selling:

Glassnode

Long-Term XRP Holders Selling:

Glassnode

This is not a random spike. A similar rise in selling happened between November 16 and 18, which was followed by a sharp drop in XRP from $2.22 to $1.96, almost 12%.

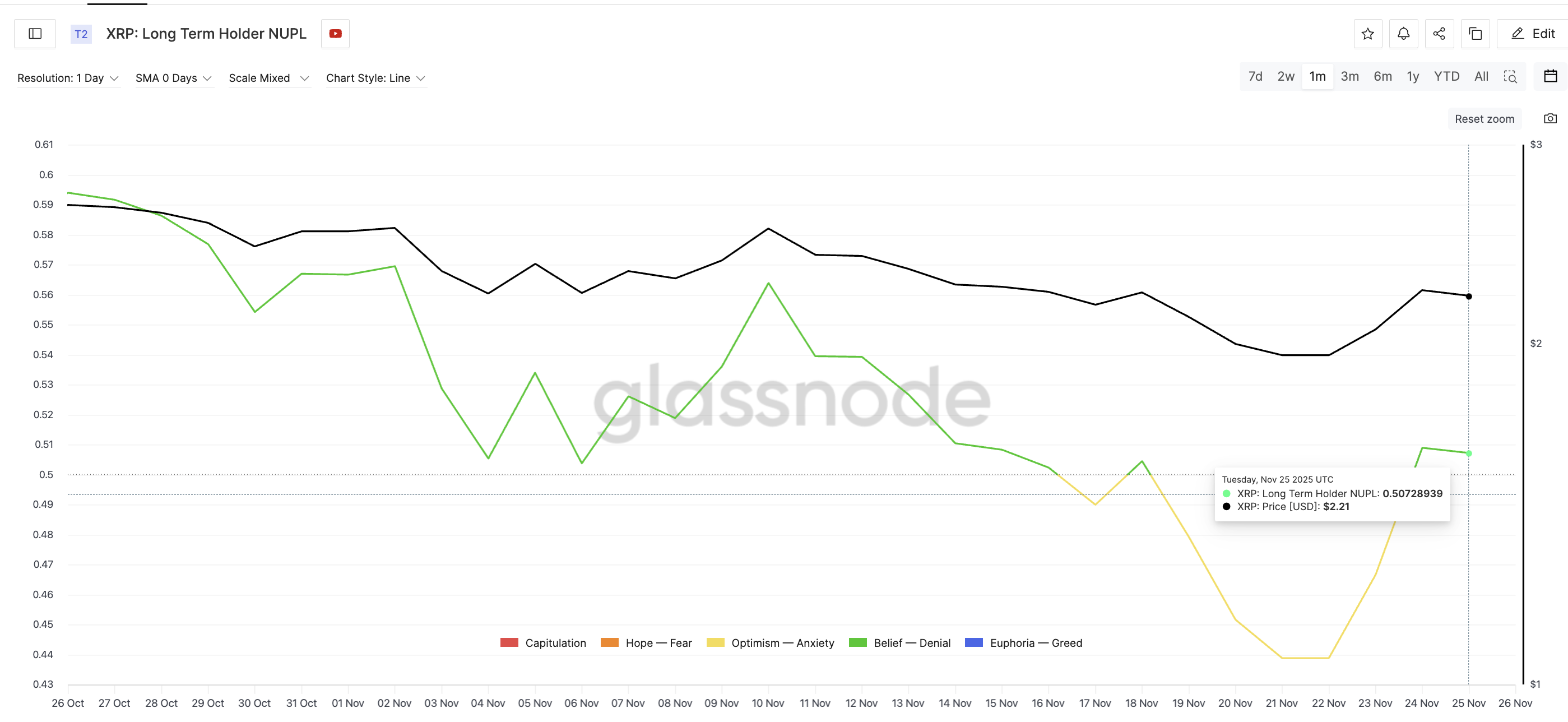

NUPL (Net Unrealized Profit/Loss) shows why. NUPL tracks how much profit or loss holders hold on paper. Long-term holder NUPL is near 0.50, which falls into the “belief–denial” region that often shows local tops. The last time NUPL hit this area on November 18, XRP corrected soon after.

High Profit-Taking Incentive:

Glassnode

High Profit-Taking Incentive:

Glassnode

So the incentive to take profit is real, and long-term holders are acting on it — this is the red flag. A sign that the XRP price is losing conviction among HODLers.

XRP Price Holds Key Levels For Now, But Breakout Confirmation Is Needed?

XRP trades between familiar levels. The first support sits at $2.06. If long-term holder selling increases and price loses this level, XRP could revisit $1.81, a recent local bottom.

To stay in its green zone, XRP needs a clean close above $2.24, flipping the short-term trend upward. That would open the path toward $2.58 and $2.69, but only if big money supports the breakout.

This is where CMF (Chaikin Money Flow) comes in. CMF measures money flowing in from large wallets. It has moved slightly above zero, indicating some inflow, but it still sits below a descending trendline. Until CMF breaks that trendline, inflows are not strong enough to fully offset long-term holder selling.

XRP Price Analysis:

TradingView

XRP Price Analysis:

TradingView

For now, XRP price still holds its green (week-on-week), but long-term holders — backed by high NUPL and rising outflows — remain the slow-forming red flag that traders should watch closely.

Read the article at BeInCryptoDisclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Solana's Abrupt Price Swings and Effects on the Market: Blockchain System Vulnerabilities and Changes in Investor Confidence

- Solana's 2025 volatility stems from infrastructure vulnerabilities, unacknowledged outages, and shifting investor sentiment. - Network design prioritizing consistency over availability caused outages, exposing risks in high-throughput systems. - Developer growth (83% increase) contrasts with security gaps and inadequate documentation in smart contracts. - Price dropped 26% in November 2025 amid extreme fear metrics, despite institutional staking and ETF inflows. - Technical upgrades face skepticism due t

Financial Wellbeing Emerging as a Key Investment Trend in 2025: Prospects in Fintech and Personal Finance Management Solutions

- Financial wellness emerges as a 2025 investment theme, driven by AI, cloud tech, and rising demand for budgeting/debt management tools. - Market growth projects $4.2B to $10.2B (2025-2034) for financial wellness software, with PFM tools expanding at 12.5% CAGR to $11.12B by 2035. - Key innovators like MX, Acorns, and Affirm leverage automation and predictive analytics, while ETFs like Invesco PFM offer diversified fintech exposure. - Strategic risks include data privacy concerns and regulatory scrutiny,

Bitcoin Leverage Liquidation Crisis: Exposing Systemic Threats in Cryptocurrency Derivatives Markets

- 2025 Bitcoin's $100,000+ price collapse triggered $22B in leveraged liquidations, exposing crypto derivatives market fragility. - 78% retail-driven perpetual futures trading with 1,001:1+ leverage ratios created self-reinforcing price declines. - Decentralized exchanges enabled $903M ETF outflows and extreme fear index readings, revealing liquidity illusion risks. - Systemic risks now span traditional markets as crypto acts as volatility mediator, amplifying macroeconomic shocks. - Regulatory reforms and

Runway unveils its inaugural world model and introduces built-in audio support to its newest video model