Bitcoin News Update: Hive Invests $300M in ATM to Boost AI Efforts While Stock Drops Amid Doubts

- Hive Digital Technologies launched a $300M ATM equity program to fund its "dual-engine" strategy of Bitcoin mining and AI infrastructure expansion. - The program enables flexible capital raising through 11 underwriters, supporting a renewable-powered data center in Canada and recent 285% revenue growth. - Despite strong financial performance, shares fell to $3.10, reflecting market skepticism about execution risks and competitive pressures in AI infrastructure. - Analysts highlight Hive's 90% renewable e

Bitcoin mining company

This move highlights Hive's "dual-engine" approach, using

The ATM offering gives Hive a flexible way to access additional capital without committing to a set price or timing, differing from conventional public offerings. Shares can be sold through "at-the-market distributions" under Canadian securities laws and Rule 415 of the U.S. Securities Act, which ensures compliance while preserving operational flexibility

Industry analysts see the program as a strategic lever to advance Hive's infrastructure goals. The company's BUZZ HPC segment is becoming increasingly important to its growth story, reflecting a wider industry transformation as mining companies shift from speculative ventures to critical infrastructure providers for AI and cloud services

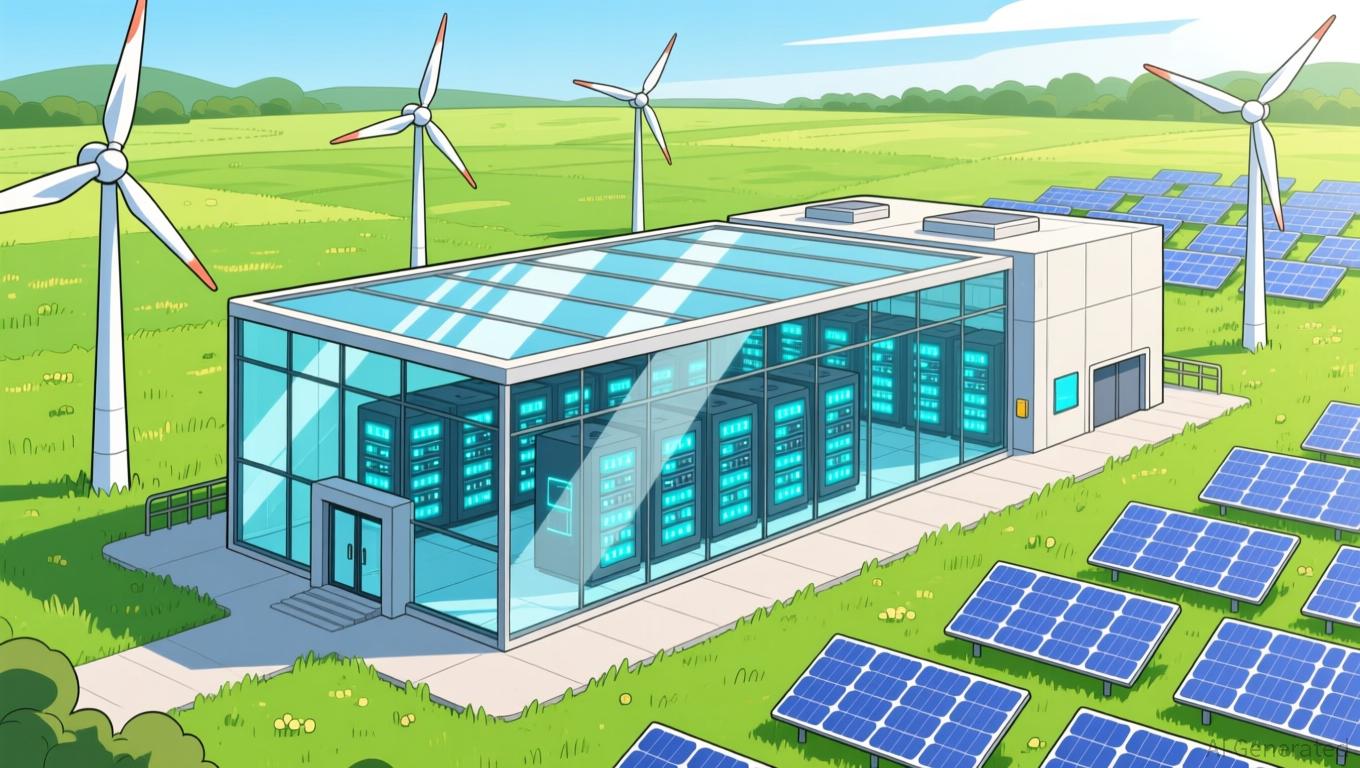

Profit margins from Bitcoin mining and energy expenses are crucial factors in Hive's dual-engine strategy, and the company is keeping a close eye on both operational performance and Bitcoin price swings. Leadership has indicated that the data center's energy mix—90% from renewable sources—will give Hive an edge in both cost efficiency and ESG standards.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin Updates: Senate Decision on Crypto Approaches While ETFs Lose $3.5B and Market Liquidity Declines

- A $101M crypto futures liquidation in October triggered a 30% Bitcoin price drop, marking the largest single-day selloff since 2022 amid ETF outflows and macroeconomic uncertainty. - $3.5B in November ETF redemptions and $4.6B stablecoin outflows highlight liquidity tightening, while leveraged traders face heightened volatility risks as retail investors retreat. - The U.S. Senate's upcoming crypto market structure bill could redefine regulatory clarity, potentially attracting institutional investment if

Ethereum Updates Today: Staked ETH ETFs Ignite Debate Over Decentralization Versus Profit

- Institutional investors and corporate treasuries continue aggressively accumulating Ethereum , with BitMine Immersion (BMNR) holding 3.5M ETH (3% of supply) after a $60M recent purchase. - Despite $3.2B in crypto fund outflows and BMNR's 30-day 50% stock decline, the firm pivoted to a staking-focused model via its Made in America Validator Network (MAVN). - BlackRock's proposed staked ETH ETF intensified concerns about Wall Street's influence, prompting Ethereum co-founder Vitalik Buterin to warn against

Bitcoin Updates: The Eco-Friendly and Secure Transformation of Crypto Fuels Widespread Acceptance

- BI DeFi launches a compliance-focused platform with cold storage and automated crypto yields, targeting passive income amid volatility. - GrnBit’s Bitcoin Mining Fund offers institutional-grade, energy-efficient mining in Alabama, leveraging low-cost TVA power and sustainable hardware. - Innovations like multilingual apps (CryptoAppsy) and Microsoft’s on-device AI aim to boost crypto accessibility and privacy, aligning with rising institutional demand. - Policy debates over Fed leadership (e.g., Kevin Ha

Trump’s Approach to Cryptocurrency: Encouraging Progress or Promoting Favoritism?

- US President Trump's crypto ties face Democratic scrutiny over alleged political favoritism and family financial gains. - Administration appoints pro-crypto figures like Kevin Hassett, linked to Coinbase , to key roles while Trump family profits from WLFI token buybacks. - Investigations allege "pay-for-play" corruption, with crypto executives donating to Trump groups and benefiting from lenient policies. - White House defends policies as innovation-driven, but critics warn of regulatory erosion and poli