What is the Current Status of Ethereum Founder Vitalik Buterin’s Wealth? Here are the Altcoins He Holds and His Losses Over the Past Week

Following the sharp pullbacks in the cryptocurrency market, Ethereum founder Vitalik Buterin's current portfolio and net worth are back on the agenda.

According to the latest data, Buterin's total assets stand at $706.9 million. An examination of Buterin's 10 different wallet addresses reveals that the majority of his portfolio remains concentrated in Ethereum.

Buterin's assets are almost entirely in Ethereum. His 241,011 ETH are worth $696.1 million, representing close to 98% of his wealth.

His second-largest investment, outside of Ethereum, is his 2,921 AETHWETH holdings through Aave v3. This position is also indexed to the ETH price.

” ]

Following this, Buterin's portfolio includes $1.28 million in memecoin-focused WHITE tokens, $385.8 million in MOODENG, $30 billion in MOODENG, and $235.4 thousand in KNC, an older decentralized finance project, with 869,000 KNC. These memecoins are tokens sent to Buterin free of charge without his consent.

The sharp sell-off in Bitcoin and altcoins last week also affected Buterin's wealth, with his total net worth shrinking by $71.74 million in just one week.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Lower volatility lifts investor confidence in risk assets, Wells Fargo’s Schumacher says

The Senate advances toward a decision on market structure: Crypto Update

Solana ETF Flows and Whale Moves Hint at Bullish Potential

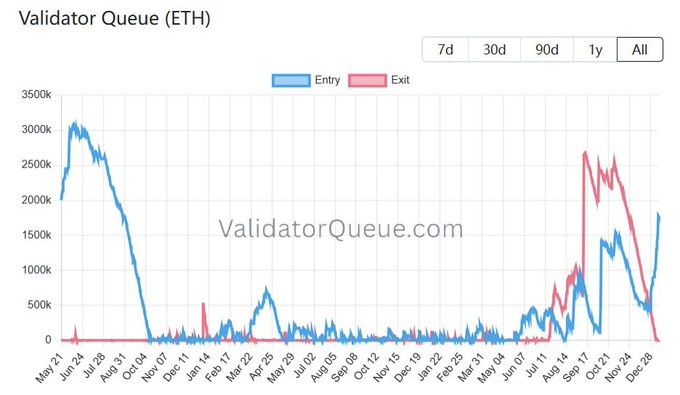

Ethereum’s Validator Entry Queue Hits $5.5B, Marking Highest Level Since August 2023