BNB holds the line: Price pauses, usage climbs, traders take a breather

BNB is trading at a level that previously marked a breakout in 2024, according to market data. After pulling back from its recent peak, the cryptocurrency is testing a former resistance level now functioning as support.

- BNB has retraced to the upper boundary of an ascending channel that capped its 2024–2025 rally.

- BNB Chain’s active addresses have steadily increased in 2025, rising from under 1 million daily users early in the year to peaks near 3.5 million/

- Futures open interest has declined from September highs, suggesting traders are waiting for clearer directional cues.

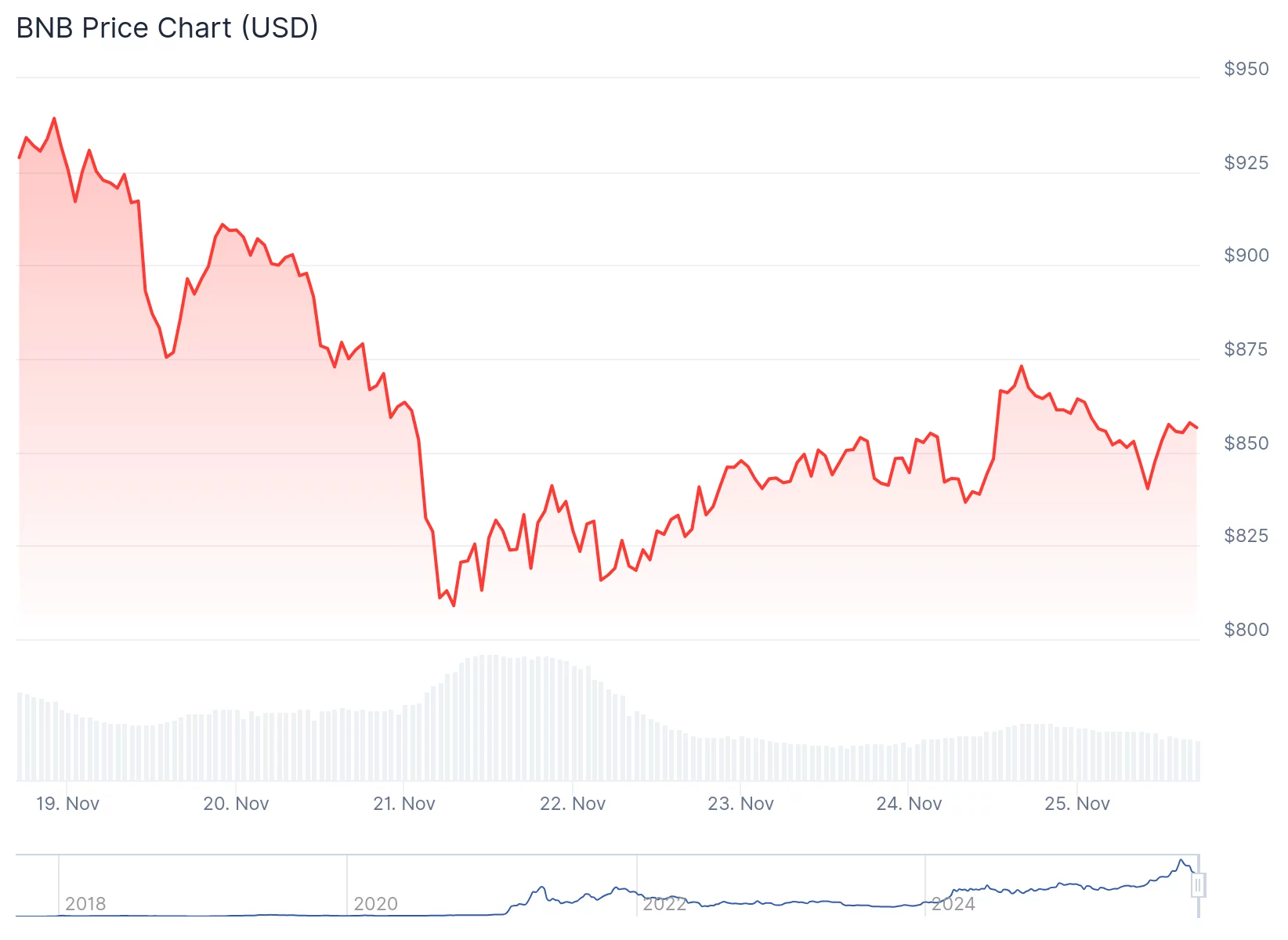

The digital asset declined over the week, according to price data. See below.

Source: CoinGecko

Source: CoinGecko

Over the course of two weeks, BNB reached the upper boundary of an ascending channel, a level that capped price action for most of 2024 and early 2025. After breaking out and achieving higher levels, the asset has retraced to retest that trendline.

The area aligns with the previous resistance-turned-support and sits in the middle of the prior rally range. Volume has not shown signs of major selling, according to trading data.

On the monthly timeframe, BNB has returned to a key trendline that has held since 2024. According to Cryptocium, another market observer, BNB has not closed a monthly candle below this line with strong downside momentum.

BNB back to a major bullish trendline

As November’s monthly close approaches, market participants are monitoring whether the level will hold.

BNB Chain’s network activity has grown steadily in 2025, according to data. Recall last month when it edged past TRON to become the most active network for stablecoin transactions, fueled by surging DEX volume and spillover from Binance’s trading incentives.

Charts shared by TCC show a rising trend in active addresses. From under one million daily users in early 2025, the chain has maintained levels above 1.5 million since July, occasionally reaching near 3.5 million. “BNB Chain is quietly climbing,” TCC posted, pointing to stronger usage despite the recent price decline.

Data from YZi Labs indicates that more BNB is being stored in self-custody, with exchange balances dropping as users move tokens to private wallets.

Open interest on futures has fallen below the September high, according to market data.

Both price and open interest have trended lower since that peak, indicating reduced speculative activity in recent weeks. Futures interest remains subdued, suggesting traders are awaiting stronger directional signals.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

YouTube is developing a new tool aimed at organizing the cluttered home feed

Robinhood’s Entry into Prediction Markets Establishes a Compliance-Focused Benchmark for Accessibility

- Robinhood accelerates prediction market expansion, now its fastest-growing revenue stream, partnering with Kalshi to trade 9B+ contracts since March. - Plans a 2026 futures exchange with Susquehanna as liquidity provider, acquiring MIAXdx to leverage CFTC-licensed infrastructure for institutional-grade compliance. - Regulatory alignment via Kalshi's CFTC approval and MIAXdx's framework enables Robinhood to bridge retail and institutional trading while maintaining oversight. - Outpaces rivals like Polymar

Bitcoin Updates: Bearish Trend in Bitcoin Fuels Increased Interest in Mutuum's DeFi Presale

- Mutuum Finance (MUTM) gains traction as a DeFi presale contender, projecting 2,600% ROI with Phase 6 nearing 99% completion and a $0.040 price hike in Phase 7. - Its buy-and-distribute tokenomics and $18.89M Phase 6 raise highlight strong demand, while Halborn Security audit and Q4 2025 lending protocol launch reinforce institutional-grade credibility. - Bitcoin's dip below $83,000 amplifies MUTM's appeal as a hedge, with analysts noting 400% post-launch price potential and 24-hour leaderboards boosting

"Automation and enhanced security are driving cryptocurrency's efforts to make trading accessible to everyone"

- Bitget's Black Friday campaign offers 100% reward matches and a 50,000 USDT prize pool for spot-grid trading, targeting retail investors with automated tools. - Mutuum Finance advances to Phase 2 with 90% presale completion, preparing a Q4 2025 protocol launch supported by Halborn audits and institutional-grade security. - Both initiatives highlight crypto's shift toward democratizing trading through automation, security, and rewards to lower entry barriers for mass adoption.