Date: Tue, Nov 25, 2025 | 05:30 PM GMT

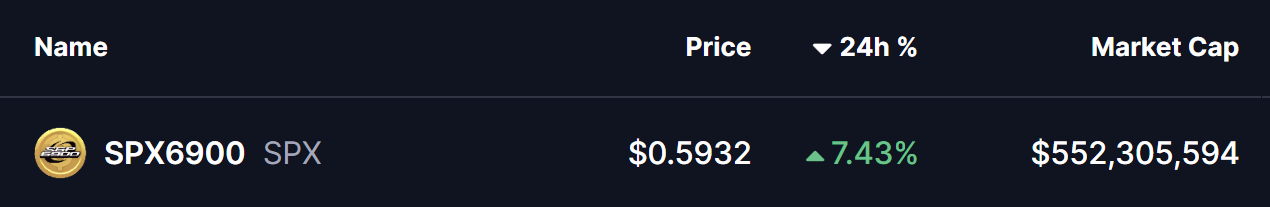

The cryptocurrency market is slowly recovering after last week’s sharp volatility, where Ethereum (ETH) dropped to a low of $2622 before bouncing back above $2900. This rebound has pushed several major memecoins into green territory, including SPX6900 (SPX).

SPX is currently up by an impressive 7% over the last 24 hours, and its latest 4-hour price setup suggests that a larger move could be taking shape if momentum continues to build.

Source: Coinmarketcap

Source: Coinmarketcap

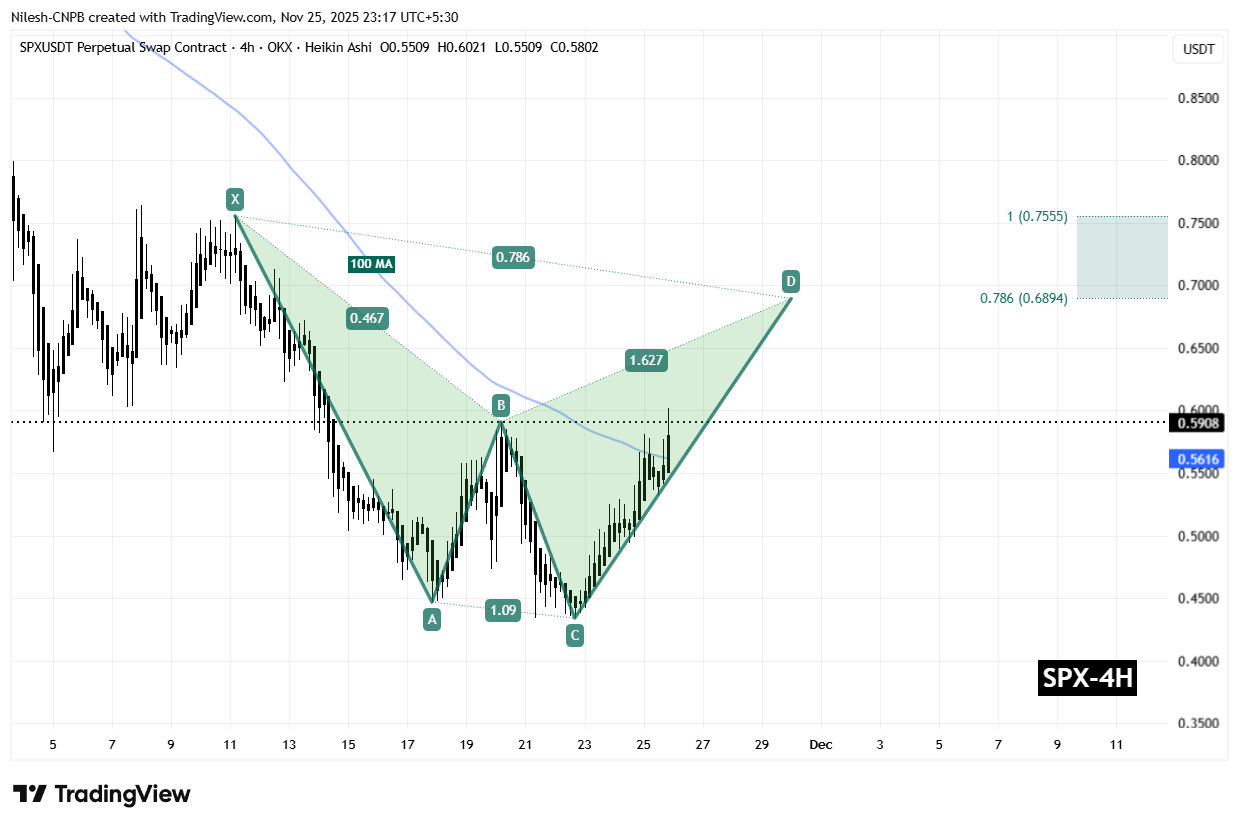

Harmonic Pattern in Play

On the 4-hour timeframe, SPX is developing a Bearish Cypher harmonic pattern — a formation that often triggers a strong bullish wave before reaching the pattern’s final completion point. While the Cypher is technically a bearish structure, its CD leg is known for delivering aggressive upside moves before the price tests the Potential Reversal Zone (PRZ).

The formation started at Point X near $0.7555, followed by a decline to Point A, a rebound into Point B, and then a deeper drop to Point C around $0.4339. From this low, SPX began a notable recovery, pushing above the 100-day moving average (MA) at $0.5616 — a key signal that bullish momentum is strengthening.

SPX6900 (SPX) 4H Chart/Coinsprobe (Source: Tradingview)

SPX6900 (SPX) 4H Chart/Coinsprobe (Source: Tradingview)

What’s Next for SPX?

According to the harmonic projection, SPX may continue climbing toward the PRZ — a crucial zone between $0.6894 (the 0.786 Fibonacci extension) and $0.7555 (the 1.0 extension). This area represents the completion of the Bearish Cypher pattern and is typically where traders anticipate heavy resistance and potential profit-taking.

However, if SPX fails to sustain above immediate support at $0.53, near-term momentum may fade, leading to a period of sideways action or minor pullback before bulls attempt another breakout.